Table Of Contents

Category

Artificial Intelligence

AIML

IoT

FinTech

Healthcare & Medicine

1. Understanding Voice and Sentiment Analysis in Modern Claims Processing

Voice and sentiment analysis in insurance are becoming integral components of modern claims processing in the insurance industry. These technologies leverage artificial intelligence (AI) and natural language processing (NLP) to analyze customer interactions, providing insights into customer emotions and satisfaction levels. This understanding can significantly enhance the claims experience for both insurers and policyholders.

- Voice analysis involves examining the tone, pitch, and pace of speech.

- Sentiment analysis focuses on the emotional tone behind words, identifying positive, negative, or neutral sentiments.

- Together, they help insurers gauge customer satisfaction and identify areas for improvement.

1.1. The Evolution of Voice and Sentiment Analysis in Insurance Claims: AI Agent Solution

The use of voice and sentiment analysis in insurance claims has evolved significantly over the years. Initially, claims processing relied heavily on manual assessments and human judgment, which often led to inconsistencies and inefficiencies. Early systems were limited to basic data entry and processing. The introduction of call centers marked a shift, allowing for more direct communication with customers. With advancements in AI and machine learning, insurers can now analyze vast amounts of data from customer interactions in real-time.

Recent developments include:

- Automated systems that can transcribe and analyze calls instantly.

- Predictive analytics that forecast customer behavior based on sentiment trends.

- Integration of voice and sentiment analysis into customer relationship management (CRM) systems for a holistic view of customer interactions.

Rapid Innovation offers cutting-edge AI-powered solutions designed to revolutionize voice and sentiment analysis in insurance claims processing. By leveraging advanced Natural Language Processing (NLP) and speech recognition technologies, our AI agent solution enhances the accuracy and efficiency of claims communication. Our AI-driven voice analytics can automatically detect stress, frustration, and other emotional cues in customer calls, allowing insurance companies to prioritize claims, offer personalized assistance, and provide real-time support to agents. Additionally, Rapid Innovation's AI systems can seamlessly integrate into existing claims management processes, optimizing workflows, reducing human error, and improving both customer satisfaction and operational efficiency. With our expertise in AI and blockchain technologies, we deliver tailored solutions that enable insurance providers to streamline their claims handling while maintaining the highest standards of customer service.

1.1.1. Challenges in Traditional Claims Communication Analysis

Despite advancements, traditional claims communication analysis faces several challenges that can hinder effective processing and customer satisfaction.

- Inconsistency in Data Interpretation: Human agents may interpret customer sentiments differently, leading to varied responses and outcomes.

- Limited Scope of Analysis: Traditional methods often focus on quantitative metrics, such as call duration, neglecting qualitative insights that voice and sentiment analysis can provide.

- Resource Intensive: Manual analysis of customer interactions is time-consuming and requires significant human resources, which can lead to delays in claims processing.

- Difficulty in Real-Time Insights: Traditional systems may not provide real-time feedback, making it challenging for insurers to address customer concerns promptly.

- Scalability Issues: As the volume of claims increases, traditional methods struggle to keep pace, resulting in backlogs and decreased customer satisfaction.

By addressing these challenges through the implementation of voice and sentiment analysis in insurance, insurers can enhance their claims processing, leading to improved customer experiences and operational efficiencies. At Rapid Innovation, we specialize in integrating AI-driven voice and sentiment analysis solutions tailored to the unique needs of the insurance sector, ensuring that our clients achieve greater ROI through enhanced customer engagement and streamlined operations.

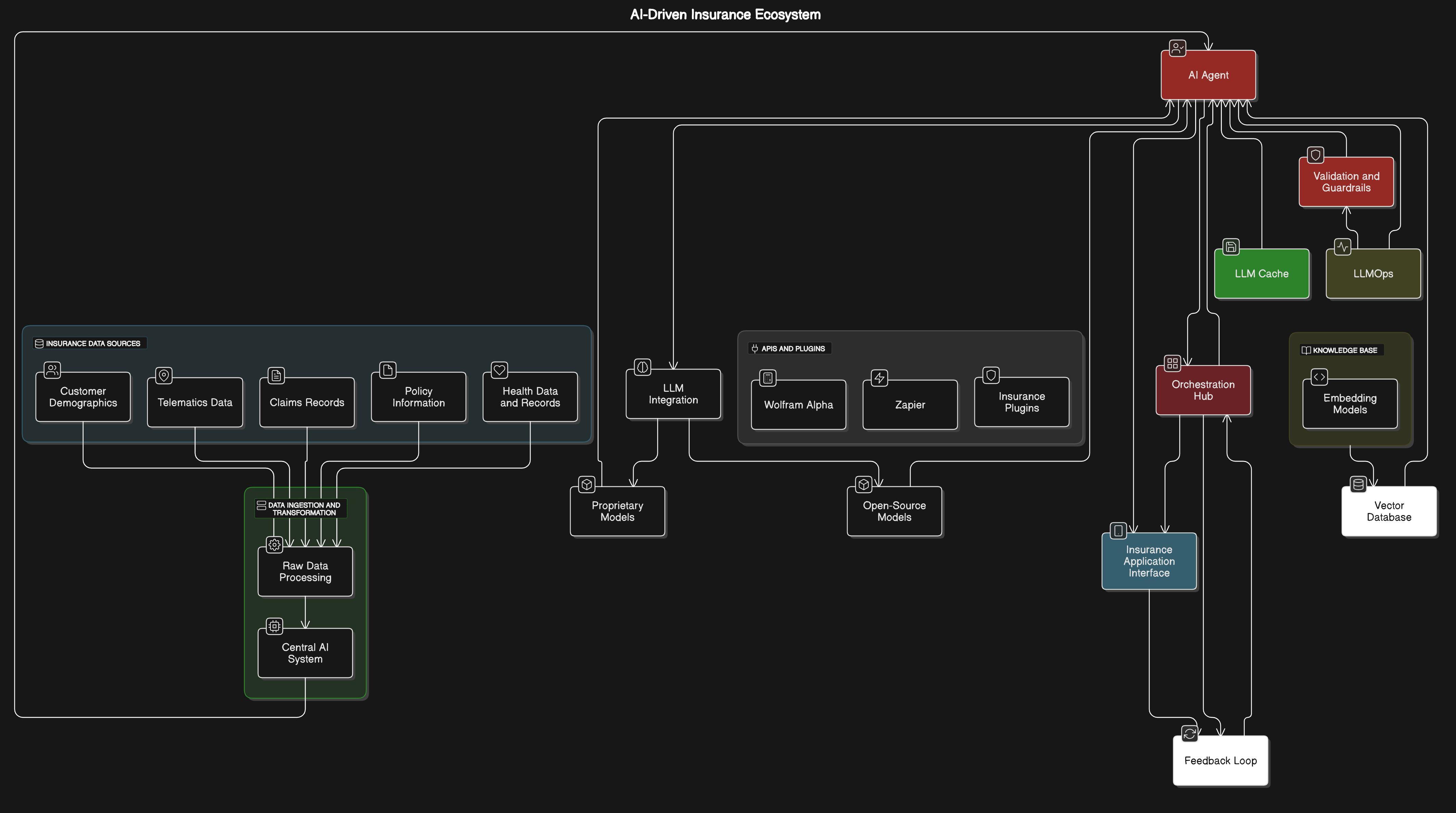

Refer to the image for a visual representation of the concepts discussed in "Understanding Voice and Sentiment Analysis in Modern Claims Processing":

1.1.2. AI-Powered Voice Analytics Revolutionizing Claims Processing

- AI-powered voice analytics is transforming the way insurance claims are processed. This technology utilizes natural language processing (NLP) and machine learning to analyze voice interactions between claimants and insurance representatives.

- Key features include:

- Real-time transcription: Converts spoken words into text instantly, allowing for immediate review and action.

- Sentiment analysis: Evaluates the emotional tone of conversations, helping to identify distressed claimants or potential fraud.

- Keyword extraction: Highlights critical information, such as policy numbers and claim details, streamlining data collection.

- Benefits of AI voice analytics in claims processing:

- Increased accuracy: Reduces human error by automating data entry and analysis.

- Faster processing times: Claims can be assessed and resolved more quickly, improving customer satisfaction.

- Enhanced compliance: Ensures that all necessary information is captured and documented, aiding in regulatory adherence.

- Companies adopting AI voice analytics report significant improvements in operational efficiency and customer experience, showcasing how Rapid Innovation can help clients leverage this technology to achieve their business goals effectively.

1.1.3. Impact of Voice Analysis on Insurance Claims Efficiency

- Voice analysis significantly enhances the efficiency of insurance claims processing. It streamlines workflows by:

- Automating routine tasks: Reduces the need for manual data entry and repetitive processes.

- Prioritizing claims: AI can assess the urgency of claims based on voice sentiment and content, allowing for quicker resolution of high-priority cases.

- The impact on efficiency includes:

- Reduced claim handling time: Studies show that AI can cut processing times by up to 30% (source: McKinsey).

- Lower operational costs: Automation leads to fewer resources needed for claims management, resulting in cost savings.

- Improved accuracy in claims assessment: Voice analytics can identify discrepancies and potential fraud, leading to more accurate payouts.

- Overall, the integration of voice analysis tools leads to a more streamlined, efficient claims process, benefiting both insurers and policyholders. Rapid Innovation's expertise in AI can guide clients in implementing these solutions to maximize their operational efficiency.

1.1.4. ROI Metrics: The Business Value of Voice Analytics in Insurance

- Measuring the return on investment (ROI) for voice analytics in insurance is crucial for understanding its business value. Key ROI metrics include:

- Cost savings: Reduction in operational costs due to automation and improved efficiency.

- Increased productivity: Employees can handle more claims in less time, leading to higher throughput.

- Customer satisfaction scores: Enhanced service quality can lead to improved customer retention and loyalty.

- Additional metrics to consider:

- Fraud detection rates: Improved identification of fraudulent claims can save significant amounts of money.

- Time to resolution: Faster claim processing times can lead to quicker payouts, enhancing customer experience.

- Companies implementing voice analytics have reported ROI improvements ranging from 15% to 25% within the first year (source: Deloitte). By focusing on these metrics, insurance companies can better understand the financial benefits of adopting voice analytics technology. Rapid Innovation is committed to helping clients measure and achieve these ROI metrics, ensuring that their investment in AI technology translates into tangible business value.

Refer to the image for a visual representation of AI-powered voice analytics in insurance claims processing.

1.2. Core Technologies Driving Voice Analytics in Claims Management

Voice analytics in claims management is transforming the insurance industry by leveraging advanced technologies. These technologies enhance the efficiency and accuracy of claims processing, leading to improved customer satisfaction and reduced operational costs. The core technologies driving voice analytics in claims management include Natural Language Processing (NLP) and speech recognition systems.

1.2.1. Natural Language Processing (NLP) in Insurance Claims Analysis

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and human language. In the context of voice analytics in claims management, NLP plays a crucial role in understanding and processing the vast amounts of unstructured data generated during claims interactions.

NLP offers several key benefits in this domain:

- Understanding Context: NLP algorithms can analyze the context of conversations, identifying key themes and sentiments expressed by claimants.

- Data Extraction: NLP can extract relevant information from voice recordings, such as policy numbers, claim details, and customer sentiments, streamlining the claims process.

- Sentiment Analysis: By assessing the emotional tone of conversations, NLP helps insurers gauge customer satisfaction and identify potential issues early in the claims process.

- Automated Categorization: NLP can categorize claims based on the content of conversations, allowing for faster routing to the appropriate claims adjuster or department.

- Regulatory Compliance: NLP tools can ensure that conversations adhere to regulatory requirements by flagging non-compliant language or practices.

NLP's ability to process and analyze human language makes it an invaluable tool in enhancing the efficiency and accuracy of claims management. At Rapid Innovation, we harness the power of NLP to help our clients streamline their claims processes, ultimately leading to greater ROI through reduced processing times and improved customer experiences.

1.2.2. Speech Recognition Accuracy in Claims Handling

Speech recognition technology converts spoken language into text, enabling insurers to capture and analyze voice interactions effectively. The accuracy of speech recognition systems is critical in claims handling, as it directly impacts the quality of data collected and the overall claims process.

The advantages of speech recognition in claims handling include:

- High Accuracy Rates: Modern speech recognition systems boast accuracy rates exceeding 90%, significantly reducing the chances of misinterpretation during claims processing.

- Real-Time Transcription: Speech recognition allows for real-time transcription of conversations, enabling claims adjusters to focus on the interaction rather than note-taking.

- Multi-Language Support: Advanced speech recognition systems can support multiple languages and dialects, catering to diverse customer bases and improving accessibility.

- Integration with Other Systems: Speech recognition can be integrated with existing claims management systems, allowing for seamless data transfer and reducing manual entry errors.

- Continuous Learning: Many speech recognition systems utilize machine learning to improve their accuracy over time, adapting to specific industry jargon and individual accents.

The combination of high accuracy and real-time capabilities makes speech recognition a vital component in optimizing claims handling processes. Rapid Innovation leverages cutting-edge speech recognition technologies to enhance our clients' claims management systems, ensuring they achieve operational excellence and maximize their return on investment.

Refer to the image for a visual representation of the core technologies driving voice analytics in claims management.

1.2.3. Emotional Intelligence Applications in Voice Analysis

- Emotional intelligence (EI) refers to the ability to recognize, understand, and manage our own emotions and the emotions of others.

- Voice analysis technology can assess emotional states through vocal characteristics such as tone, pitch, and pace.

- Applications of EI in voice analysis include:

- Customer Service: Enhancing interactions by identifying customer emotions, leading to improved service and satisfaction.

- Fraud Detection: Analyzing the emotional cues in a claimant's voice to identify inconsistencies or potential deceit.

- Mental Health Assessment: Using voice analysis to monitor emotional well-being, providing insights into stress or anxiety levels.

- Research indicates that emotional cues can significantly impact communication effectiveness, making EI a valuable tool in voice analysis.

- Companies are increasingly integrating EI into their voice analysis systems to create more empathetic and responsive customer interactions, which can lead to improved customer loyalty and retention.

1.2.4. Real-Time Voice Processing for Claims Management Efficiency

- Real-time voice processing involves analyzing audio data as it is being captured, allowing for immediate insights and actions.

- Key benefits of real-time voice processing in claims management include:

- Faster Decision-Making: Instant analysis of claims-related conversations can expedite the claims process.

- Improved Accuracy: Real-time data can reduce errors by providing immediate feedback and clarifications during calls.

- Enhanced Customer Experience: Quick responses to customer inquiries can lead to higher satisfaction rates.

- Technologies such as natural language processing (NLP) and machine learning are integral to real-time voice processing, enabling systems to learn and adapt over time.

- Studies show that organizations utilizing real-time processing can reduce claims handling time by up to 30%.

- Implementing real-time voice processing can lead to significant cost savings and operational efficiencies in claims management, ultimately enhancing the bottom line.

2. Voice Analysis Applications in Insurance Claims Management

- Voice analysis technology is increasingly being adopted in the insurance industry to streamline claims management processes.

- Applications of voice analysis in this context include:

- Claim Verification: Analyzing the claimant's voice to verify identity and assess the legitimacy of claims.

- Sentiment Analysis: Understanding the emotional tone of claimants to gauge their satisfaction and concerns, which can inform follow-up actions.

- Training and Development: Using voice analysis to evaluate and improve the performance of claims adjusters through feedback on communication styles.

- Voice analysis can help identify patterns in claims that may indicate fraud or misrepresentation, enhancing risk management strategies.

- The integration of voice analysis tools can lead to a more efficient claims process, reducing the time and resources needed to resolve claims.

- According to industry reports, companies that leverage voice analysis in claims management can see a reduction in fraud rates by up to 20%.

- Overall, voice analysis is transforming the way insurance companies handle claims, making processes more efficient and customer-centric, ultimately driving greater ROI for organizations.

At Rapid Innovation, we harness the power of AI and voice analysis technology to help our clients achieve these efficiencies, ensuring they remain competitive in a rapidly evolving market.

2.1. Optimizing Claims Call Center Operations with Voice Analysis

Voice analysis technology is transforming the way claims call centers operate. By leveraging advanced algorithms and machine learning, organizations can enhance efficiency, improve customer satisfaction, and streamline processes. Here are some key aspects of optimizing claims call center operations through voice analysis:

- Voice analysis can assess caller emotions and intent.

- It helps identify trends in customer inquiries.

- The technology can provide insights into agent performance.

2.1.1. AI-Powered Call Routing and Priority Assignment Strategies

AI-powered call routing utilizes voice analysis to direct calls to the most appropriate agents based on various factors. This ensures that customers receive timely and relevant assistance.

- Dynamic Call Routing: Calls are routed based on the caller's emotional state, urgency, and specific needs, which reduces wait times and improves first-call resolution rates.

- Priority Assignment: High-priority calls, such as those from distressed customers, are escalated to experienced agents. This strategy enhances customer satisfaction by addressing urgent issues promptly.

- Data-Driven Insights: Voice analysis provides data on call patterns, helping to refine routing algorithms. Continuous learning from past interactions allows for better future call handling.

- Cost Efficiency: Optimized routing reduces operational costs by minimizing the time agents spend on calls that do not require their expertise. This leads to better resource allocation and improved overall productivity.

2.1.2. Real-Time Agent Assistance for Enhanced Customer Service

Real-time agent assistance powered by voice analysis can significantly improve the quality of customer service in claims call centers. This technology provides agents with immediate support during calls, enabling them to respond more effectively to customer needs.

- Instant Feedback: Voice analysis tools can provide agents with real-time feedback on their tone and pace, helping them adjust their communication style to better connect with customers.

- Knowledge Base Integration: Agents receive instant access to relevant information and resources based on the conversation, which reduces the time spent searching for answers and enhances the accuracy of information provided.

- Sentiment Analysis: Real-time sentiment analysis helps agents gauge customer emotions and adjust their approach accordingly. Understanding customer sentiment can lead to more empathetic interactions and improved resolution rates.

- Training and Development: Voice analysis can identify areas where agents may need additional training. Continuous monitoring allows for targeted coaching, leading to improved agent performance over time.

- Enhanced Customer Experience: With real-time assistance, agents can provide quicker and more accurate responses, leading to higher customer satisfaction and loyalty, as customers feel valued and understood.

At Rapid Innovation, we harness the power of AI and voice analysis technology to help our clients optimize their claims call center operations. By implementing these advanced solutions, organizations can achieve greater ROI through improved efficiency, reduced operational costs, and enhanced customer satisfaction. Our expertise in AI and machine learning ensures that your business can leverage these technologies effectively, driving success in a competitive landscape. For more information, visit our AI Customer Service Agent page.

2.1.3. Quality Monitoring Best Practices for Claims Calls

Quality monitoring is essential in claims calls to ensure that customer interactions meet company standards and regulatory requirements. Implementing best practices can enhance the quality of service provided.

- Establish clear criteria for evaluation:

- Define specific metrics to assess call quality, such as adherence to scripts, empathy, and resolution effectiveness.

- Use a standardized scoring system to maintain consistency across evaluations.

- Regularly train and update staff:

- Conduct ongoing training sessions to keep agents informed about new policies, procedures, and technologies.

- Provide feedback based on monitoring results to help agents improve their performance.

- Utilize technology for monitoring:

- Implement call recording and analytics software to capture and analyze claims call quality for quality assurance.

- Use speech recognition and sentiment analysis tools to identify areas for improvement.

- Encourage a culture of continuous improvement:

- Foster an environment where agents feel comfortable sharing feedback and suggestions.

- Regularly review monitoring processes and adjust them based on agent and customer feedback.

- Conduct regular audits:

- Schedule periodic audits of call monitoring processes to ensure compliance and effectiveness.

- Analyze trends in claims call quality over time to identify areas needing attention.

2.1.4. Performance Metrics for Call Center Efficiency in Insurance

Performance metrics are crucial for evaluating the efficiency of call centers in the insurance industry. These metrics help identify strengths and weaknesses in operations.

- Average Handle Time (AHT):

- Measures the average duration of a claims call, including hold time and after-call work.

- A lower AHT can indicate efficiency, but it should not compromise service quality.

- First Call Resolution (FCR):

- Tracks the percentage of claims calls resolved on the first interaction without the need for follow-up.

- High FCR rates are indicative of effective problem-solving and customer satisfaction.

- Call Abandonment Rate:

- Represents the percentage of callers who hang up before reaching an agent.

- A high abandonment rate may signal long wait times or inadequate staffing.

- Customer Satisfaction Score (CSAT):

- Measures customer satisfaction through post-call surveys.

- High CSAT scores reflect positive customer experiences and effective service.

- Service Level:

- Indicates the percentage of claims calls answered within a specific time frame.

- Maintaining a high service level is essential for customer retention and satisfaction.

2.2. Enhancing Customer Interaction Through Voice Analysis in Claims

Voice analysis technology can significantly enhance customer interactions during claims processing by providing insights into customer emotions and agent performance.

- Real-time sentiment analysis:

- Analyzes the tone, pitch, and pace of a caller's voice to gauge their emotional state.

- Helps agents tailor their responses based on the customer's mood, improving the interaction.

- Identifying key phrases and keywords:

- Detects specific words or phrases that indicate customer concerns or needs.

- Enables agents to address issues more effectively and provide relevant information.

- Performance feedback for agents:

- Provides agents with insights into their communication style and effectiveness.

- Helps identify areas for improvement, such as active listening or empathy.

- Training and development:

- Uses voice analysis data to inform training programs for agents.

- Focuses on enhancing skills that lead to better customer interactions.

- Predictive analytics:

- Analyzes historical voice data to predict customer behavior and preferences.

- Allows for proactive engagement strategies, improving overall customer experience.

At Rapid Innovation, we leverage advanced AI technologies, including voice analysis and sentiment detection, to help our clients optimize their claims processes. By implementing AI insurance solutions, businesses can enhance customer satisfaction, reduce operational costs, and ultimately achieve a greater return on investment (ROI). Our expertise in AI and blockchain ensures that we provide tailored solutions that meet the unique needs of each client, driving efficiency and effectiveness in their operations. For more insights on enhancing customer service with AI, check out this link on AI for customer service.

2.2.1. Optimizing First Notice of Loss (FNOL) Processes with AI

- First Notice of Loss (FNOL) is a critical step in the insurance claims process, marking the initial report of a loss by the policyholder.

- AI can enhance FNOL processes by automating data collection and analysis, particularly in areas such as ai insurance claims and ai in healthcare claims processing.

- Key benefits of AI in FNOL include:

- Faster claim initiation: AI can quickly gather necessary information from policyholders through chatbots or automated forms, streamlining the process and reducing wait times.

- Improved accuracy: AI algorithms can reduce human error by validating data in real-time, ensuring that the information collected is reliable and accurate.

- Enhanced customer experience: AI-driven interfaces can provide immediate feedback and guidance to claimants, fostering a more positive interaction with the insurer.

- Fraud detection: AI can analyze historical data to identify patterns and predict potential fraud, allowing insurers to take proactive measures and mitigate risks.

- Claim prioritization: Machine learning models can prioritize claims based on complexity and urgency, ensuring that resources are allocated efficiently and effectively.

- By integrating AI into FNOL, insurers can significantly reduce processing times and improve overall customer satisfaction, ultimately leading to greater ROI, especially in the context of ai claims processing and ai for claims processing.

2.2.2. Streamlining Claim Status Inquiries with Voice Technology

- Voice technology is transforming how policyholders interact with their insurance providers regarding claim status inquiries.

- Key advantages of using voice technology include:

- 24/7 availability: Voice-activated systems can provide information at any time, reducing the need for customers to wait for business hours and enhancing accessibility.

- Natural language processing (NLP): Advanced voice systems can understand and respond to customer inquiries in a conversational manner, making interactions more intuitive and user-friendly.

- Reduced call center workload: Automating routine inquiries allows human agents to focus on more complex issues, improving operational efficiency.

- Voice technology can provide real-time updates on claim status, including:

- Current processing stage

- Estimated timelines for resolution

- Required documentation or actions from the policyholder

- Integration with existing systems ensures that voice technology can pull accurate data, enhancing the reliability of the information provided.

- By streamlining claim status inquiries through voice technology, insurers can improve customer engagement and satisfaction, leading to increased loyalty and retention, particularly in the realm of ai for insurance claims and claims automation the future of insurance.

2.2.3. Dispute Resolution Management Using Sentiment Insights

- Dispute resolution is a crucial aspect of the claims process, often involving disagreements between policyholders and insurers.

- Sentiment analysis can play a vital role in understanding customer emotions and improving dispute resolution outcomes.

- Key components of using sentiment insights include:

- Analyzing communication: AI tools can assess emails, chat logs, and call transcripts to gauge customer sentiment, providing valuable insights into customer experiences.

- Identifying pain points: By understanding the emotional context of disputes, insurers can pinpoint specific issues that lead to dissatisfaction and address them proactively.

- Tailoring responses: Insights from sentiment analysis can help customer service representatives craft more empathetic and effective responses, improving the overall interaction.

- Proactive engagement: Insurers can initiate proactive engagement based on sentiment analysis, allowing them to address concerns before they escalate into disputes.

- Training programs: Data-driven insights can inform training programs for customer service teams, equipping them with skills to handle sensitive situations more effectively.

- By leveraging sentiment insights, insurers can enhance their dispute resolution processes, leading to improved customer retention and loyalty, ultimately driving greater ROI for their operations, especially in the context of machine learning in claims processing and machine learning in insurance claims.

At Rapid Innovation, we specialize in implementing these advanced AI and voice technologies, ensuring that our clients can achieve their business goals efficiently and effectively. Our expertise in AI and blockchain development allows us to tailor solutions that not only streamline processes but also enhance customer satisfaction and operational efficiency, including applications in artificial intelligence insurance claims and property damage insurance ai.

2.2.4. Measuring Customer Satisfaction in Insurance Claims

Measuring customer satisfaction in insurance claims is crucial for understanding the effectiveness of the claims process and improving overall service quality. According to JD Power auto claims satisfaction ratings, customer feedback is essential in evaluating service quality.

- Importance of Customer Satisfaction

- Directly impacts customer retention and loyalty.

- Influences brand reputation and market competitiveness.

- Key Metrics for Measurement

- Net Promoter Score (NPS): Gauges customer willingness to recommend the service.

- Customer Satisfaction Score (CSAT): Measures satisfaction with specific interactions.

- Customer Effort Score (CES): Assesses how easy it is for customers to resolve their issues.

- Methods of Measurement

- Surveys: Post-claim surveys can provide immediate feedback on the claims experience, including insights from JD Power auto claims satisfaction 2020, 2021, and 2022.

- Interviews: In-depth discussions can uncover deeper insights into customer feelings.

- Social Media Monitoring: Analyzing customer comments and reviews on platforms can reveal sentiment trends.

- Challenges in Measurement

- Response Bias: Customers may not always provide honest feedback.

- Timing: Feedback collected too late may not accurately reflect the experience.

- Diverse Customer Needs: Different demographics may have varying expectations and satisfaction levels.

- Tools and Technologies

- Customer Relationship Management (CRM) systems can track and analyze customer interactions.

- Data analytics tools can help identify patterns in customer feedback, including insights from JD Power claims satisfaction 2022.

- Sentiment analysis software can automate the assessment of customer emotions in feedback.

2.3. Claims Triage and Prioritization Using Voice and Sentiment Analysis

Claims triage and prioritization are essential for efficient claims processing, ensuring that urgent cases receive immediate attention. Voice and sentiment analysis technologies can significantly enhance this process.

- Role of Voice Analysis

- Captures tone, pitch, and speech patterns to assess urgency and emotional state.

- Helps identify distressed customers who may require faster resolution.

- Benefits of Sentiment Analysis

- Analyzes customer communications (emails, calls, chats) to gauge overall sentiment.

- Enables insurers to prioritize claims based on emotional urgency rather than just severity.

- Implementation Strategies

- Integrate voice and sentiment analysis tools into existing claims management systems.

- Train staff to interpret analysis results and respond accordingly.

- Use insights to develop targeted communication strategies for different customer segments.

- Challenges in Implementation

- Data Privacy: Ensuring compliance with regulations regarding customer data.

- Technology Integration: Merging new tools with legacy systems can be complex.

- Accuracy: Ensuring the analysis tools accurately interpret emotions and intent.

2.3.1. Automated Triage Systems for Efficient Claims Handling

Automated triage systems streamline the claims handling process, allowing insurers to manage workloads effectively and improve response times.

- Features of Automated Triage Systems

- Rule-Based Algorithms: Automatically categorize claims based on predefined criteria.

- Machine Learning: Continuously improves categorization accuracy by learning from past claims data.

- Real-Time Processing: Provides immediate feedback and prioritization for incoming claims.

- Advantages of Automation

- Increased Efficiency: Reduces the time spent on manual sorting and prioritization.

- Consistency: Ensures uniform handling of claims, minimizing human error.

- Scalability: Easily adapts to fluctuating claim volumes without compromising service quality.

- Integration with Other Technologies

- Can be combined with AI-driven chatbots for initial customer interactions.

- Works alongside data analytics tools to provide insights into claim trends and patterns.

- Enhances customer experience by providing faster resolutions and updates.

- Considerations for Implementation

- Initial Investment: Requires upfront costs for technology acquisition and integration.

- Staff Training: Employees need to be trained to work alongside automated systems.

- Continuous Monitoring: Regular assessments are necessary to ensure the system remains effective and relevant.

- Future Trends

- Increased use of AI and machine learning for more sophisticated triage processes.

- Greater emphasis on customer experience, with systems designed to enhance communication and transparency.

- Potential for predictive analytics to anticipate claim issues before they arise, allowing for proactive management.

At Rapid Innovation, we leverage our expertise in AI and blockchain technologies to help insurance companies implement these advanced systems effectively. By utilizing AI-driven analytics and automated triage systems, we enable our clients to enhance customer satisfaction, streamline operations, and ultimately achieve greater ROI. Our tailored solutions ensure that insurers can not only meet but exceed customer expectations, fostering loyalty and improving their competitive edge in the market, as highlighted in customer satisfaction in insurance claims studies.

2.3.2. Prioritizing Claims Based on Customer Sentiment Analysis

- Customer sentiment analysis involves evaluating customer feedback to gauge their feelings and attitudes towards the claims process.

- By analyzing sentiment, insurers can identify which claims may require immediate attention based on customer emotions.

- Tools such as natural language processing (NLP) can be employed to analyze text from customer communications, social media, and surveys.

- Positive sentiment may indicate satisfaction with the claims process, while negative sentiment can highlight areas needing improvement.

- Prioritizing claims based on customer sentiment analysis can lead to:

- Enhanced customer satisfaction by addressing concerns promptly.

- Improved operational efficiency by focusing resources on high-impact claims.

- Better retention rates as customers feel valued and heard.

- Insurers can use customer sentiment scores to categorize claims into different urgency levels, allowing for a more structured approach to claims management.

2.3.3. Resource Allocation Strategies for High-Value Insurance Claims

- High-value insurance claims often require more resources due to their complexity and potential financial impact.

- Effective resource allocation strategies can help insurers manage these claims efficiently and minimize losses.

- Key strategies include:

- Risk assessment: Evaluate the potential risk associated with each claim to determine the level of resources needed.

- Dedicated teams: Assign specialized teams to handle high-value claims, ensuring that experienced professionals manage these cases.

- Technology integration: Utilize claims management software to streamline processes and track resource allocation in real-time.

- Data analytics: Leverage data to identify patterns in high-value claims, allowing for proactive resource planning.

- Benefits of effective resource allocation:

- Faster claim resolution times, leading to improved customer satisfaction.

- Reduced operational costs by optimizing resource use.

- Enhanced fraud detection capabilities, as dedicated teams can focus on high-risk claims.

2.4. Post-Claims Engagement and Voice Feedback Analysis

- Post-claims engagement refers to the interactions insurers have with customers after a claim has been settled. This phase is crucial for maintaining customer relationships and gathering insights for future improvements.

- Voice feedback analysis involves collecting and analyzing customer feedback through various channels, such as phone calls, surveys, and online reviews.

- Key components of post-claims engagement include:

- Follow-up communications: Regularly check in with customers to ensure their satisfaction with the claims process.

- Feedback collection: Use surveys and interviews to gather insights on customer experiences and areas for improvement.

- Voice of the customer (VoC) programs: Implement structured programs to capture and analyze customer feedback systematically.

- Benefits of effective post-claims engagement:

- Increased customer loyalty as clients feel valued and heard.

- Identification of trends and common issues, allowing for targeted improvements in the claims process.

- Enhanced brand reputation through positive customer experiences and word-of-mouth referrals.

At Rapid Innovation, we leverage advanced AI technologies, including NLP and data analytics, to empower insurers in these areas. By implementing our solutions, clients can enhance their claims management processes, leading to greater ROI and improved customer satisfaction. Our expertise in AI and Blockchain ensures that we provide tailored solutions that meet the unique needs of each client, driving efficiency and effectiveness in their operations. We also offer customer sentiment analysis tools to further support insurers in understanding and improving customer sentiment.

2.4.1. Gathering Post-Claim Customer Feedback with AI

- AI technologies are transforming how businesses collect and analyze customer feedback after a claim has been processed.

- Automated surveys can be deployed immediately after a claim is settled, ensuring timely feedback.

- Natural Language Processing (NLP) allows for the analysis of open-ended responses, providing deeper insights into customer sentiments.

- Chatbots can engage customers in real-time, asking targeted questions about their claims experience.

- AI can identify patterns in feedback, highlighting common issues or areas of satisfaction.

- This data can be collected across multiple channels, including email, SMS, and social media, ensuring a comprehensive view of customer opinions.

- By leveraging AI, companies can reduce the time and resources spent on manual feedback collection and analysis, ultimately leading to a greater return on investment (ROI).

- Utilizing customer feedback analysis tools can enhance the effectiveness of this process.

2.4.2. Analyzing Customer Feedback for Continuous Claims Improvement

- Analyzing customer feedback is crucial for identifying strengths and weaknesses in the claims process.

- AI-driven analytics can categorize feedback into themes, making it easier to pinpoint specific areas for improvement.

- Sentiment analysis can quantify customer emotions, helping businesses understand overall satisfaction levels.

- Regularly reviewing feedback allows companies to track changes in customer perceptions over time.

- Insights gained from feedback can inform training programs for claims adjusters, enhancing their customer service skills.

- Continuous improvement initiatives can be developed based on feedback trends, leading to more efficient claims processing.

- Companies can benchmark their performance against industry standards, ensuring they remain competitive and maximize their ROI.

- Implementing feedback analytics can provide deeper insights into customer satisfaction survey analysis.

2.4.3. Creating Customer Loyalty Programs Based on Voice Insights

- Customer loyalty programs can be tailored using insights gathered from customer feedback and interactions.

- Voice of the Customer (VoC) data can reveal what customers value most, allowing businesses to design rewards that resonate.

- Personalized loyalty programs can enhance customer engagement by offering relevant incentives based on individual preferences.

- AI can help segment customers based on their feedback, enabling targeted marketing strategies.

- Implementing feedback-driven loyalty programs can increase retention rates and encourage repeat business.

- Regularly updating loyalty offerings based on ongoing feedback ensures that programs remain attractive and relevant.

- By fostering a sense of community and appreciation, businesses can strengthen their relationships with customers, ultimately driving higher ROI through increased customer loyalty.

- Utilizing user feedback analysis can further refine these loyalty programs.

3. Sentiment Analysis Techniques in Claims Processing

Sentiment analysis plays a crucial role in claims processing by helping organizations understand the emotional state of claimants. By analyzing the sentiments expressed in communications, particularly in sentiment analysis in claims processing, companies can improve customer service, streamline processes, and enhance overall satisfaction. Various techniques are employed to assess sentiments, particularly in voice communications, where emotions can be detected through vocal cues.

3.1. Real-Time Emotion Detection Methods in Voice Analysis

Real-time emotion detection in voice analysis involves using technology to assess the emotional tone of a speaker's voice as they communicate. This technique is particularly useful in claims processing, where understanding a claimant's emotional state can lead to better service and resolution of issues.

- Voice analysis software can capture and analyze vocal features such as pitch, tone, and speed.

- Machine learning algorithms are often employed to classify emotions based on these vocal features.

- Real-time analysis allows for immediate feedback and intervention, enhancing the customer experience.

3.1.1. Identifying Stress and Frustration Through Voice Patterns

Identifying stress and frustration through voice patterns is a key aspect of emotion detection in claims processing. These emotions can significantly impact a claimant's experience and the efficiency of the claims process.

Stress indicators in voice patterns may include increased pitch, rapid speech rate, and volume. For instance, a higher pitch can indicate anxiety or stress, while rapid speech may suggest urgency or frustration. Additionally, a louder voice can be a sign of agitation or anger.

Frustration can be detected through vocal tremors, pauses, and changes in tone. Vocal tremors may indicate emotional distress, while frequent pauses can suggest difficulty in articulating thoughts due to frustration. Moreover, a harsh or flat tone may reflect dissatisfaction.

The implications of detecting these emotions include tailored responses, proactive support, and improved training. Agents can adjust their communication style based on the emotional state of the claimant, leading to quicker resolutions and support for claimants in distress. Furthermore, insights from voice analysis can inform training programs for claims processors to better handle emotionally charged interactions.

By leveraging these techniques, organizations can enhance their claims processing systems, leading to improved customer satisfaction and more efficient operations. At Rapid Innovation, we specialize in integrating advanced AI solutions, such as AI insurance solutions, into claims processing systems, ensuring that our clients achieve greater ROI through enhanced customer engagement and streamlined operations.

3.1.2. Urgency Detection Algorithms in Insurance Claims Handling

Urgency detection algorithms play a crucial role in streamlining the insurance claims process, including automated insurance claims and claims adjustment. These algorithms analyze various data points to determine the urgency of a claim, allowing insurers to prioritize their responses effectively.

- Data Sources: Algorithms utilize data from multiple sources, including:

- Claim submission details

- Customer communication history

- External factors like weather events or natural disasters

- Machine Learning Techniques: Many urgency detection systems employ machine learning techniques to improve accuracy over time. These may include:

- Natural Language Processing (NLP) to analyze text in claims

- Predictive analytics to forecast claim outcomes based on historical data

- Benefits:

- Faster response times for urgent claims

- Improved customer satisfaction due to timely resolutions

- Efficient resource allocation within the claims department

- Challenges:

- Ensuring data privacy and compliance with regulations

- Balancing automation with human oversight to avoid misclassification of claims

3.1.3. Customer Satisfaction Indicators Derived from Voice Analysis

Voice analysis technology is increasingly being used to gauge customer satisfaction in real-time. By analyzing vocal attributes, insurers can gain insights into customer emotions and satisfaction levels during interactions, particularly during the insurance claims processing phase.

- Key Indicators:

- Tone and pitch variations that may indicate frustration or satisfaction

- Speech rate and pauses that can reflect engagement levels

- Sentiment analysis to assess overall customer sentiment during calls

- Implementation:

- Integration with call center software to analyze customer interactions

- Use of AI algorithms to process and interpret voice data

- Benefits:

- Immediate feedback on customer interactions, allowing for quick adjustments

- Identification of training needs for customer service representatives

- Enhanced understanding of customer needs and pain points

- Challenges:

- Ensuring accuracy in voice analysis across diverse accents and dialects

- Addressing privacy concerns related to voice data collection

3.1.4. Escalation Prediction Models for Improved Service Delivery

Escalation prediction models are designed to anticipate when a customer issue is likely to escalate, allowing insurers to intervene proactively. These models analyze various factors to predict potential escalations, particularly in the context of home insurance claim processes and medical claims processing.

- Data Utilization:

- Historical data on customer interactions and complaints

- Real-time data from ongoing customer service engagements

- Customer demographics and behavior patterns

- Modeling Techniques:

- Use of statistical methods and machine learning algorithms to identify patterns

- Development of risk scores for individual cases based on predictive analytics

- Benefits:

- Reduction in the number of escalated cases, leading to lower operational costs

- Improved customer retention through proactive engagement

- Enhanced service delivery by addressing issues before they escalate

- Challenges:

- Ensuring the model is adaptable to changing customer behaviors

- Balancing predictive insights with the need for personalized customer service.

At Rapid Innovation, we leverage these advanced technologies to help our clients in the insurance sector achieve greater ROI. By implementing urgency detection algorithms, we enable insurers to respond swiftly to critical claims, including those related to auto insurance claim processes and vehicle insurance claim procedures, thereby enhancing customer satisfaction and operational efficiency. Our expertise in AI and machine learning ensures that these systems continuously improve, adapting to new data and trends.

Furthermore, our voice analysis solutions provide real-time insights into customer sentiment, allowing insurers to refine their service strategies and training programs. This proactive approach not only mitigates escalations but also fosters stronger customer relationships, ultimately driving retention and profitability.

Incorporating these innovative solutions positions our clients at the forefront of the insurance industry, enabling them to meet and exceed their business goals effectively and efficiently.

3.2. Tracking Sentiment Across the Insurance Claims Journey

Understanding customer sentiment throughout the insurance claims journey is crucial for improving service delivery and enhancing customer satisfaction. By tracking sentiment at various stages, insurers can identify pain points and areas for improvement.

3.2.1. Analyzing Initial Claim Filing Experience for Insights

The initial claim filing experience sets the tone for the entire claims process. Analyzing sentiment at this stage can provide valuable insights into customer expectations and frustrations related to insurance claims sentiment analysis.

- Importance of First Impressions

The initial interaction can significantly influence customer perceptions. A smooth filing process can lead to higher satisfaction rates. - Key Factors to Analyze

- Ease of use of the claim filing platform (online or offline).

- Clarity of instructions and required documentation.

- Responsiveness of customer service during the filing process.

- Methods for Gathering Sentiment

- Surveys and feedback forms immediately after filing.

- Monitoring social media and online reviews for real-time feedback.

- Utilizing sentiment analysis tools to gauge emotional responses.

- Common Sentiment Indicators

Positive sentiment often correlates with a user-friendly interface and clear communication, while negative sentiment may arise from complex processes or lack of support. - Actionable Insights

Insurers should identify common pain points and streamline the filing process, enhance training for customer service representatives to improve support, and implement technology solutions to simplify documentation requirements. Rapid Innovation can assist in developing AI-driven sentiment analysis tools that provide real-time insights, enabling insurers to make data-informed decisions that enhance the initial claim filing experience.

3.2.2. Assessing Processing Milestone Satisfaction Levels

Once a claim is filed, the processing milestones become critical touchpoints that can affect overall satisfaction. Assessing sentiment at these stages helps insurers understand customer experiences and expectations through insurance claims sentiment analysis.

- Importance of Milestone Tracking

Each milestone (e.g., claim acknowledgment, investigation, resolution) is an opportunity to engage with the customer. Timely updates can significantly enhance customer trust and satisfaction. - Key Milestones to Monitor

- Acknowledgment of claim receipt.

- Communication during the investigation phase.

- Notification of claim decision and payment processing.

- Techniques for Measuring Satisfaction

- Regular surveys at each milestone to capture customer sentiment.

- Analyzing call center interactions for tone and satisfaction levels.

- Tracking Net Promoter Score (NPS) at different stages of the claims process.

- Common Sentiment Trends

Positive sentiment is often linked to timely updates and clear communication, while negative sentiment may stem from delays or lack of information. - Strategies for Improvement

Insurers should implement automated notifications to keep customers informed at each milestone, train staff to provide empathetic and clear communication during interactions, and use data analytics to identify and address bottlenecks in the claims process. Rapid Innovation can leverage blockchain technology to create transparent and secure communication channels, ensuring that customers receive timely updates and fostering trust throughout the claims journey.

By effectively tracking sentiment across the insurance claims journey, insurers can make informed decisions that enhance customer experiences and improve overall satisfaction. Rapid Innovation is committed to providing AI and blockchain solutions that empower insurers to achieve greater ROI through improved customer engagement and streamlined processes, particularly through insurance claims sentiment analysis.

3.2.3. Evaluating Resolution Satisfaction for Future Claims

- Resolution satisfaction is crucial for understanding customer experiences in the claims process. It involves assessing how effectively and efficiently claims are resolved.

- Key metrics to evaluate include:

- Time taken to resolve claims

- Communication quality during the claims process

- Overall customer satisfaction post-resolution

- Gathering feedback through surveys can provide insights into:

- Areas of improvement in the claims process

- Customer expectations and perceptions

- Analyzing resolution satisfaction helps insurers:

- Identify trends in customer dissatisfaction

- Implement changes to enhance the claims experience

- Reduce the likelihood of future claims disputes

- Insurers can use this data to tailor their services and improve customer retention.

- Regularly monitoring resolution satisfaction can lead to:

- Increased trust in the insurer

- Higher customer loyalty

- Better overall performance in the market

3.2.4. Feedback Analysis for Enhancing Customer Experiences

- Feedback analysis is essential for understanding customer needs and preferences. It involves collecting and interpreting customer feedback from various channels:

- Surveys

- Social media

- Customer service interactions

- Key aspects to focus on include:

- Identifying common pain points in customer interactions

- Understanding customer expectations and satisfaction levels

- Recognizing trends in feedback over time

- Utilizing feedback analysis can lead to:

- Improved product offerings tailored to customer needs

- Enhanced customer service protocols

- More effective communication strategies

- Insurers can leverage technology, such as AI and machine learning, to:

- Analyze large volumes of feedback quickly

- Identify sentiment and trends in customer opinions

- Implementing changes based on feedback can result in:

- Increased customer satisfaction

- Higher retention rates

- Positive word-of-mouth referrals

3.3. Sentiment-Driven Marketing Strategies in Insurance

- Sentiment-driven marketing focuses on understanding customer emotions and attitudes towards insurance products. It involves analyzing customer sentiment through:

- Social media monitoring

- Customer reviews

- Feedback surveys

- Key benefits of sentiment-driven marketing include:

- Tailoring marketing messages to resonate with customer emotions

- Creating targeted campaigns that address specific customer concerns

- Enhancing brand loyalty by aligning with customer values

- Strategies to implement sentiment-driven marketing:

- Use sentiment analysis tools to gauge public perception of the brand

- Develop content that addresses common customer fears or misconceptions about insurance

- Engage with customers on social media to foster a sense of community

- By understanding sentiment, insurers can:

- Anticipate customer needs and preferences

- Adjust marketing strategies in real-time based on customer feedback

- Improve overall customer engagement and conversion rates

- Ultimately, sentiment-driven marketing can lead to:

- Stronger customer relationships

- Increased brand awareness

- Higher sales and profitability in the insurance sector.

At Rapid Innovation, we harness the power of AI and blockchain technology to enhance these processes. By implementing AI-driven analytics, we help insurers evaluate resolution satisfaction and feedback analysis more effectively, leading to actionable insights that drive customer satisfaction and retention. Our blockchain solutions ensure transparency and security in the claims process, fostering trust and loyalty among customers. Through our tailored consulting services, we empower clients to achieve greater ROI by optimizing their operations and enhancing customer experiences.

Incorporating customer feedback analysis, feedback analytics, customer feedback analysis tools, and user feedback analysis into our strategies allows us to better understand and respond to customer needs. We utilize customer feedback analytics tools and customer feedback analysis AI to streamline our processes. Additionally, we employ customer feedback analysis using NLP to gain deeper insights into customer sentiment and feedback data analysis, ensuring that we continuously improve our services. By analyzing customer reviews and conducting customer satisfaction survey analysis, we can effectively measure and enhance the overall customer experience.

3.3.1. Leveraging Customer Sentiment for Targeted Marketing Campaigns

- Understanding customer sentiment is crucial for effective marketing.

- Customer sentiment analysis tools can evaluate customer feedback from various sources, including social media, reviews, and surveys.

- By analyzing this data, businesses can identify:

- Positive sentiments that indicate brand loyalty.

- Negative sentiments that highlight areas for improvement.

- Targeted marketing campaigns can be developed based on sentiment insights:

- Tailoring messages to resonate with specific customer emotions.

- Creating campaigns that address customer pain points or enhance positive experiences.

- Examples of leveraging sentiment:

- A brand noticing a surge in positive sentiment about a product can launch a campaign highlighting that product.

- Conversely, if negative sentiment is detected, a company can create a campaign focused on resolving those issues.

- Utilizing customer sentiment data can lead to:

- Increased customer engagement.

- Higher conversion rates.

- Improved customer retention.

- At Rapid Innovation, we harness advanced AI-driven sentiment analysis tools to help our clients gain actionable insights from customer feedback. By implementing these tools, businesses can optimize their marketing strategies, leading to greater ROI and enhanced customer relationships.

3.3.2. Personalizing Communications Based on Voice Sentiment Analysis

- Voice sentiment analysis involves assessing the emotional tone of spoken communication.

- This technology can be applied in customer service and sales interactions to enhance personalization.

- Key benefits of voice sentiment analysis include:

- Understanding customer emotions in real-time during conversations.

- Adjusting responses based on detected sentiments, leading to more empathetic interactions.

- Personalization strategies can include:

- Tailoring responses to match the customer's emotional state (e.g., calming a frustrated customer).

- Offering personalized recommendations based on the tone of the conversation.

- Implementing voice sentiment analysis can lead to:

- Improved customer satisfaction.

- Increased loyalty as customers feel understood and valued.

- Rapid Innovation specializes in integrating voice sentiment analysis technologies into customer service platforms, enabling businesses to create more personalized and effective communication strategies that drive customer satisfaction and loyalty.

3.3.3. Enhancing Brand Reputation Through Proactive Voice Engagement

- Proactive voice engagement involves reaching out to customers before they express concerns or feedback.

- This strategy can significantly enhance brand reputation by demonstrating attentiveness and care.

- Key components of proactive voice engagement include:

- Regular check-ins with customers to gauge satisfaction.

- Addressing potential issues before they escalate.

- Benefits of proactive engagement:

- Builds trust and loyalty among customers.

- Reduces negative feedback and public complaints.

- Techniques for effective proactive engagement:

- Utilizing voice calls or voice messages to follow up on recent purchases or service experiences.

- Implementing automated systems that trigger outreach based on customer behavior or sentiment analysis.

- Brands that excel in proactive engagement often see:

- Higher customer retention rates.

- Positive word-of-mouth referrals.

- At Rapid Innovation, we empower businesses to implement proactive voice engagement strategies through our AI solutions, ensuring that clients can maintain strong relationships with their customers and enhance their overall brand reputation.

4. Fraud Detection and Risk Assessment Using Voice Analysis

Voice analysis technology has emerged as a powerful tool in fraud detection and risk assessment, particularly in sectors like insurance. By examining vocal characteristics, organizations can identify potential fraudulent activities and assess risks more effectively. Voice analysis fraud detection can detect emotional states, stress levels, and inconsistencies in speech. It provides a non-invasive method to evaluate the authenticity of claims, and the technology can be integrated into existing claims processing systems for real-time analysis.

4.1. Identifying Voice-Based Fraud Indicators in Insurance Claims

In the insurance industry, fraudulent claims can lead to significant financial losses. Voice analysis helps in identifying indicators that suggest potential fraud. Key indicators include changes in pitch and tone that may indicate stress or deception, speech hesitations or inconsistencies in the narrative, and unusual speech patterns that deviate from the norm for the claimant. Voice analysis can be used to screen claims before they are processed, flag suspicious claims for further investigation, and enhance the overall efficiency of the claims process.

4.1.1. Analyzing Stress Patterns for Fraud Detection in Claims

Stress patterns in a claimant's voice can be a strong indicator of potential fraud. By analyzing these patterns, insurers can gain insights into the authenticity of claims. Stress indicators may include increased vocal tension, which can be detected through pitch analysis; variations in speech rate, where a faster or slower pace may suggest discomfort; and changes in volume, where a sudden increase or decrease can indicate emotional distress.

Techniques for analyzing stress patterns include acoustic analysis tools that measure frequency and amplitude variations, machine learning algorithms that can identify patterns associated with stress, and comparison of voice samples against a database of known fraudulent claims. The benefits of analyzing stress patterns are early detection of potentially fraudulent claims, reducing losses; improved accuracy in claims assessment, leading to fairer outcomes; and enhanced customer experience by streamlining the claims process.

By leveraging voice analysis for fraud detection and risk assessment, insurance companies can better protect themselves against fraudulent activities while ensuring a more efficient claims process. At Rapid Innovation, we specialize in integrating advanced voice analysis fraud detection technologies into your existing systems, enabling you to achieve greater ROI through enhanced fraud detection capabilities and streamlined operations. Our expertise in AI and blockchain ensures that your organization remains at the forefront of innovation, effectively mitigating risks while maximizing efficiency. For more information, check out our introduction to AI anomaly detection.

4.1.2. Inconsistency Detection in Customer Responses with Voice Analysis

Voice analysis technology has emerged as a powerful tool for detecting inconsistencies in customer responses. This method leverages various acoustic features to assess the authenticity of a speaker's statements.

- Key Features Analyzed:

- Pitch: Variations in pitch can indicate stress or deception.

- Tone: Changes in tone may reveal emotional states that contradict verbal content.

- Speech Rate: A sudden increase or decrease in speech rate can signal discomfort or evasion.

- Applications:

- Customer Service: Companies can use voice analysis to identify when customers are not being truthful about their issues.

- Fraud Prevention: Insurers can detect inconsistencies in claims by analyzing recorded conversations through voice analysis for fraud detection.

- Benefits:

- Enhanced Accuracy: Voice analysis can provide insights that traditional methods may overlook.

- Real-Time Feedback: Immediate detection allows for prompt follow-up actions.

- Challenges:

- Privacy Concerns: The use of voice analysis raises ethical questions regarding consent and data usage.

- Technology Limitations: Not all voice analysis tools are equally effective, and false positives can occur.

4.1.3. Recognizing Behavioral Red Flags in Potential Fraud Claims

Identifying behavioral red flags is crucial in the insurance industry to mitigate fraud risks. Certain patterns of behavior can indicate potential fraudulent activity.

- Common Red Flags:

- Inconsistent Stories: Claimants who provide conflicting information about the incident.

- Unusual Timing: Claims filed shortly after policy inception or significant life changes.

- Excessive Detail: Overly detailed accounts may suggest fabrication.

- Behavioral Indicators:

- Body Language: Non-verbal cues such as fidgeting or avoiding eye contact can signal dishonesty.

- Emotional Responses: Disproportionate emotional reactions may indicate a lack of authenticity.

- Technological Integration:

- Machine Learning: Algorithms can analyze historical data to identify patterns associated with fraud.

- Predictive Analytics: Tools can forecast potential fraud based on behavioral trends.

- Importance:

- Cost Savings: Early detection of fraud can save insurers significant amounts in payouts.

- Improved Claim Processing: Streamlining the claims process by focusing on high-risk cases.

4.1.4. Historical Pattern Matching for Risk Evaluation in Claims

Historical pattern matching involves analyzing past claims data to identify trends and assess risk in new claims. This method is essential for effective risk management in the insurance sector.

- Data Sources:

- Claims History: Analyzing previous claims to identify common characteristics of fraudulent claims.

- Customer Profiles: Understanding the demographics and behaviors of claimants.

- Pattern Recognition Techniques:

- Statistical Analysis: Using statistical methods to find correlations between different variables.

- Data Mining: Extracting useful information from large datasets to uncover hidden patterns.

- Benefits:

- Risk Assessment: Helps insurers evaluate the likelihood of fraud in new claims based on historical data.

- Resource Allocation: Enables better allocation of resources to high-risk claims for thorough investigation.

- Challenges:

- Data Quality: Inaccurate or incomplete data can lead to misleading conclusions.

- Evolving Fraud Tactics: Fraudsters continuously adapt, making it essential to update models regularly.

- Future Directions:

- Integration with AI: Combining historical pattern matching with artificial intelligence for more robust risk evaluation.

- Real-Time Analysis: Developing systems that can analyze claims data in real-time for immediate insights.

At Rapid Innovation, we leverage advanced AI and blockchain technologies to enhance these processes, ensuring that our clients achieve greater ROI through improved accuracy, efficiency, and fraud prevention. By integrating voice analysis for fraud detection and behavioral detection with machine learning algorithms, we empower businesses to make informed decisions and streamline their operations effectively. For more information on the impact of AI on insurance policies and prices, visit AI based Insurance pricing and use cases.

4.2. Risk Scoring and Assessment Techniques in Claims Processing

Risk scoring and assessment techniques are essential in claims processing as they help insurers evaluate the likelihood of fraud, assess the validity of insurance claims risk assessment, and streamline decision-making. By implementing effective risk scoring models and multi-factor analysis, insurance companies can enhance their operational efficiency and reduce losses.

4.2.1. Developing Voice Risk Scoring Models for Insurance

Voice risk scoring models leverage voice analysis technology to assess the risk associated with insurance claims. These models analyze various vocal attributes to identify potential fraud or inconsistencies in claims.

- Vocal attributes analyzed may include:

- Tone and pitch variations

- Speech patterns and hesitations

- Emotional indicators in voice

- Benefits of voice risk scoring models:

- Enhanced fraud detection: By identifying inconsistencies in a claimant's voice, insurers can flag potentially fraudulent claims for further investigation.

- Improved customer experience: Quick assessments can lead to faster claim resolutions, enhancing customer satisfaction.

- Cost efficiency: Reducing fraudulent claims can significantly lower operational costs for insurers.

- Implementation considerations:

- Data privacy: Insurers must ensure compliance with data protection regulations when collecting and analyzing voice data.

- Technology integration: Voice risk scoring models should be integrated with existing claims processing systems for seamless operation.

- Continuous improvement: Regular updates and training of the model are necessary to adapt to evolving fraud tactics.

4.2.2. Multi-Factor Risk Analysis for Insurance Claims Handling

Multi-factor risk analysis involves evaluating multiple variables to assess the risk associated with insurance claims. This approach provides a comprehensive view of potential risks and helps insurers make informed decisions.

- Key factors in multi-factor risk analysis may include:

- Claimant history: Previous claims, payment history, and any past fraudulent activities.

- Claim details: The nature of the claim, the amount requested, and any discrepancies in documentation.

- External data: Information from social media, public records, and other databases that may indicate risk.

- Advantages of multi-factor risk analysis:

- Holistic risk assessment: By considering various factors, insurers can better understand the context of a claim and its associated risks.

- Enhanced decision-making: A comprehensive analysis allows for more accurate risk scoring and prioritization of claims for investigation.

- Fraud prevention: Identifying patterns and anomalies across multiple factors can help prevent fraudulent claims before they are paid.

- Implementation strategies:

- Data integration: Insurers should consolidate data from various sources to create a unified view of each claim.

- Advanced analytics: Utilizing machine learning and predictive analytics can enhance the accuracy of risk assessments.

- Training and development: Staff should be trained in interpreting multi-factor risk analysis results to make informed decisions.

By employing voice risk scoring models and multi-factor risk analysis, insurance companies can significantly improve their claims processing efficiency and reduce the risk of fraud. Rapid Innovation specializes in developing and implementing these advanced AI-driven solutions, ensuring that our clients achieve greater ROI through enhanced operational efficiency and reduced fraud-related losses. Our expertise in AI and blockchain technology positions us as a trusted partner in transforming claims processing for the insurance industry. For more information, visit Rapid Innovation.

4.2.3. Predictive Risk Indicators for Proactive Claims Management

Predictive risk indicators are essential tools in the insurance industry, allowing companies to identify potential claims before they occur. By analyzing historical data and trends, insurers can develop models that predict the likelihood of claims based on various risk factors.

- Key components of predictive risk indicators:

- Historical claims data: Analyzing past claims helps identify patterns and trends.

- Customer demographics: Understanding the characteristics of policyholders can reveal risk levels.

- External factors: Economic conditions, weather patterns, and regional crime rates can influence risk.

- Benefits of using predictive risk indicators:

- Early intervention: Insurers can proactively address potential issues before they escalate.

- Improved underwriting: Better risk assessment leads to more accurate pricing and policy offerings.

- Enhanced customer satisfaction: Proactive management can lead to quicker resolutions and improved service.

- Examples of predictive risk indicators:

- Machine learning algorithms: These can analyze vast datasets to identify risk patterns, enabling insurers to make data-driven decisions.

- Social media sentiment analysis: Monitoring public sentiment can provide insights into potential claims, allowing for timely interventions.

- IoT data: Devices like telematics in vehicles can provide real-time data on driving behavior, influencing risk assessments and enhancing underwriting processes.

At Rapid Innovation, we offer tailored Blockchain insurance solutions that can help you leverage these predictive risk indicators effectively. Additionally, you can explore more about the role of generative AI in insurance to enhance your understanding of innovative technologies in the industry.

4.2.4. Automated Risk Flagging Systems for Efficient Claims Review

Automated risk flagging systems streamline the claims review process by identifying potentially fraudulent or high-risk claims. These systems utilize advanced algorithms and machine learning to analyze claims data in real-time.

- Features of automated risk flagging systems:

- Real-time data analysis: Claims are assessed as they are submitted, allowing for immediate action and reducing the backlog of claims.

- Customizable risk thresholds: Insurers can set specific criteria for flagging claims based on their risk appetite, tailoring the system to their unique needs.

- Integration with existing systems: These systems can work alongside current claims management software for seamless operation, enhancing overall efficiency.

- Advantages of automated risk flagging:

- Increased efficiency: Reduces the time spent on manual reviews, allowing adjusters to focus on high-priority claims and improving overall productivity.

- Enhanced accuracy: Algorithms can identify patterns that human reviewers might miss, reducing false positives and ensuring that genuine claims are processed swiftly.

- Cost savings: By detecting fraudulent claims early, insurers can save significant amounts in payouts, ultimately improving their bottom line.

- Implementation considerations:

- Data quality: Ensuring that the data fed into the system is accurate and comprehensive is crucial for effective flagging and reliable outcomes.

- Continuous learning: The system should evolve based on new data and trends to improve its predictive capabilities, adapting to changing risk landscapes.

- Training for staff: Adjusters and claims handlers need to understand how to interpret flagged claims effectively, ensuring that the system's benefits are fully realized.

5. Implementation Strategies and Best Practices for Voice Analytics in Insurance

Voice analytics is becoming increasingly important in the insurance sector, providing insights into customer interactions and improving claims processing. Implementing voice analytics requires careful planning and execution.

- Key strategies for implementation:

- Define objectives: Clearly outline what you want to achieve with voice analytics, such as improving customer service or identifying fraud, to ensure alignment with business goals.

- Choose the right technology: Select a voice analytics platform that integrates well with existing systems and meets your specific needs, ensuring compatibility and ease of use.

- Train staff: Ensure that employees understand how to use the technology and interpret the data it provides, fostering a culture of data-driven decision-making.

- Best practices for effective voice analytics:

- Focus on data privacy: Ensure compliance with regulations regarding customer data and privacy, building trust with clients and stakeholders.

- Monitor performance: Regularly assess the effectiveness of voice analytics in achieving your objectives, making adjustments as necessary to optimize outcomes.

- Use insights for continuous improvement: Analyze the data collected to refine processes and enhance customer interactions, driving ongoing enhancements in service delivery.