Table Of Contents

Category

Artificial Intelligence

AIML

IoT

FinTech

Customer Service

1. Introduction to AI in Insurance Customer Service

Artificial Intelligence (AI) is transforming various industries, and the insurance sector is no exception. The integration of AI in insurance customer service is reshaping how insurance companies interact with their clients, enhancing efficiency, personalization, and overall customer satisfaction. As consumers increasingly demand faster and more responsive service, AI technologies are stepping in to meet these expectations. AI technologies include chatbots, machine learning, and natural language processing. The insurance industry is leveraging AI to streamline operations and improve customer experiences. Additionally, AI can analyze vast amounts of data to provide insights and automate routine tasks.

1.1. The Role of Artificial Intelligence in Modern Insurance

AI plays a crucial role in modern insurance by automating processes, improving decision-making, and enhancing customer interactions.

- Automation of Routine Tasks: AI can handle repetitive tasks such as data entry, claims processing, and policy renewals, freeing up human agents to focus on more complex issues.

- Enhanced Data Analysis: AI algorithms can analyze customer data to identify trends, assess risks, and predict future behaviors, allowing insurers to tailor their offerings.

- Personalized Customer Interactions: AI enables insurers to provide personalized recommendations and solutions based on individual customer profiles and preferences.

- 24/7 Availability: AI-powered chatbots and virtual assistants can provide round-the-clock support, addressing customer inquiries and issues at any time.

- Fraud Detection: AI systems can detect unusual patterns in claims data, helping to identify and prevent fraudulent activities.

1.2. Key Benefits of AI-Driven Customer Service Solutions

AI-driven customer service solutions offer numerous advantages for both insurance companies and their clients.

- Improved Efficiency: Automation reduces the time taken to process claims and respond to inquiries, leading to quicker resolutions.

- Cost Savings: By automating tasks, companies can reduce operational costs associated with customer service.

- Enhanced Customer Experience: AI can provide instant responses and personalized interactions, improving overall customer satisfaction.

- Scalability: AI solutions can easily scale to handle increased customer inquiries without the need for proportional increases in staff.

- Data-Driven Insights: AI can analyze customer interactions to provide insights that help improve service strategies and product offerings.

- Increased Accuracy: AI reduces human error in data handling and decision-making, leading to more accurate outcomes for customers.

By embracing AI in insurance customer service, insurance companies can not only enhance their operational efficiency but also build stronger relationships with their clients, ultimately leading to increased loyalty and retention. At Rapid Innovation, we specialize in implementing AI solutions tailored to the unique needs of the insurance sector, ensuring that our clients achieve greater ROI through enhanced operational capabilities and improved customer engagement. For more information, check out this guide to AI in insurance.

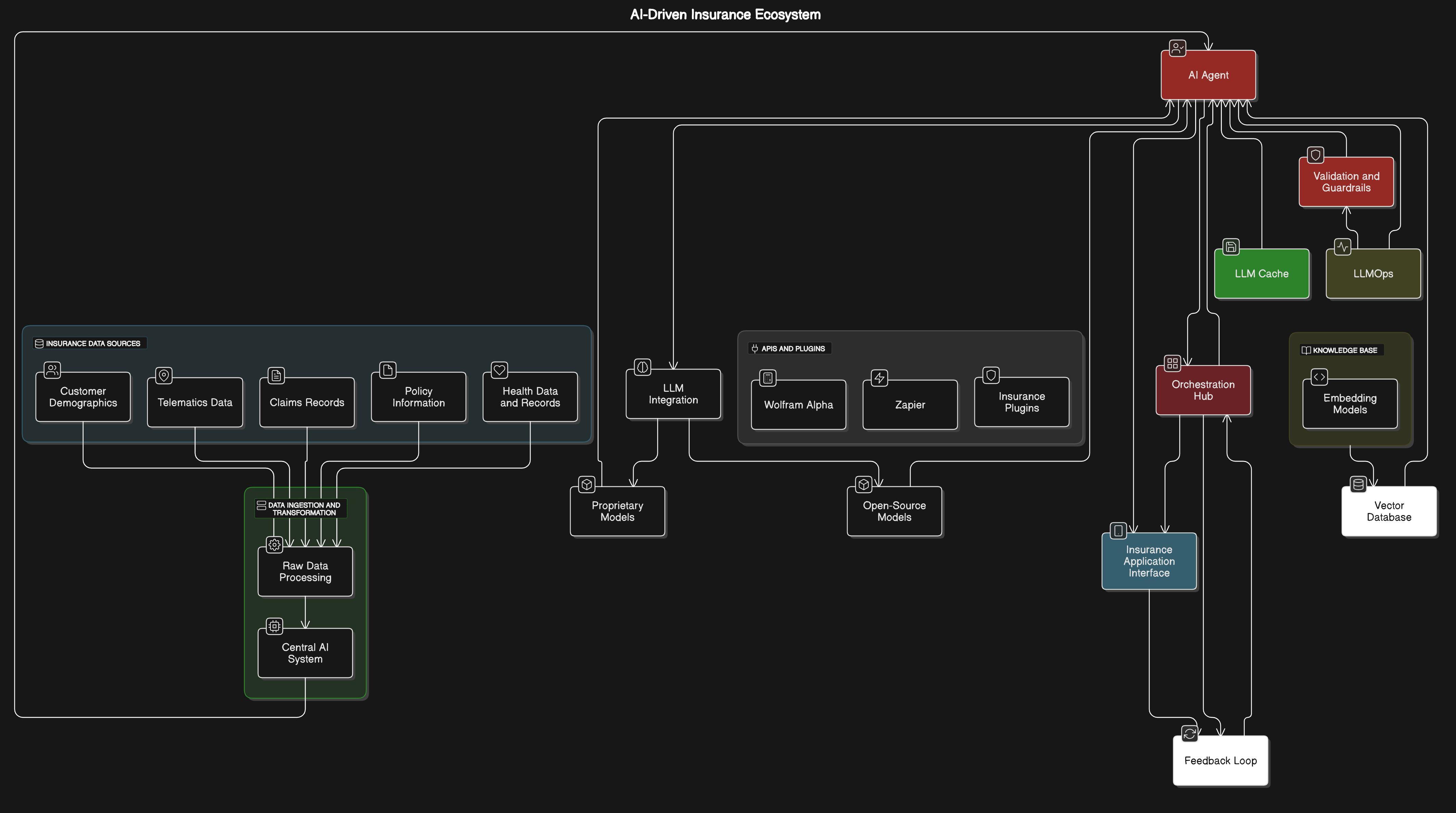

Refer to the image for a visual representation of the role of AI in insurance customer service:

1.3. Overview of AI Technologies Transforming Customer Engagement

Artificial Intelligence (AI) technologies are revolutionizing how businesses engage with customers. These technologies enhance customer experiences by providing personalized, efficient, and timely interactions. Key AI technologies transforming customer engagement include:

- Chatbots and Virtual Assistants:

- Provide 24/7 customer support.

- Handle common inquiries, freeing up human agents for complex issues.

- Use natural language processing (NLP) to understand and respond to customer queries, exemplifying ai powered customer engagement.

- Predictive Analytics:

- Analyze customer data to forecast future behaviors and preferences.

- Enable businesses to tailor marketing strategies and product offerings.

- Help in identifying potential churn and implementing retention strategies, which is crucial for ai customer engagement.

- Sentiment Analysis:

- Assess customer emotions through social media, reviews, and feedback.

- Allow companies to gauge customer satisfaction and adjust services accordingly.

- Provide insights into brand perception and areas for improvement, enhancing intelligent customer engagement.

- Personalization Engines:

- Use algorithms to deliver customized content and recommendations.

- Enhance user experience by showing relevant products or services.

- Increase conversion rates and customer loyalty, a key aspect of ai for customer engagement.

- Voice Recognition Technology:

- Facilitate hands-free interactions through voice commands.

- Improve accessibility for customers with disabilities.

- Enable seamless integration with smart devices, contributing to engagement ai.

These AI technologies not only streamline operations but also create a more engaging and satisfying customer experience. At Rapid Innovation, we leverage these technologies, including conversational ai for customer engagement, to help our clients achieve greater ROI by enhancing customer engagement and satisfaction.

1.4. Defining AI-Enhanced Customer Interactions in Insurance

AI-enhanced customer interactions in the insurance sector involve the integration of AI technologies to improve communication, service delivery, and overall customer satisfaction. Key aspects include:

- Automated Claims Processing:

- AI systems can analyze claims data quickly and accurately, reducing processing time and minimizing human error. This enhances customer satisfaction by providing faster resolutions.

- Risk Assessment and Underwriting:

- AI algorithms evaluate risk factors more comprehensively, enabling insurers to offer personalized premiums based on individual risk profiles and improving accuracy in underwriting decisions.

- Customer Support and Engagement:

- AI chatbots can provide instant responses to policy inquiries, offer personalized policy recommendations based on customer needs, and facilitate proactive communication regarding policy updates or renewals, showcasing the benefits of ai customer engagement.

- Fraud Detection:

- AI systems analyze patterns in claims data to identify potential fraud, reducing losses for insurers and maintaining lower premiums for customers, thereby enhancing trust in the insurance process.

- Customer Journey Mapping:

- AI tools track customer interactions across various touchpoints, providing insights into customer behavior and preferences, and helping insurers tailor their services to meet customer expectations.

AI-enhanced interactions in insurance not only improve operational efficiency but also foster stronger relationships between insurers and their clients. Rapid Innovation specializes in implementing these AI claim processing solutions, including dynamics 365 ai for customer service, ensuring our clients can maximize their operational capabilities and customer satisfaction.

1.5. Comparison: Traditional Customer Service vs. AI-Powered Service: Rapid Innovation’s AI Agent Solution for Insurance Customer Service

The shift from traditional customer service to AI-powered service represents a significant evolution in how businesses interact with customers. Here’s a comparison of the two approaches:

- Response Time:

- Traditional: Often involves long wait times for customer support.

- AI-Powered: Provides instant responses through chatbots and automated systems, a hallmark of ai powered customer engagement.

- Availability:

- Traditional: Limited to business hours, with human agents available only during specific times.

- AI-Powered: Offers 24/7 support, allowing customers to get help anytime.

- Scalability:

- Traditional: Difficult to scale during peak times, leading to overwhelmed staff.

- AI-Powered: Easily handles multiple inquiries simultaneously without compromising service quality.

- Personalization:

- Traditional: Limited ability to tailor interactions based on individual customer data.

- AI-Powered: Uses data analytics to provide personalized recommendations and solutions, enhancing ai for customer engagement.

- Cost Efficiency:

- Traditional: Higher operational costs due to staffing and training needs.

- AI-Powered: Reduces costs by automating routine tasks and minimizing the need for extensive human resources.

- Data Utilization:

- Traditional: Often lacks comprehensive data analysis capabilities.

- AI-Powered: Leverages big data and machine learning to gain insights into customer behavior and preferences.

- Customer Satisfaction:

- Traditional: May lead to frustration due to slow response times and limited availability.

- AI-Powered: Enhances customer satisfaction through quick, efficient, and personalized service, a key benefit of intelligent customer engagement.

At Rapid Innovation, we understand that the shift from traditional customer service to AI-powered solutions is transforming the insurance industry. Our AI agents streamline customer interactions by automating routine inquiries, claims processing, and policy updates, providing faster, more accurate service. These intelligent agents are powered by advanced technologies such as Natural Language Processing (NLP) and machine learning, enabling them to handle complex customer requests with a personalized touch. Whether it's assisting with policy inquiries, processing claims, or offering tailored recommendations, Rapid Innovation’s AI solutions reduce response times and improve customer satisfaction, ultimately enhancing operational efficiency and delivering a seamless customer experience. With our AI-powered solutions, insurers can elevate their customer service offerings to new levels, ensuring that policyholders receive the attention they deserve around the clock.

2. AI Use Cases Across Insurance Domains

The insurance industry is increasingly leveraging artificial intelligence (AI) to enhance operations, improve customer experiences, and streamline processes. AI applications span various domains within insurance, including underwriting, claims processing, fraud detection, and customer service.

2.1. Life Insurance Customer Experience Enhancement

In the life insurance sector, customer experience is paramount. Insurers are utilizing AI to create more personalized, efficient, and engaging interactions with policyholders. This not only helps in retaining customers but also in attracting new ones.

- AI-driven tools analyze customer data to understand preferences and needs.

- Enhanced communication channels, such as chatbots, provide instant support.

- Predictive analytics help insurers anticipate customer needs and tailor services accordingly.

2.1.1. Personalized Policy Recommendations Using AI

Personalized policy recommendations represent a significant advancement in life insurance, driven by AI technologies. By analyzing vast amounts of data, insurers can offer tailored policy options that align with individual customer profiles.

AI systems process data from various sources, including customer demographics, health records, and lifestyle choices. Machine learning algorithms identify patterns and preferences, enabling insurers to suggest policies that best fit a customer's needs and adjust recommendations based on changing customer circumstances.

Personalized recommendations lead to enhanced customer engagement, resulting in increased customer satisfaction as clients feel understood and higher conversion rates as tailored options resonate more with potential buyers. Additionally, AI allows for real-time adjustments, providing dynamic policy suggestions that adapt to customer feedback and continuous learning from customer interactions to refine future recommendations.

By implementing AI for personalized policy recommendations, life insurers can significantly improve customer experience, leading to better retention and loyalty. At Rapid Innovation, we specialize in developing and integrating AI solutions that empower insurance companies to harness these capabilities, ultimately driving greater ROI and operational efficiency. This includes applications such as ai life insurance, ai insurance, and artificial intelligence in insurance, which are transforming the landscape of the insurance industry. Furthermore, the integration of ai in the insurance industry is paving the way for innovative approaches to customer service and policy management, ensuring that insurers remain competitive in a rapidly evolving market. For more insights on how AI impacts insurance policies and prices.

Refer to the image based on the AI use cases in the insurance domain for a visual representation of the concepts discussed.

2.1.2. AI in Claims Processing and Support

AI is revolutionizing claims processing in the insurance industry by streamlining operations and enhancing customer experience, particularly in areas such as machine learning in insurance claims.

- Automation of Routine Tasks: AI can automate repetitive tasks such as data entry, document verification, and initial claim assessments. This reduces the time taken to process claims and minimizes human error, allowing insurers to focus on more complex cases.

- Fraud Detection: Machine learning algorithms analyze patterns in claims data to identify potential fraud. By flagging suspicious claims for further investigation, AI helps insurers save significant amounts of money, ultimately improving their bottom line.

- Faster Decision-Making: AI systems can analyze vast amounts of data quickly, allowing for faster claim approvals or denials. This leads to improved customer satisfaction as policyholders receive timely updates, fostering loyalty and trust.

- Enhanced Customer Support: AI-driven tools can provide real-time updates to policyholders about their claims status, reducing the need for them to contact customer service. This not only enhances the customer experience but also optimizes operational efficiency.

- Predictive Analytics: AI can predict claim outcomes based on historical data, helping insurers allocate resources more effectively and manage risks better. This proactive approach enables insurers to make informed decisions that align with their business goals, particularly in the context of machine learning insurance claims. For more insights on personalized risk evaluation in insurance with AI agents.

2.1.3. Chatbot Support for Policyholder Inquiries

Chatbots are becoming an integral part of customer service in the insurance sector, providing immediate assistance to policyholders.

- 24/7 Availability: Chatbots can operate around the clock, offering support to policyholders at any time, which is particularly beneficial for urgent inquiries. This ensures that customer needs are met promptly, enhancing overall satisfaction.

- Instant Responses: They can provide immediate answers to frequently asked questions, such as policy details, coverage limits, and claim procedures, enhancing user experience and reducing wait times.

- Personalized Interactions: Advanced chatbots use AI to understand user queries better and provide tailored responses based on individual policyholder data. This personalization fosters a deeper connection between the insurer and the policyholder.

- Cost-Effective Solution: Implementing chatbots can significantly reduce operational costs by minimizing the need for large customer service teams. This allows insurers to allocate resources to other critical areas of their business.

- Data Collection and Insights: Chatbots can gather data on common inquiries and customer concerns, providing valuable insights for insurers to improve their services. This data-driven approach enables continuous improvement and innovation.

2.1.4. AI-Enhanced Underwriting Processes for Tailored Policies

AI is transforming underwriting processes, allowing insurers to create more personalized policies for their clients.

- Data-Driven Insights: AI can analyze a wide range of data sources, including social media, IoT devices, and historical claims data, to assess risk more accurately. This comprehensive analysis leads to better-informed underwriting decisions.

- Speed and Efficiency: Automated underwriting processes reduce the time taken to evaluate applications, enabling quicker policy issuance and improved customer satisfaction. This efficiency translates to a competitive advantage in the market.

- Risk Assessment: AI models can identify potential risks associated with individual applicants, allowing insurers to tailor policies that meet specific needs and mitigate risks effectively. This targeted approach enhances the insurer's ability to manage their portfolio.

- Dynamic Pricing Models: AI enables insurers to develop dynamic pricing strategies based on real-time data, ensuring that premiums reflect the current risk profile of the policyholder. This adaptability helps maintain profitability while remaining competitive.

- Continuous Learning: Machine learning algorithms continuously improve their accuracy by learning from new data, allowing for ongoing refinement of underwriting criteria and processes. This commitment to innovation positions insurers for long-term success in a rapidly evolving industry, including advancements in AI in insurance claims processing.

At Rapid Innovation, we leverage our expertise in AI and Blockchain to help clients implement these transformative technologies, ultimately driving greater ROI and achieving their business goals efficiently and effectively.

Refer to the image for a visual representation of how AI is transforming claims processing and support in the insurance industry.

2.1.5. Predictive Analytics for Customer Retention Strategies

AI for predictive analytics in insurance plays a crucial role in enhancing customer retention by leveraging data and statistical algorithms. Insurance businesses can forecast customer behavior and identify at-risk customers, ultimately driving greater ROI.

- Understanding customer behavior:

- Analyzing historical data to identify patterns in customer interactions.

- Segmenting customers based on their purchasing habits and preferences.

- Identifying at-risk customers:

- Using predictive models to determine which customers are likely to churn.

- Implementing early warning systems to alert teams about potential losses.

- Tailoring retention strategies:

- Developing personalized marketing campaigns based on customer insights.

- Offering targeted promotions or loyalty programs to retain high-value customers through effective customer retention management strategies.

- Measuring effectiveness:

- Continuously monitoring retention rates and customer feedback.

- Adjusting strategies based on real-time data to improve outcomes, including customer retention marketing strategies.

- Tools and technologies:

- Utilizing machine learning algorithms to enhance predictive accuracy.

- Employing customer relationship management (CRM) systems to track interactions, which is essential for retention marketing. For more insights, check out this article on predicting customer retention trends.

2.2. Property and Casualty Insurance Innovations

The property and casualty insurance sector is undergoing significant innovations driven by technology and changing consumer expectations. These innovations aim to improve efficiency, enhance customer experience, and reduce costs, aligning with Rapid Innovation's commitment to delivering impactful solutions.

- Digital transformation:

- Adoption of online platforms for policy management and claims processing.

- Use of mobile apps to provide customers with easy access to their insurance information.

- Data-driven underwriting:

- Leveraging big data analytics to assess risk more accurately.

- Implementing telematics to monitor driving behavior for auto insurance.

- Enhanced customer engagement:

- Utilizing chatbots and AI for 24/7 customer support.

- Offering personalized insurance products based on individual needs.

- Claims automation:

- Streamlining the claims process through automated systems.

- Reducing processing time and improving customer satisfaction.

- Regulatory compliance:

- Innovations that help insurers comply with changing regulations efficiently.

- Use of blockchain technology to enhance transparency and security in transactions.

2.2.1. Automated Damage Assessments and Emergency Response

Automated damage assessments and emergency response systems are revolutionizing how property and casualty insurers handle claims and emergencies. These innovations enhance efficiency and improve customer service during critical times, showcasing the potential of AI and blockchain technologies.

- Use of drones and aerial imagery:

- Employing drones to assess property damage after natural disasters.

- Capturing high-resolution images to provide accurate damage reports.

- AI and machine learning:

- Utilizing AI algorithms to analyze images and assess damage severity.

- Automating the claims process by generating initial estimates based on data.

- Real-time data collection:

- Integrating IoT devices to monitor properties and detect damages early.

- Providing insurers with real-time information to expedite response efforts.

- Streamlined communication:

- Implementing automated systems to notify customers about claim status.

- Offering digital platforms for customers to submit claims and receive updates.

- Enhanced emergency response:

- Coordinating with emergency services to provide timely assistance.

- Using predictive analytics to anticipate areas most likely to be affected by disasters.

These innovations not only improve operational efficiency but also enhance the overall customer experience, ensuring that policyholders receive timely support when they need it most. Rapid Innovation is dedicated to helping clients leverage these advancements to achieve their business goals effectively and efficiently, including strategies for client retention and retention marketing tactics.

2.2.2. Intelligent Claims Resolution: Reducing Fraud and Accelerating Payments

Intelligent claims resolution technology leverages advanced technologies to streamline the claims process, reduce fraud, and expedite payments.

- Automation:

- Automated systems can quickly process claims, significantly reducing the time taken for approval.

- Machine learning algorithms analyze historical data to identify patterns and flag potentially fraudulent claims, enhancing the accuracy of the claims process.

- Fraud Detection:

- AI tools can assess claims against a database of known fraud cases, increasing the likelihood of catching fraudulent activities before they impact the business.

- Predictive analytics can identify unusual patterns in claims submissions, prompting further investigation and minimizing losses.

- Enhanced Customer Experience:

- Faster claims processing leads to improved customer satisfaction, fostering loyalty and retention.

- Real-time updates on claim status keep customers informed, reducing anxiety and uncertainty during the claims process.

- Cost Efficiency:

- Reducing fraud saves insurers significant amounts of money, which can be redirected to other areas of the business for growth and innovation.

- Streamlined processes lower operational costs associated with manual claims handling, allowing for better resource allocation.

- Data-Driven Insights:

- Analyzing claims data helps insurers understand trends and improve future risk assessments, leading to more informed decision-making.

- Insights gained can inform product development and marketing strategies, ultimately driving greater ROI. For more information on the impact of AI on finance.

2.2.3. AI-Driven Risk Assessment for Premium Pricing

AI-driven risk assessment transforms how insurers evaluate risk and set premium prices, leading to more accurate and fair pricing models.

- Enhanced Data Analysis:

- AI can process vast amounts of data from various sources, including social media, IoT devices, and historical claims data, providing a comprehensive view of risk.

- This analysis allows for a more nuanced understanding of individual risk profiles, enabling tailored insurance solutions.

- Personalized Premiums:

- Insurers can offer personalized premiums based on specific risk factors, rather than relying on broad categories, enhancing competitiveness in the market.

- This approach can lead to improved customer retention as clients feel their unique needs are being addressed.

- Predictive Modeling:

- Machine learning algorithms can predict future claims based on historical data, allowing insurers to adjust premiums accordingly and proactively manage risk.

- Insurers can identify high-risk customers early and take proactive measures to mitigate potential losses, enhancing overall profitability.

- Continuous Learning:

- AI systems continuously learn from new data, improving their risk assessment capabilities over time and ensuring that pricing remains relevant and competitive in a changing market.

- This adaptability allows insurers to stay ahead of industry trends and customer expectations.

- Regulatory Compliance:

- AI can help insurers comply with regulations by ensuring that pricing models are transparent and justifiable, reducing the risk of penalties.

- Automated reporting tools can streamline compliance processes, reducing the burden on staff and allowing them to focus on strategic initiatives.

2.2.4. Geospatial Analysis for Disaster Risk Management

Geospatial analysis plays a crucial role in disaster risk management, enabling insurers to assess and mitigate risks associated with natural disasters.

- Risk Mapping:

- Geospatial data helps create detailed risk maps that identify areas prone to natural disasters such as floods, earthquakes, and hurricanes, informing underwriting decisions.

- These maps assist insurers in setting appropriate premiums based on the level of risk, enhancing financial stability.

- Real-Time Monitoring:

- Geospatial technology allows for real-time monitoring of environmental changes and disaster events, enabling insurers to respond quickly to emerging risks.

- This capability improves their ability to manage claims and support affected customers during critical times.

- Improved Decision-Making:

- Data visualization tools enable insurers to analyze complex data sets easily, leading to better-informed decisions that can mitigate risk exposure.

- Insights gained from geospatial analysis can guide investment in risk mitigation strategies, ultimately protecting the bottom line.

- Enhanced Customer Communication:

- Insurers can provide customers with valuable information about their risk exposure and preparedness measures, fostering a proactive approach to risk management.

- This proactive communication fosters trust and strengthens customer relationships, leading to increased loyalty.

- Collaboration with Emergency Services:

- Geospatial analysis facilitates collaboration between insurers and emergency services, improving disaster response efforts and community resilience.

- Sharing data can enhance overall disaster preparedness and reduce the impact of disasters on both insurers and their clients.

At Rapid Innovation, we harness the power of AI and blockchain technologies to implement these advanced claims resolution technology solutions, helping our clients achieve greater ROI while enhancing operational efficiency and customer satisfaction.

2.2.5. Personalized Coverage Recommendations Based on Usage Data

Personalized coverage recommendations leverage data analytics to tailor insurance plans to individual needs. This approach enhances customer satisfaction and optimizes coverage. Usage data is collected from various sources, including health records, claims history, and lifestyle choices. Advanced algorithms analyze this data to identify patterns and preferences. Recommendations can include personalized insurance recommendations that align with health needs and adjustments to existing coverage based on changing circumstances.

Benefits of personalized recommendations: - Increased relevance of insurance products - Higher customer retention rates - Improved claims experience

Insurers can utilize machine learning to refine recommendations over time, ensuring they remain accurate and beneficial. This approach not only helps customers find the right coverage but also reduces the risk of underinsurance or overinsurance. Additionally, insights from prognostic healthcare analytics can further enhance the personalization of coverage recommendations.

2.3. Health Insurance Customer Care Transformation

The transformation of customer care in health insurance is driven by technology and changing consumer expectations. Insurers are adopting innovative strategies to enhance service delivery. Key elements of this transformation include the integration of digital tools for seamless communication, the use of chatbots and virtual assistants for 24/7 support, and enhanced self-service options for policy management.

Focus on customer experience:

- Personalized interactions based on customer data

- Quick resolution of queries and issues

- Proactive outreach to address potential concerns

Data analytics plays a crucial role in understanding customer needs and preferences. Insurers are investing in training staff to handle complex inquiries and provide empathetic support. The goal is to create a more responsive and customer-centric service model that builds trust and loyalty.

2.3.1. Proactive Health Management Through AI

AI is revolutionizing proactive health management in the insurance sector, enabling insurers to support customers in maintaining their health. AI technologies can analyze vast amounts of health data to identify risks and trends. Key applications of AI in health management include predictive analytics to foresee potential health issues, personalized health recommendations based on individual data, and automated reminders for preventive care and screenings.

Benefits of proactive health management:

- Early intervention can lead to better health outcomes

- Reduced healthcare costs for both insurers and customers

- Enhanced engagement with policyholders through tailored health programs

AI-driven platforms can facilitate virtual health coaching, access to wellness resources and tools, and continuous monitoring of health metrics. By focusing on prevention, insurers can foster a healthier customer base, ultimately leading to lower claims and improved profitability.

At Rapid Innovation, we harness the power of AI and data analytics to help insurers implement personalized coverage recommendations and transform customer care. Our expertise in machine learning enables us to develop tailored solutions that enhance customer engagement and optimize operational efficiency, ultimately driving greater ROI for our clients. By integrating advanced technologies, we empower insurers to meet evolving consumer expectations and achieve their business goals effectively.

2.3.2. Streamlining Benefits Navigation with Intelligent Assistants

Intelligent assistants are transforming how patients navigate their healthcare benefits navigation. These digital tools leverage artificial intelligence to provide personalized support, making it easier for users to understand and utilize their health benefits.

- Personalized Guidance: Intelligent assistants can analyze individual health plans and provide tailored information based on a user's specific needs, ensuring that patients receive the most relevant advice.

- 24/7 Availability: Unlike traditional customer service, intelligent assistants are available around the clock, allowing patients to access information whenever they need it, thus enhancing user experience and satisfaction.

- Simplified Processes: These tools can guide users through complex processes, such as claims filing or understanding coverage limits, reducing confusion and frustration, which can lead to quicker resolutions.

- Integration with Health Records: Intelligent assistants can access electronic health records to provide relevant information, ensuring that users receive accurate and up-to-date guidance, ultimately improving decision-making.

- Cost Savings: By helping patients understand their benefits better, intelligent assistants can lead to more informed decisions, potentially reducing out-of-pocket expenses and increasing overall satisfaction with healthcare services.

2.3.3. Virtual Health Assistants for Chronic Disease Management

Virtual health assistants are playing a crucial role in managing chronic diseases, offering continuous support and monitoring for patients. These assistants can track vital signs and symptoms, alerting healthcare providers if any concerning changes occur. They also send reminders for medication schedules, helping patients adhere to their treatment plans. Additionally, virtual health assistants provide patients with information about their conditions, empowering them to make informed decisions about their health. They can help create and adjust care plans based on real-time data, ensuring that treatment remains effective and relevant. Furthermore, these tools facilitate communication between patients and healthcare providers, allowing for timely interventions and adjustments to care.

- Continuous Monitoring: These assistants can track vital signs and symptoms, alerting healthcare providers if any concerning changes occur, which can lead to timely interventions.

- Medication Reminders: Virtual health assistants can send reminders for medication schedules, helping patients adhere to their treatment plans and improving health outcomes.

- Educational Resources: They provide patients with information about their conditions, empowering them to make informed decisions about their health, thus enhancing patient engagement.

- Personalized Care Plans: Virtual assistants can help create and adjust care plans based on real-time data, ensuring that treatment remains effective and relevant, which can lead to better health outcomes.

- Enhanced Communication: These tools facilitate communication between patients and healthcare providers, allowing for timely interventions and adjustments to care, ultimately improving the quality of care.

2.3.4. AI-Driven Care Pathways for Improved Patient Outcomes

AI-driven care pathways are revolutionizing patient care by utilizing data analytics to create optimized treatment plans. AI algorithms analyze vast amounts of patient data to identify trends and predict outcomes, leading to more effective treatment strategies. These pathways help standardize care across different providers, ensuring that patients receive consistent and evidence-based treatment. AI can monitor patient responses to treatment in real-time, allowing for immediate adjustments to care plans as needed. Additionally, AI-driven pathways enhance communication among healthcare teams, ensuring that all providers are aligned in their approach to patient care. By predicting patient needs, AI can help healthcare systems allocate resources more efficiently, improving overall care delivery.

- Data-Driven Insights: AI algorithms analyze vast amounts of patient data to identify trends and predict outcomes, leading to more effective treatment strategies and improved patient care.

- Standardized Protocols: These pathways help standardize care across different providers, ensuring that patients receive consistent and evidence-based treatment, which can enhance overall healthcare quality.

- Real-Time Adjustments: AI can monitor patient responses to treatment in real-time, allowing for immediate adjustments to care plans as needed, thus optimizing treatment effectiveness.

- Improved Coordination: AI-driven pathways enhance communication among healthcare teams, ensuring that all providers are aligned in their approach to patient care, which can lead to better patient experiences.

- Better Resource Allocation: By predicting patient needs, AI can help healthcare systems allocate resources more efficiently, improving overall care delivery and maximizing return on investment for healthcare organizations.

At Rapid Innovation, we harness the power of AI and blockchain technology to develop intelligent solutions that streamline healthcare processes, enhance patient engagement, and ultimately drive better business outcomes for our clients. By integrating these advanced technologies, we help organizations achieve greater ROI while improving the quality of care they provide.

2.3.5. Enhanced Fraud Detection in Claims Submissions

Fraud detection in claims submissions is a critical aspect of the insurance industry, as fraudulent claims can lead to significant financial losses. Enhanced fraud detection mechanisms leverage advanced technologies and data analytics to identify and mitigate fraudulent activities, including the use of insurance fraud detection software.

- Use of Artificial Intelligence (AI) and Machine Learning (ML):

- AI algorithms analyze historical claims data to identify patterns indicative of fraud, which is essential for effective fraud detection in insurance.

- Machine learning models continuously improve by learning from new data, enhancing detection accuracy over time, particularly in areas like life insurance fraud detection.

- Predictive Analytics:

- Predictive models assess the likelihood of fraud based on various factors, such as claim history and claimant behavior, which is crucial for fraud detection in insurance claims.

- Insurers can prioritize investigations on high-risk claims, optimizing resource allocation, especially in health insurance fraud detection.

- Real-time Monitoring:

- Continuous monitoring of claims submissions allows for immediate detection of suspicious activities, supported by insurance fraud prevention strategies.

- Automated alerts can be generated for claims that deviate from established norms, aiding in claim fraud detection.

- Data Integration:

- Combining data from multiple sources (e.g., social media, public records) provides a comprehensive view of claimants, enhancing insurance fraud analytics.

- Cross-referencing data helps identify inconsistencies that may indicate fraud, particularly in auto insurance fraud detection.

- Collaboration with Law Enforcement:

- Insurers can work with law enforcement agencies to share information and track fraudulent activities, which is vital for underwriting fraud detection.

- Joint efforts can lead to more effective investigations and prosecutions, leveraging tools like friss fraud detection.

2.4. Commercial Insurance Service Improvements

Commercial insurance service improvements focus on enhancing the overall customer experience and operational efficiency. These improvements are essential for retaining clients and staying competitive in the market.

- Streamlined Claims Processing:

- Automation of claims processing reduces the time taken to settle claims, which is critical for effective claim fraud analytics.

- Digital platforms allow for easy submission and tracking of claims, improving customer satisfaction.

- Enhanced Customer Support:

- 24/7 customer service options, including chatbots and online support, provide immediate assistance.

- Personalized communication helps build stronger relationships with clients.

- Improved Risk Assessment:

- Advanced analytics tools enable insurers to better assess risks associated with commercial clients.

- Accurate risk assessments lead to more appropriate coverage options and pricing.

- Flexible Policy Options:

- Insurers are offering customizable policies that cater to the specific needs of businesses.

- This flexibility allows clients to choose coverage that aligns with their unique risk profiles.

- Technology Integration:

- Utilizing technology such as mobile apps and online portals enhances accessibility for clients.

- Clients can manage their policies, make payments, and file claims conveniently.

2.4.1. Tailored Coverage Solutions through Data Analytics

Data analytics plays a pivotal role in creating tailored coverage solutions for commercial insurance clients. By analyzing vast amounts of data, insurers can develop policies that meet the specific needs of individual businesses.

- Understanding Client Needs:

- Data analytics helps insurers gather insights into the unique risks faced by different industries.

- Surveys and feedback mechanisms can be employed to understand client expectations better.

- Risk Profiling:

- Insurers can create detailed risk profiles for businesses based on historical data and industry benchmarks.

- This profiling allows for the development of targeted coverage options that address specific vulnerabilities.

- Dynamic Pricing Models:

- Data-driven pricing models adjust premiums based on real-time risk assessments.

- This approach ensures that clients pay for coverage that accurately reflects their risk exposure.

- Predictive Modeling for Future Needs:

- Predictive analytics can forecast potential risks and coverage needs based on industry trends.

- Insurers can proactively offer solutions to clients before they encounter issues.

- Enhanced Underwriting Processes:

- Data analytics streamlines the underwriting process, allowing for quicker decision-making.

- Insurers can assess applications more accurately, reducing the likelihood of errors and omissions.

At Rapid Innovation, we harness the power of AI and data analytics to enhance fraud detection and improve commercial insurance services. Our expertise in these domains enables us to provide tailored solutions that not only mitigate risks but also drive greater ROI for our clients. By integrating advanced technologies into their operations, we help insurers achieve operational efficiency and deliver exceptional customer experiences, including effective fraud detection in health insurance and shift claims fraud detection. For more insights on the role of AI in insurance.

2.4.2. Enhancing Customer Engagement with AI-Powered Feedback Loops

- AI-powered feedback loops utilize machine learning algorithms to analyze customer interactions and sentiments, enabling businesses to gain deeper insights into customer preferences, particularly in areas like ai powered customer engagement.

- These systems can gather feedback from various channels, including social media, surveys, and customer service interactions, ensuring a comprehensive understanding of customer experiences, which is essential for ai customer engagement.

- By analyzing this data, businesses can identify trends and areas for improvement in their products or services, leading to more informed decision-making, especially when implementing ai for customer engagement strategies.

- AI can personalize customer experiences by tailoring recommendations based on previous interactions and preferences, enhancing customer satisfaction and engagement through artificial intelligence customer engagement techniques.

- Continuous feedback collection allows companies to adapt quickly to changing customer needs and preferences, ensuring they remain competitive in the market, particularly with engagement ai solutions.

- Implementing AI feedback loops can lead to increased customer satisfaction and loyalty, ultimately driving higher revenue and ROI, especially when utilizing conversational ai for customer engagement.

- Companies can use sentiment analysis to gauge customer emotions and adjust their strategies accordingly, fostering a more responsive business environment, as seen with cogno ai exotel.

- Real-time feedback mechanisms enable businesses to address issues promptly, enhancing overall customer experience and reducing churn, which is crucial for dynamics 365 ai for customer service.

2.4.3. Real-Time Risk Monitoring and Alerts for Businesses

- Real-time risk monitoring involves the continuous assessment of potential threats to a business's operations, ensuring proactive risk management.

- AI technologies can analyze vast amounts of data from various sources to identify patterns and anomalies that may indicate risk, providing businesses with actionable insights.

- Businesses can set up automated alerts to notify relevant stakeholders when a potential risk is detected, facilitating timely responses.

- This proactive approach allows companies to respond quickly to emerging threats, minimizing potential damage and safeguarding assets.

- AI can enhance risk assessment by incorporating predictive analytics, helping businesses anticipate future risks and prepare accordingly.

- Industries such as finance, healthcare, and manufacturing benefit significantly from real-time risk monitoring, as it helps them maintain operational integrity.

- By leveraging AI, organizations can improve their decision-making processes and resource allocation in risk management, leading to more efficient operations.

- Continuous monitoring helps ensure compliance with regulations and standards, reducing the likelihood of penalties and enhancing corporate governance.

2.4.4. AI for Compliance and Regulatory Reporting Automation

- AI can streamline compliance processes by automating data collection and reporting tasks, reducing the administrative burden on organizations.

- Regulatory requirements often involve complex data management; AI simplifies this by organizing and analyzing data efficiently, ensuring accuracy and timeliness.

- Automated reporting reduces the risk of human error, ensuring that reports are accurate and timely, which is crucial for maintaining compliance.

- AI systems can be programmed to stay updated with changing regulations, helping businesses remain compliant and avoid costly fines.

- Natural language processing (NLP) assist in interpreting regulatory texts, making it easier for organizations to understand their obligations and implement necessary changes.

- By automating compliance tasks, businesses can allocate resources more effectively, focusing on strategic initiatives rather than manual reporting.

- AI can also facilitate audits by providing real-time access to compliance data and documentation, enhancing transparency and accountability.

- Enhanced compliance through AI can lead to improved trust with stakeholders and reduced legal risks, ultimately contributing to a stronger business reputation.

At Rapid Innovation, we leverage our expertise in AI and Blockchain to help businesses implement these advanced solutions, ensuring they achieve their goals efficiently and effectively while maximizing ROI, as demonstrated by exotel acquires cogno ai and intelligent customer engagement initiatives. For more information on how AI and machine learning can enhance regulatory compliance.

2.5. Claims Fraud Detection Across All Insurance Types

Claims fraud is a significant issue across various insurance sectors, including health, auto, and property insurance. Detecting fraudulent claims is crucial for maintaining the integrity of the insurance system and ensuring that legitimate claims are processed efficiently. The use of advanced technologies, particularly machine learning and real-time monitoring systems, has transformed the way insurers identify and manage fraud. Fraudulent claims can lead to increased premiums for policyholders, and the insurance industry loses billions annually due to fraud. Effective fraud detection, such as insurance fraud detection and insurance fraud prevention, can save companies money and improve customer trust.

2.5.1. Machine Learning Algorithms for Identifying Anomalies

Machine learning algorithms play a pivotal role in identifying anomalies in claims data that may indicate fraud. These algorithms analyze vast amounts of data to detect patterns and irregularities that human analysts might miss.

- Types of Algorithms Used:

- Supervised learning: Trains on labeled datasets to predict outcomes.

- Unsupervised learning: Identifies patterns in unlabeled data, useful for discovering new fraud schemes.

- Neural networks: Mimic human brain functions to recognize complex patterns.

- Benefits of Machine Learning in Fraud Detection:

- Increased accuracy: Algorithms can achieve higher precision in identifying fraudulent claims compared to traditional methods.

- Speed: Automated systems can process claims in real-time, allowing for quicker decision-making.

- Adaptability: Machine learning models can evolve with new data, improving their effectiveness over time.

- Examples of Anomaly Detection:

- Identifying unusual claim amounts compared to historical data.

- Detecting patterns of claims from specific providers or policyholders that deviate from the norm.

- Recognizing repeated claims for similar incidents that may indicate collusion, such as in insurance claim fraud detection.

2.5.2. Real-Time Fraud Monitoring Systems

Real-time fraud monitoring systems are essential for proactive fraud detection. These systems continuously analyze incoming claims data and flag suspicious activities as they occur.

- Key Features of Real-Time Monitoring Systems:

- Instant alerts: Notify fraud analysts immediately when suspicious claims are detected.

- Integration with existing systems: Seamlessly work with claims processing and customer relationship management systems.

- Dashboard analytics: Provide visual representations of data trends and anomalies for quick assessment.

- Advantages of Real-Time Monitoring:

- Immediate response: Allows insurers to investigate and address potential fraud before claims are paid out.

- Enhanced customer experience: Reduces the time legitimate claims take to process, improving customer satisfaction.

- Comprehensive data analysis: Leverages big data to analyze multiple factors, such as claim history, provider behavior, and geographic trends.

- Implementation Considerations:

- Data quality: Ensuring that the data fed into the system is accurate and comprehensive.

- Scalability: Systems should be able to handle increasing volumes of claims as the business grows, including life insurance fraud detection and health insurance fraud detection.

- Regulatory compliance: Must adhere to legal standards regarding data privacy and fraud detection practices.

By leveraging machine learning algorithms and real-time monitoring systems, insurance companies can significantly enhance their fraud detection capabilities, ultimately leading to reduced losses and improved operational efficiency. At Rapid Innovation, we specialize in implementing these advanced technologies, ensuring that our clients achieve greater ROI through effective fraud management solutions tailored to their specific needs, including insurance fraud analytics and anomaly detection in insurance claims.

2.5.3. AI-Based Pattern Recognition for Suspicious Claims

AI-based pattern recognition is a powerful tool in the insurance industry, particularly for identifying suspicious claims. This technology leverages machine learning algorithms to analyze vast amounts of data and detect anomalies that may indicate fraudulent activity, such as in ai fraud detection insurance.

- Data Analysis: AI systems can process large datasets quickly, identifying patterns that human analysts might miss. This includes historical claims data, customer behavior patterns, and external data sources (e.g., social media, public records).

- Anomaly Detection: By establishing a baseline of normal behavior, AI can flag claims that deviate significantly from this norm. This includes unusual claim amounts, repeated claims from the same individual, and claims filed shortly after policy inception.

- Predictive Modeling: AI can predict the likelihood of fraud based on historical data. This involves using algorithms to assess risk factors and continuously updating models with new data to improve accuracy.

- Efficiency Improvement: Automating the detection of suspicious claims allows insurers to reduce manual review time, focus resources on high-risk claims, and improve overall claims processing efficiency.

- Case Studies: Many insurance companies have successfully implemented AI for fraud detection, leading to significant cost savings and improved detection rates. For example, some insurers report a reduction in fraudulent claims by up to 30% after adopting ai insurance fraud technologies.

2.6. Customer Education and Engagement

Customer education and engagement are crucial for building trust and ensuring that clients understand their insurance products. Engaging customers effectively can lead to better decision-making and increased satisfaction.

- Importance of Education: Educated customers are more likely to understand their coverage options, make informed decisions about policies, and recognize the value of their insurance.

- Engagement Strategies: Insurers can employ various strategies to enhance customer engagement, including interactive online platforms, regular communication through newsletters and updates, and personalized customer service experiences.

- Feedback Mechanisms: Gathering customer feedback is essential for improving services. This can be achieved through surveys and polls, social media interactions, and direct communication channels.

- Community Involvement: Engaging with the community can enhance brand loyalty. This includes sponsoring local events, offering educational workshops, and partnering with local organizations.

2.6.1. AI-Enhanced Educational Resources for Customers

AI can significantly enhance educational resources for customers, making information more accessible and tailored to individual needs.

- Personalized Learning: AI can analyze customer data to provide personalized educational content, including tailored articles and videos based on customer profiles and recommendations for relevant insurance products.

- Chatbots and Virtual Assistants: These AI tools can provide instant answers to customer queries, offering 24/7 support for common questions and guidance on policy details and claims processes.

- Interactive Tools: AI can power interactive tools that help customers understand their insurance needs. Examples include coverage calculators, risk assessment quizzes, and policy comparison tools.

- Content Creation: AI can assist in generating educational content, ensuring it is up-to-date with the latest industry trends and easily digestible and engaging for customers.

- Data-Driven Insights: By analyzing customer interactions, AI can identify knowledge gaps and areas where customers need more information, allowing insurers to develop targeted educational campaigns and improve overall customer understanding of products and services.

- Case Studies: Some insurers have successfully implemented AI-driven educational resources, resulting in increased customer engagement and satisfaction. For instance, companies that use chatbots report higher customer retention rates due to improved service accessibility.

At Rapid Innovation, we harness the power of AI and blockchain technologies to help our clients in the insurance sector achieve greater efficiency and effectiveness in their operations. By implementing AI-based solutions for ai fraud detection in insurance and customer engagement, we enable insurers to not only reduce costs but also enhance customer satisfaction, ultimately leading to a higher return on investment. Our expertise in these domains positions us as a trusted partner in driving innovation and achieving business goals.

2.6.2. Interactive AI Tools for Policy Comparison and Selection

Interactive AI tools are revolutionizing the way individuals and organizations compare and select policies. These tools leverage advanced algorithms and data analytics to provide users with tailored recommendations based on their specific needs and preferences.

- User-Friendly Interfaces:

- Many tools feature intuitive designs that allow users to easily input their criteria.

- Visual aids, such as charts and graphs, help users understand complex data.

- Real-Time Data Analysis:

- AI tools can analyze vast amounts of data in real-time, ensuring users have access to the most current information.

- This capability allows for dynamic comparisons across various policy options, including health insurance plan comparison.

- Customization Options:

- Users can filter policies based on specific parameters, such as cost, coverage, and provider ratings.

- Some tools offer scenario-based simulations to illustrate potential outcomes of different policy choices, such as using a compare health insurance plans calculator.

- Enhanced Decision-Making:

- By providing comprehensive insights, these tools empower users to make informed decisions.

- They can highlight the pros and cons of each policy, facilitating a clearer understanding of options, including a calculator to compare health insurance plans.

- Examples of Tools:

- Websites like Policygenius and Insure.com offer interactive comparison tools that help users evaluate insurance policies side by side, including health care plan comparison and health plan comparison spreadsheet.

At Rapid Innovation, we harness the power of AI and blockchain technologies to develop and implement these interactive tools, ensuring that our clients can achieve greater ROI through enhanced decision-making, improved customer engagement, and streamlined operations. By integrating AI-driven solutions, we empower businesses to optimize their policy comparison processes, including health shield plan comparison and policy comparison tools, enhance customer service with chatbots, and deliver personalized learning experiences through virtual assistants.

3. Foundational AI Technologies for Insurance Customer Service

The insurance industry is increasingly leveraging foundational AI technologies, such as conversational ai for insurance, to enhance customer service. These technologies streamline operations, improve customer interactions, and provide personalized experiences.

3.1. Intelligent Automation in Customer Interactions

Intelligent automation refers to the use of AI technologies to automate customer interactions, making them more efficient and effective. This includes the deployment of chatbots, virtual assistants, and other automated systems that can handle customer inquiries and support tasks. The benefits of intelligent automation include:

- Enhances efficiency by reducing response times.

- Frees up human agents to focus on complex issues.

- Provides 24/7 availability for customer support.

- Improves consistency in responses and service quality.

- Collects and analyzes customer data for better insights.

3.1.1. Benefits of Chatbots and Virtual Assistants

Chatbots and virtual assistants are at the forefront of intelligent automation in customer service. They offer numerous benefits that can significantly improve the customer experience in the insurance sector, particularly through insurance conversational ai.

These benefits include:

- 24/7 Availability: Chatbots can operate around the clock, providing immediate assistance to customers regardless of the time of day. This is particularly beneficial for customers who may need help outside of regular business hours.

- Quick Response Times: Chatbots can handle multiple inquiries simultaneously, ensuring that customers receive prompt responses. This reduces wait times and enhances customer satisfaction.

- Cost Efficiency: By automating routine inquiries, insurance companies can reduce operational costs. Chatbots can handle a large volume of requests without the need for additional human resources.

- Personalized Interactions: Advanced chatbots can analyze customer data to provide tailored responses. They can remember past interactions and preferences, creating a more personalized experience for each customer.

- Scalability: As customer demand fluctuates, chatbots can easily scale to meet the needs without the need for extensive training or hiring of additional staff.

- Data Collection and Insights: Chatbots can gather valuable data from customer interactions, which can be analyzed to improve services and identify trends. This data can inform marketing strategies and product development, particularly in the context of ai technologies for insurance customer service.

- Multilingual Support: Many chatbots are equipped to handle multiple languages, making it easier for insurance companies to serve diverse customer bases.

- Integration with Other Systems: Chatbots can be integrated with CRM systems and other tools, allowing for seamless information sharing and improved service delivery.

- Reduction of Human Error: Automated systems minimize the risk of human error in responses, ensuring that customers receive accurate information.

- Enhanced Customer Engagement: Chatbots can engage customers through proactive messaging, such as reminders for policy renewals or updates on claims status.

By implementing chatbots and virtual assistants, insurance companies can significantly enhance their customer service capabilities, leading to improved customer satisfaction and loyalty. At Rapid Innovation, we specialize in developing and integrating these AI solutions, ensuring that our clients achieve greater ROI through enhanced operational efficiency and customer engagement. For more insights on the impact of chatbots, check out AI Chatbots: The Revolution in Customer Support.

3.1.2. Natural Language Processing (NLP) for Enhanced Communication

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and humans through natural language. It enables machines to understand, interpret, and respond to human language in a valuable way.

- Improved Customer Interactions: NLP can analyze customer inquiries and provide relevant responses, enhancing the overall communication experience. This capability allows businesses to engage with customers more effectively, leading to higher satisfaction rates and improved retention.

- Sentiment Analysis: By evaluating customer feedback, NLP can determine the sentiment behind the words, helping businesses gauge customer satisfaction and adjust strategies accordingly. This insight can drive product improvements and marketing strategies that resonate with the target audience.

- Chatbots and Virtual Assistants: NLP powers chatbots that can handle customer queries 24/7, providing instant support and freeing up human agents for more complex issues. This not only improves operational efficiency but also enhances customer experience by providing immediate assistance.

- Language Translation: NLP facilitates real-time translation services, allowing businesses to communicate with a global audience without language barriers. This capability opens up new markets and customer segments, driving growth and increasing ROI.

- Content Generation: NLP can assist in creating personalized content for marketing campaigns, improving engagement and conversion rates. By tailoring messages to individual preferences, businesses can significantly enhance their marketing effectiveness.

3.2. Data Analytics and Insights for Customer Understanding

Data analytics involves examining data sets to draw conclusions about the information they contain. In the context of customer understanding, it helps businesses make informed decisions based on customer behavior and preferences.

- Customer Segmentation: Data analytics allows businesses to categorize customers based on demographics, purchasing behavior, and preferences, enabling targeted marketing strategies. This targeted approach can lead to higher conversion rates and better resource allocation.

- Behavioral Insights: Analyzing customer interactions can reveal patterns in behavior, helping businesses understand what drives customer decisions. This understanding can inform product development and marketing strategies, leading to increased customer loyalty.

- Performance Metrics: Businesses can track key performance indicators (KPIs) to assess the effectiveness of marketing campaigns and customer engagement strategies. By continuously monitoring these metrics, organizations can optimize their efforts for greater impact.

- Personalization: Insights gained from data analytics can be used to tailor products and services to meet individual customer needs, enhancing customer loyalty. Personalized experiences foster deeper connections with customers, resulting in repeat business.

- Market Trends: By analyzing data, businesses can identify emerging trends and adapt their strategies to stay competitive. This proactive approach ensures that organizations remain relevant in a rapidly changing market landscape.

3.2.1. Predictive Analytics: Anticipating Customer Needs

Predictive analytics uses statistical algorithms and machine learning techniques to identify the likelihood of future outcomes based on historical data. This approach is particularly useful for anticipating customer needs.

- Customer Behavior Prediction: By analyzing past purchasing patterns, businesses can forecast future buying behavior, allowing for proactive marketing efforts. This foresight enables companies to align their offerings with customer expectations, driving sales.

- Churn Prediction: Predictive analytics can identify customers at risk of leaving, enabling businesses to implement retention strategies before it's too late. By addressing potential churn proactively, organizations can maintain a stable customer base and revenue stream.

- Inventory Management: Businesses can predict demand for products, optimizing inventory levels and reducing costs associated with overstocking or stockouts. Efficient inventory management leads to cost savings and improved cash flow.

- Targeted Marketing Campaigns: By understanding which customers are likely to respond to specific offers, businesses can create more effective marketing campaigns. This targeted approach maximizes marketing ROI and enhances customer engagement.

- Enhanced Customer Experience: Anticipating customer needs leads to a more personalized experience, increasing satisfaction and loyalty. By leveraging predictive analytics, businesses can create tailored experiences that resonate with their customers, fostering long-term relationships.

At Rapid Innovation, we harness the power of AI and blockchain technologies to help businesses achieve these outcomes efficiently and effectively. Our expertise in natural language processing, data analytics, and predictive analytics enables us to deliver tailored solutions that drive greater ROI for our clients. We utilize natural language programming, natural language understanding, and natural language processing techniques to enhance our services. Our approach integrates nlp in artificial intelligence, ensuring that we stay at the forefront of advancements in the field.

3.2.2. Customer Segmentation and Personalization Techniques

Customer segmentation and personalization are crucial for businesses aiming to enhance customer experience and drive sales. By understanding the different segments of their customer base, companies can tailor their marketing strategies effectively.

- Definition of Customer Segmentation: The process of dividing a customer base into distinct groups based on shared characteristics. Segments can be based on demographics, psychographics, behavior, or geographic location.

- Benefits of Customer Segmentation:

- Improved targeting of marketing campaigns.

- Increased customer satisfaction through personalized experiences.

- Higher conversion rates and customer loyalty.

- Techniques for Customer Segmentation:

- Demographic Segmentation: Age, gender, income, education level.

- Behavioral Segmentation: Purchase history, brand loyalty, product usage.

- Psychographic Segmentation: Lifestyle, values, interests.

- Geographic Segmentation: Location-based targeting, regional preferences.

- Personalization Techniques:

- Dynamic Content: Tailoring website content based on user behavior and preferences.

- Email Personalization: Sending targeted emails based on customer segments.

- Product Recommendations: Using algorithms to suggest products based on past purchases or browsing history.

- Customer Journey Mapping: Understanding the customer journey to provide relevant touchpoints.

- Tools and Technologies:

- Customer Relationship Management (CRM) systems.

- Data analytics platforms for insights.

- Machine learning algorithms for predictive analytics.

At Rapid Innovation, we leverage advanced AI and machine learning technologies to enhance customer segmentation and personalization efforts. By utilizing predictive analytics, we help businesses identify key customer segments and tailor their marketing strategies accordingly, resulting in improved ROI and customer engagement. Understanding that customer in different segment are essential for effective marketing, we focus on creating personalized experiences that resonate with each group. For more insights on this topic, check out our article on advanced analytics for optimized customer segmentation and credit assessment.

4. Advanced AI Technologies in Customer Service

AI technologies are transforming customer service by enhancing efficiency and improving customer interactions. Businesses are increasingly adopting these technologies to meet customer expectations.

- Chatbots and Virtual Assistants:

- Provide 24/7 customer support.

- Handle common inquiries and issues without human intervention.

- Use natural language processing (NLP) to understand and respond to customer queries.

- Predictive Analytics:

- Analyze customer data to anticipate needs and preferences.

- Help businesses proactively address issues before they escalate.

- Improve inventory management and resource allocation.

- Sentiment Analysis:

- Use AI to gauge customer emotions from interactions.

- Help businesses understand customer satisfaction and areas for improvement.

- Enable personalized responses based on customer sentiment.

- Automated Ticketing Systems:

- Streamline the process of handling customer inquiries.

- Automatically categorize and prioritize tickets based on urgency.

- Reduce response times and improve service efficiency.

- Voice Recognition Technology:

- Allow customers to interact with services using voice commands.

- Enhance accessibility for users with disabilities.

- Improve user experience by providing hands-free options.

4.1. Omnichannel Customer Engagement Strategies

Omnichannel customer engagement strategies focus on providing a seamless experience across multiple channels. This approach ensures that customers can interact with a brand through their preferred platforms.

- Definition of Omnichannel Engagement: A multi-channel approach that integrates various communication methods, ensuring a consistent brand experience regardless of the channel used.

- Key Components of Omnichannel Strategies:

- Unified Customer Data: Centralized data systems to track customer interactions across channels.

- Consistent Messaging: Maintaining the same tone and message across all platforms.

- Cross-Channel Integration: Allowing customers to switch between channels without losing context.

- Benefits of Omnichannel Engagement:

- Enhanced customer satisfaction through personalized experiences.

- Increased customer retention and loyalty.

- Improved sales through a more effective customer journey.

- Implementation Tactics:

- Customer Journey Mapping: Identify key touchpoints and optimize them for a seamless experience.

- Training Staff: Ensure that customer service representatives are knowledgeable about all channels.

- Utilizing Technology: Invest in tools that facilitate communication across channels, such as CRM systems.

- Examples of Omnichannel Engagement:

- Retailers offering online shopping, in-store pickup, and returns.

- Brands using social media, email, and chatbots to engage customers.

- Companies providing consistent support through phone, email, and live chat.

By leveraging customer segmentation, advanced AI technologies, and omnichannel strategies, businesses can create a more personalized and efficient customer experience, ultimately driving greater ROI and customer loyalty. Rapid Innovation is committed to helping clients achieve these goals through tailored solutions that integrate AI and blockchain technologies.

4.1.1. Ensuring Consistency Across Communication Channels

Consistency in communication is crucial for building trust and maintaining a strong brand identity. It involves delivering a unified message across various platforms and touchpoints.

- Brand Voice: Establish a clear brand voice that reflects your company’s values and mission. This voice should be consistent whether in emails, social media posts, or customer service interactions.

- Messaging: Ensure that the core messages about products, services, and promotions are the same across all channels. This helps avoid confusion and reinforces brand recognition.

- Visual Identity: Use consistent logos, colors, and design elements across all platforms. This visual consistency helps customers easily identify your brand.

- Training: Provide training for employees on communication standards and brand guidelines. This ensures that everyone representing the brand is on the same page.

- Feedback Mechanism: Implement a system for gathering feedback from customers about their experiences across different channels. This can help identify inconsistencies and areas for improvement.

4.1.2. Benefits of Voice and Multimodal Interaction Platforms

Voice and multimodal interaction platforms are transforming how businesses engage with customers. These technologies offer several advantages:

- Enhanced Accessibility: Voice interfaces allow users to interact with technology hands-free, making it easier for individuals with disabilities or those multitasking.

- Improved User Experience: Multimodal platforms combine voice, text, and visual elements, providing a richer and more engaging experience. Users can choose their preferred method of interaction.

- Increased Efficiency: Voice commands can speed up tasks, allowing customers to get information or complete transactions more quickly than traditional methods.

- Personalization: These platforms can leverage AI to provide personalized responses based on user preferences and past interactions, enhancing customer satisfaction.

- Data Collection: Voice and multimodal interactions generate valuable data on customer behavior and preferences, which can be used to refine marketing strategies and improve service offerings.

4.2. Predictive Customer Support Models

Predictive customer support models utilize data analytics and machine learning to anticipate customer needs and improve service delivery.

- Proactive Engagement: By analyzing customer data, businesses can identify potential issues before they arise and reach out to customers proactively, reducing frustration and enhancing satisfaction.

- Resource Optimization: Predictive models help allocate resources more effectively by forecasting demand for support services, ensuring that staff are available when needed.

- Tailored Solutions: These models can analyze past interactions to provide personalized support, suggesting solutions based on similar cases or customer history.

- Reduced Response Times: By predicting common inquiries and issues, businesses can streamline their support processes, leading to faster response times and improved customer experiences.

- Continuous Improvement: Predictive analytics can identify trends and patterns in customer behavior, allowing businesses to continuously refine their support strategies and offerings.

At Rapid Innovation, we leverage AI and blockchain technologies to enhance customer communication strategies and predictive models, ensuring that our clients achieve greater ROI. By implementing AI-driven analytics, we help businesses understand customer behavior more deeply, allowing for tailored communication and proactive support. Our blockchain solutions ensure data integrity and security, fostering trust and consistency across all customer interactions. This holistic approach not only improves customer satisfaction but also drives operational efficiency, ultimately leading to a more significant return on investment for our clients. For more information on AI-driven customer support.

4.2.1. Proactive Issue Resolution: Anticipating Customer Problems

Proactive issue resolution involves identifying and addressing potential customer problems before they escalate. This approach enhances customer satisfaction and loyalty by demonstrating a commitment to service excellence.