Table Of Contents

Category

Artificial Intelligence

AIML

IoT

Blockchain

Healthcare & Medicine

1. Understanding NLP in Insurance Document Processing

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and human language. In the context of insurance document processing, NLP plays a crucial role in automating and enhancing the management of vast amounts of textual data. NLP enables the extraction of relevant information from unstructured data, such as claims forms, policy documents, and customer communications. It helps in categorizing and tagging documents, making it easier for insurance companies to retrieve and analyze information. By automating routine tasks, NLP reduces the time and effort required for document processing, allowing staff to focus on more complex tasks.

1.1. Digital Transformation of Insurance Documentation : AI Agent Solution

The insurance industry is undergoing a significant digital transformation, driven by advancements in technology and changing customer expectations. Digital tools are being adopted to streamline processes, improve customer service, and enhance operational efficiency. The shift from paper-based documentation to digital formats allows for easier storage, retrieval, and sharing of information. Insurers are increasingly using cloud-based solutions to manage documents, enabling real-time access and collaboration among teams. This transformation is not just about technology; it also involves a cultural shift within organizations to embrace innovation and adapt to new ways of working.

1.1.1. Current Challenges in Insurance Document Management

Despite the advancements in digital transformation, insurance document management still faces several challenges:

- Volume of Data: The sheer volume of documents generated in the insurance industry can be overwhelming. Insurers deal with thousands of claims, policies, and communications daily, making it difficult to manage and process effectively.

- Data Silos: Many organizations still operate in silos, where information is stored in separate systems. This fragmentation can lead to inefficiencies and hinder collaboration among departments.

- Compliance and Regulation: Insurance companies must adhere to strict regulatory requirements regarding data management and privacy. Ensuring compliance while managing large volumes of documents can be challenging.

- Quality of Data: Inaccurate or incomplete data can lead to poor decision-making and increased operational costs. Ensuring data quality is essential for effective document management.

- Integration with Legacy Systems: Many insurers still rely on outdated legacy systems that are not compatible with modern digital tools. Integrating new technologies with these systems can be complex and costly.

- Customer Expectations: As customers demand faster and more personalized services, insurers must find ways to process documents quickly while maintaining accuracy and compliance.

Rapid Innovation’s AI agent solution transforms the insurance document processing landscape by combining the power of Natural Language Processing (NLP) with advanced machine learning algorithms. Our AI agents automate the analysis and categorization of complex insurance documents, such as claims forms, medical records, and policy documents, drastically reducing manual intervention and enhancing accuracy. By intelligently interpreting and processing unstructured data, our solution improves the speed of claims processing, policy management, and risk assessment. Additionally, our AI agents can be customized to handle specific document types or regulatory requirements, ensuring compliance while optimizing operational workflows. With Rapid Innovation’s AI-powered agents, insurance companies can enhance document handling efficiency, minimize errors, and improve both customer experience and internal productivity.

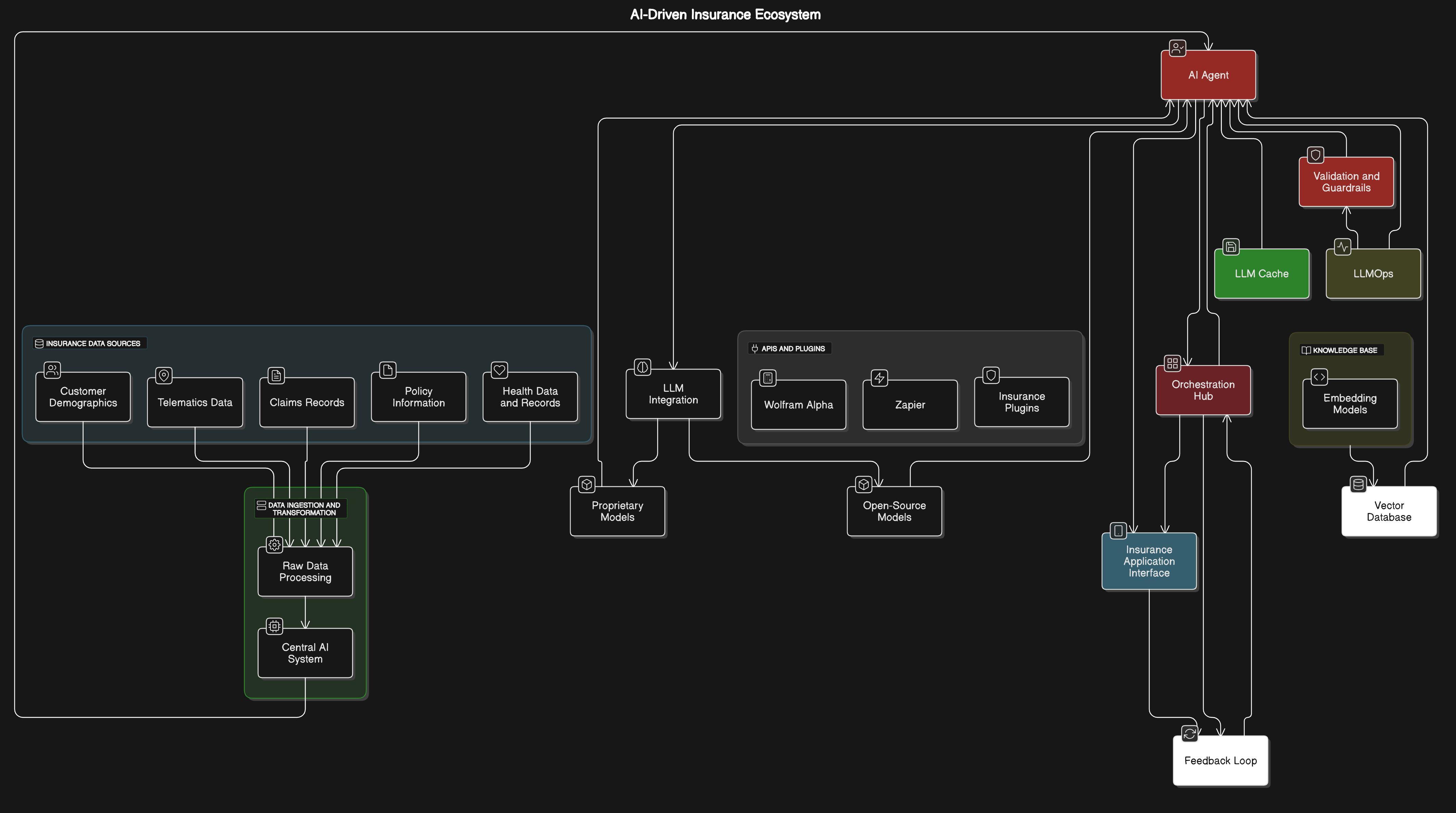

Refer to the image for a visual representation of the role of NLP in insurance document processing:

1.1.2. Impact of Manual Processing on Operational Efficiency

Manual processing of documents can significantly hinder operational efficiency in various ways:

- Time Consumption: Manual data entry and document handling are time-intensive tasks. Employees spend considerable time sorting, filing, and retrieving documents, which could be better utilized on more strategic activities. Rapid Innovation leverages AI-driven automation, including intelligent document processing and automated document generation, to streamline these processes, allowing employees to focus on high-value tasks that drive business growth.

- Error Rates: Human error is a common issue in manual processing. Mistakes in data entry can lead to incorrect information being recorded, which can have downstream effects on decision-making and reporting. By implementing AI solutions, such as automated document processing and intelligent document processing solutions, Rapid Innovation helps clients reduce error rates through intelligent data validation and processing, ensuring accuracy and reliability in their operations.

- Workflow Bottlenecks: Manual processes often create bottlenecks in workflows. For instance, if one employee is responsible for processing documents, any delay on their part can stall the entire operation. Rapid Innovation's AI solutions can automate document workflows, including document workflow automation and automated document assembly, enabling seamless processing and reducing dependency on individual performance.

- Limited Scalability: As organizations grow, manual processes become increasingly difficult to manage. Scaling operations often requires hiring more staff, which can lead to higher overhead costs. With Rapid Innovation's AI solutions, clients can scale their operations efficiently without a proportional increase in labor costs, allowing for sustainable growth through automated document scanning and automated contract management.

- Inconsistent Processes: Manual processing can lead to variations in how tasks are performed, resulting in inconsistent outcomes. This inconsistency can affect the quality of service provided to customers. Rapid Innovation implements standardized AI-driven processes, such as legal document assembly and automated data extraction, that ensure uniformity and quality across all operations.

- Lack of Visibility: Manual systems often lack real-time tracking and reporting capabilities, making it difficult for management to monitor progress and identify areas for improvement. Rapid Innovation's AI solutions provide real-time analytics and insights, empowering organizations to make informed decisions and optimize their operations through document workflow management software.

Refer to the image below for a visual representation of the impact of manual processing on operational efficiency.

1.2. Fundamentals of Insurance Document NLP

Natural Language Processing (NLP) is a critical technology in the insurance industry, particularly for managing and analyzing vast amounts of documentation. Insurance documents, such as policies, claims, and underwriting reports, often contain complex language and terminology. NLP helps in automating the extraction of relevant information, improving efficiency, and enhancing customer service.

- NLP enables the analysis of unstructured data, which is prevalent in insurance documents.

- It helps in automating repetitive tasks, reducing human error, and speeding up processes, such as insurance document automation and automated document processing insurance.

- NLP can enhance customer interactions through chatbots and virtual assistants, providing quick responses to inquiries.

1.2.1. Key NLP Technologies for Insurance

Several NLP technologies are particularly relevant to the insurance sector, each serving unique functions to streamline operations and improve data handling.

- Text Classification: This technology categorizes documents based on their content, helping insurers quickly identify relevant information. For example, claims can be classified as approved, denied, or pending, which is essential in insurance agency workflow procedures.

- Named Entity Recognition (NER): NER identifies and classifies key entities within the text, such as names, dates, and monetary values. This is crucial for extracting pertinent details from claims and policies, especially in intelligent document processing insurance.

- Sentiment Analysis: This technique assesses the sentiment expressed in customer communications, allowing insurers to gauge customer satisfaction and address concerns proactively.

- Optical Character Recognition (OCR): OCR converts scanned documents into machine-readable text, enabling the digitization of paper records and facilitating easier data extraction, which is vital for insurance document processing.

- Text Summarization: This technology condenses lengthy documents into concise summaries, making it easier for stakeholders to grasp essential information quickly, particularly in the context of document automation for insurance.

1.2.2. Machine Learning vs. Rule-Based Approaches

When implementing NLP in insurance, organizations often choose between machine learning and rule-based approaches. Each has its advantages and limitations.

- Machine Learning Approaches:

- Data-Driven: Machine learning models learn from large datasets, improving their accuracy over time as they are exposed to more examples.

- Flexibility: These models can adapt to new patterns and changes in language, making them suitable for evolving insurance terminology, such as automating the underwriting of insurance applications.

- Scalability: Machine learning can handle vast amounts of data, making it ideal for large insurance firms with extensive documentation, including automated document processing claims processing.

- Examples: Algorithms like Support Vector Machines (SVM) and Neural Networks are commonly used for tasks such as classification and sentiment analysis.

- Rule-Based Approaches:

- Predefined Rules: These systems rely on a set of manually crafted rules to process language, which can be effective for specific tasks, such as broker RFP.

- Transparency: Rule-based systems are easier to understand and audit since the logic behind decisions is explicit.

- Limitations: They can struggle with ambiguity and variations in language, requiring constant updates to remain effective.

- Use Cases: Often used for straightforward tasks like keyword extraction or basic classification where the language is predictable, such as in insurance agency procedures.

In conclusion, both machine learning and rule-based approaches have their place in the insurance industry. The choice between them often depends on the specific needs of the organization, the complexity of the tasks, and the volume of data being processed.

At Rapid Innovation, we leverage these NLP technologies to help our clients in the insurance sector achieve greater efficiency and ROI. By implementing tailored NLP solutions, we enable insurers to automate document processing, enhance customer interactions, and ultimately drive better business outcomes. Our expertise in AI and machine learning ensures that our clients can adapt to the evolving landscape of the insurance industry, maximizing their operational effectiveness and customer satisfaction, particularly in intelligent document processing claims processing and life insurance underwriting.

Refer to the image for a visual representation of the key concepts discussed in the Fundamentals of Insurance Document NLP.

1.2.3. Document Classification and Categorization

Document classification and categorization are crucial processes in managing large volumes of documents, especially in industries like insurance where paperwork is abundant.

- Definition:

- Document classification involves assigning predefined labels to documents based on their content.

- Categorization refers to grouping documents into broader categories for easier retrieval and management.

- Techniques:

- Machine Learning: Algorithms like Support Vector Machines (SVM) and Naive Bayes are commonly used for classification tasks.

- Natural Language Processing (NLP): NLP techniques help in understanding the context and semantics of the text, improving classification accuracy.

- Benefits:

- Improved Efficiency: Automating the classification process saves time and reduces manual errors.

- Enhanced Searchability: Categorized documents are easier to search and retrieve, improving workflow.

- Compliance and Risk Management: Proper classification helps in adhering to regulatory requirements by ensuring that documents are stored and managed correctly.

- Applications in Insurance:

- Policy Documents: Classifying various types of insurance policies for quick access.

- Claims Processing: Categorizing claims documents to streamline processing and reduce turnaround time.

1.2.4. Text Extraction and Analysis Capabilities

Text extraction and analysis are vital for transforming unstructured data into structured formats that can be easily analyzed and utilized.

- Text Extraction:

- Definition: The process of retrieving specific information from documents, such as names, dates, and policy numbers.

- Techniques: Optical Character Recognition (OCR) is often used to convert scanned documents into editable text. NLP tools can also extract relevant data from text.

- Text Analysis:

- Definition: Involves analyzing the extracted text to derive insights and patterns.

- Techniques: Sentiment analysis, keyword extraction, and entity recognition are common methods used in text analysis.

- Benefits:

- Data-Driven Decisions: Extracted and analyzed data can inform strategic decisions in underwriting and claims management.

- Risk Assessment: Analyzing text from claims can help identify patterns that indicate potential fraud.

- Enhanced Customer Experience: Quick access to relevant information improves response times and customer satisfaction.

- Applications in Insurance:

- Claims Analysis: Extracting data from claims documents to assess validity and expedite processing.

- Customer Feedback: Analyzing customer feedback to improve services and products.

2. Essential NLP Applications in Insurance Documents

Natural Language Processing (NLP) has numerous applications in the insurance sector, particularly in handling documents.

- Claims Processing:

- Automating the extraction of relevant information from claims documents.

- Analyzing claims for patterns that may indicate fraud or inconsistencies.

- Policy Management:

- Classifying and categorizing various insurance policies for better organization.

- Extracting key terms and conditions from policy documents to ensure compliance.

- Customer Support:

- Implementing chatbots that utilize NLP to understand and respond to customer inquiries.

- Analyzing customer interactions to improve service quality and identify common issues.

- Risk Assessment:

- Using NLP to analyze historical claims data and identify risk factors.

- Extracting insights from unstructured data sources, such as social media, to assess public sentiment and potential risks.

- Regulatory Compliance:

- Automating the review of documents to ensure they meet regulatory standards.

- Extracting and categorizing compliance-related information from various documents.

- Market Analysis:

- Analyzing market trends and customer sentiment through text data from surveys and reviews.

- Extracting insights from competitor documents to inform strategic planning.

NLP applications in insurance documents not only enhance operational efficiency but also improve customer satisfaction and compliance with regulations. At Rapid Innovation, we leverage our expertise in AI and NLP to help clients streamline their document classification and categorization processes, ultimately driving greater ROI and operational excellence.

2.1. Automated Claims Processing with NLP

Automated claims processing using Natural Language Processing (NLP) is revolutionizing the insurance and healthcare industries. By leveraging NLP, organizations can streamline their claims management processes, reduce human error, and enhance overall efficiency. NLP enables machines to understand and interpret human language, allowing for the automation of various tasks involved in claims processing, including automated claims management and insurance claim process automation. This technology can analyze vast amounts of unstructured data, such as claims forms and medical records, to extract relevant information quickly and accurately. The implementation of NLP in claims processing can lead to faster turnaround times and improved customer satisfaction, ultimately driving greater ROI for businesses.

2.1.1. Claims Form Data Extraction

Claims form data extraction is a critical component of automated claims processing. It involves the use of NLP techniques to extract relevant information from claims forms, which are often filled with unstructured data. NLP algorithms can identify key fields in claims forms, such as patient information, treatment details, and billing codes. By automating data extraction, organizations can significantly reduce the time spent on manual data entry, which is essential for claims automation. This process minimizes human error, ensuring that the extracted data is accurate and reliable. Advanced NLP models can also handle variations in language and terminology, making them adaptable to different claims formats. The extracted data can be integrated into claims management systems for further processing, leading to quicker claim approvals and enhanced operational efficiency.

2.1.2. Medical Record Analysis

Medical record analysis is another vital aspect of automated claims processing. NLP can be employed to analyze medical records, extracting pertinent information that supports claims validation and decision-making. NLP can process large volumes of medical records, identifying relevant diagnoses, treatments, and outcomes. This analysis helps in verifying the legitimacy of claims by cross-referencing the information provided in claims forms with the medical records, which is crucial for automated claims processing insurance. By automating this process, healthcare providers can ensure compliance with regulations and reduce the risk of fraudulent claims. Additionally, NLP can assist in identifying patterns and trends in medical data, which can inform future healthcare decisions and policy-making. The ability to analyze unstructured data from medical records enhances the overall accuracy of claims processing, leading to better resource allocation and patient care, thereby maximizing the return on investment for healthcare organizations.

At Rapid Innovation, we specialize in implementing these advanced NLP solutions tailored to your specific needs, ensuring that your organization can achieve its business goals efficiently and effectively, including AI insurance solutions and insurance claim automation.

2.1.3. Damage Assessment Reports Processing

Damage assessment reports are critical in evaluating the extent of loss or damage incurred by policyholders. The processing of these reports involves several key steps:

- Data Collection: Gather information from various sources, including policyholders, adjusters, and third-party experts. Utilize photographs, videos, and written descriptions to document the damage. Rapid Innovation leverages AI-driven tools to automate data collection, ensuring accuracy and reducing manual effort. This is particularly important in the context of automated insurance claims.

- Report Review: Assess the completeness and accuracy of the submitted reports. Ensure that all necessary documentation is included, such as receipts and repair estimates. Our AI algorithms can assist in flagging incomplete submissions, enhancing the review process, which is a crucial part of the claims process.

- Damage Evaluation: Analyze the data to determine the severity of the damage. Use industry standards and guidelines to assess the cost of repairs or replacements. By employing machine learning models, we can provide more precise evaluations, leading to better resource allocation and cost management, similar to the methodologies used in the medicare claims processing manual.

- Collaboration with Experts: Engage with engineers, contractors, or other specialists for detailed evaluations. Incorporate their insights into the final assessment report. Our blockchain solutions can facilitate secure and transparent communication among all parties involved, ensuring trust and accountability, which is essential in the insurance claims management systems.

- Final Report Generation: Compile findings into a comprehensive report that outlines the damage, estimated costs, and recommendations. Ensure the report is clear and accessible for all stakeholders involved. Rapid Innovation's automated reporting tools can streamline this process, reducing turnaround time, which is vital for the car insurance claim process.

- Timely Processing: Aim for quick turnaround times to facilitate prompt claims resolution. Implement technology solutions to streamline the report processing workflow. Our integrated systems ensure that all steps are efficiently managed, enhancing overall operational effectiveness, similar to the state farm claim process. For more insights on how AI agents can enhance risk evaluation in insurance check out our website.

2.1.4. Claims Validation and Fraud Detection

Claims validation and fraud detection are essential components of the insurance claims process. They help ensure that claims are legitimate and that resources are used appropriately. Key aspects include:

- Initial Claim Review: Verify the authenticity of the claim against policy terms and conditions. Check for discrepancies in the information provided by the claimant. Our AI systems can quickly analyze claims against historical data to identify inconsistencies, which is crucial in the insurance claims processing.

- Data Analytics: Utilize advanced analytics and algorithms to identify patterns indicative of fraud. Analyze historical claims data to establish benchmarks for normal claims behavior. Rapid Innovation employs sophisticated machine learning techniques to enhance fraud detection capabilities, similar to those used in automated claims processing insurance.

- Cross-Referencing Information: Compare claims data with external databases, such as law enforcement records or credit reports. Look for red flags, such as multiple claims from the same individual or unusual claim amounts. Our blockchain technology ensures secure and efficient data sharing, improving the accuracy of cross-referencing, which is essential in the medical claims processing.

- Field Investigations: Conduct on-site investigations when necessary to gather additional evidence. Interview claimants and witnesses to clarify details surrounding the claim. Our solutions can assist in managing and documenting these investigations effectively, similar to the procedures followed in the vehicle insurance claim process.

- Collaboration with Law Enforcement: Work with authorities to investigate suspected fraudulent claims. Share information and findings to support legal actions against fraudsters. Rapid Innovation's secure data-sharing platforms facilitate collaboration with law enforcement agencies, enhancing the overall claims process.

- Continuous Monitoring: Implement ongoing monitoring of claims to detect emerging fraud trends. Adjust fraud detection strategies based on new insights and data. Our AI systems continuously learn from new data, enhancing their ability to identify potential fraud, which is critical in the insurance claim process for car.

2.2. Policy Document Analysis and Management

Effective policy document analysis and management are crucial for ensuring that insurance policies are clear, compliant, and easily accessible. This process involves several important steps:

- Document Organization: Create a systematic filing system for policy documents, both physical and digital. Use categorization methods to group documents by type, such as active policies, expired policies, and endorsements. Rapid Innovation can implement AI-driven document management systems that enhance organization and retrieval, similar to the house insurance claim process.

- Content Review: Regularly review policy documents for clarity and comprehensiveness. Ensure that all terms, conditions, and exclusions are clearly stated and easily understood. Our AI tools can assist in identifying ambiguous language, improving policy clarity, which is essential for the insurance claims management systems.

- Compliance Checks: Verify that policy documents comply with regulatory requirements and industry standards. Stay updated on changes in legislation that may affect policy language. Rapid Innovation's solutions can automate compliance checks, reducing the risk of non-compliance, similar to the processes in the usaa insurance claims process.

- Version Control: Maintain a version history for all policy documents to track changes over time. Ensure that all stakeholders are using the most current version of a policy. Our blockchain technology provides an immutable record of document versions, enhancing transparency.

- Accessibility and Retrieval: Implement a user-friendly document management system that allows for easy access and retrieval of policy documents. Train staff on how to navigate the system effectively. Our solutions prioritize user experience, ensuring that stakeholders can easily find the information they need.

- Stakeholder Communication: Facilitate clear communication with policyholders regarding their coverage and any changes to their policies. Provide summaries or highlights of key policy features to enhance understanding. Rapid Innovation can develop communication platforms that streamline interactions with policyholders.

- Regular Audits: Conduct periodic audits of policy documents to identify any discrepancies or areas for improvement. Use audit findings to refine document management practices and enhance policy clarity. Our AI analytics can support audit processes, providing insights that drive continuous improvement.

2.2.1. Policy Information Extraction

Policy information extraction involves the process of identifying and retrieving relevant data from insurance documents, which is crucial for effective policy management and customer service, such as insurance policy management and insurance policy manager.

- Key components of policy information extraction include:

- Data Identification: Recognizing important fields such as policyholder name, policy number, coverage limits, and exclusions.

- Natural Language Processing (NLP): Utilizing NLP techniques to interpret and extract information from unstructured text in policy documents, including management liability insurance.

- Machine Learning Models: Implementing machine learning algorithms to improve the accuracy of data extraction over time.

- Benefits of effective policy information extraction:

- Improved Efficiency: Reduces the time spent on manual data entry and minimizes human error, allowing organizations to allocate resources more effectively, as seen in insurance policy management software.

- Enhanced Customer Experience: Quick access to policy details allows for better customer service and faster response times, leading to increased customer satisfaction and loyalty, particularly for those using progressive com manage policy.

- Regulatory Compliance: Ensures that all necessary information is captured and stored in accordance with legal requirements, mitigating risks associated with non-compliance.

2.2.2. Coverage Analysis and Comparison

Coverage analysis and comparison is the process of evaluating different insurance policies to determine the best options for clients based on their needs, including management liability and property management liability insurance.

- Key aspects of coverage analysis include:

- Policy Features: Assessing the specific features of each policy, such as coverage limits, deductibles, and exclusions, which can be found in third party risk management policy.

- Cost-Benefit Analysis: Comparing the costs of premiums against the benefits provided by each policy to ensure clients receive maximum value, as seen in hiscox policy management.

- Market Comparison: Analyzing similar policies from various insurers to identify competitive advantages or disadvantages, including those from allianz manage my policy.

- Benefits of coverage analysis and comparison:

- Informed Decision-Making: Clients can make better choices based on a clear understanding of their options, leading to more satisfactory outcomes, especially when using tools like insurance policy management system.

- Tailored Recommendations: Insurance agents can provide personalized advice that aligns with the client's unique circumstances, enhancing the overall service experience, such as trustmarkvb manage my policy.

- Cost Savings: Identifying policies that offer the best value can lead to significant savings for clients, improving their financial well-being, particularly for those considering e&o insurance for property management.

2.2.3. Policy Renewal Automation

Policy renewal automation streamlines the process of renewing insurance policies, making it more efficient for both insurers and policyholders, including those using hiscox manage policy.

- Key features of policy renewal automation include:

- Automated Notifications: Sending reminders to policyholders about upcoming renewals to ensure they do not lapse, thereby maintaining coverage continuity, as seen in the general manage my policy.

- Data Pre-Fill: Automatically populating renewal forms with existing policy information to save time for both agents and clients, reducing administrative overhead, which is beneficial for progressive manage my policy users.

- Online Portals: Providing clients with access to online platforms where they can review and renew their policies easily, enhancing user experience, similar to the services offered by www hiscox com manage your policy.

- Benefits of policy renewal automation:

- Increased Retention Rates: Simplifying the renewal process encourages policyholders to stay with their current insurer, fostering long-term relationships, particularly for those using progressive manage policy.

- Reduced Administrative Burden: Automation decreases the workload for insurance agents, allowing them to focus on more complex tasks that require human expertise.

- Enhanced Customer Satisfaction: A seamless renewal experience leads to higher levels of customer satisfaction and loyalty, ultimately driving business growth.

At Rapid Innovation, we leverage advanced AI and blockchain technologies to enhance these processes, ensuring that our clients achieve greater ROI through improved efficiency, accuracy, and customer engagement. By integrating AI-driven solutions, we empower organizations to automate and optimize their operations, while our blockchain expertise ensures secure and transparent transactions, fostering trust and compliance in the insurance sector.

2.2.4. Endorsement Processing

Endorsement processing is a critical component in various industries, particularly in insurance and finance. It involves the evaluation and approval of changes to existing policies or contracts, ensuring that any modifications align with company guidelines and regulatory requirements.

- Definition: Endorsements are amendments or additions to an existing policy that alter its terms or coverage.

- Importance:

- Provides flexibility for customers to adjust their coverage as needed.

- Helps maintain compliance with legal and regulatory standards.

- Enhances customer satisfaction by accommodating their changing needs.

- Steps in Endorsement Processing:

- Submission: Customers submit requests for endorsements through various channels (online, phone, in-person).

- Review: The request is reviewed by an underwriter or designated staff to assess the implications.

- Approval: If the endorsement meets the criteria, it is approved and documented.

- Communication: Customers are informed of the changes and any adjustments in premiums or coverage.

- Challenges:

- Ensuring timely processing to avoid customer dissatisfaction.

- Managing complex requests that may require additional documentation or underwriting.

- Keeping up with regulatory changes that may affect endorsement terms.

2.3. Customer Communication and Engagement

Effective customer communication and engagement are vital for building strong relationships and ensuring customer loyalty. Companies must adopt strategies that foster open dialogue and provide value to their customers.

- Key Elements:

- Clarity: Communication should be clear and concise to avoid misunderstandings.

- Timeliness: Responding promptly to customer inquiries enhances satisfaction.

- Personalization: Tailoring communication to individual customer needs fosters a sense of connection.

- Channels of Communication:

- Email: A traditional yet effective method for detailed communication.

- Social Media: Engaging customers through platforms like Facebook and Twitter for real-time interaction.

- Phone Support: Direct communication for urgent issues or complex inquiries.

- Engagement Strategies:

- Regular Updates: Keeping customers informed about new products, services, or changes.

- Feedback Mechanisms: Encouraging customers to share their opinions and experiences.

- Loyalty Programs: Rewarding customers for their continued business to enhance engagement.

- Benefits:

- Improved customer satisfaction and retention.

- Increased brand loyalty and advocacy.

- Enhanced understanding of customer needs and preferences.

2.3.1. Insurance Chatbots for Customer Support

Insurance Chatbots have emerged as a transformative tool in customer support, providing immediate assistance and improving overall service efficiency. They utilize artificial intelligence to interact with customers in real-time.

- Functionality:

- Answering FAQs: Chatbots can provide instant responses to common questions, reducing wait times.

- 24/7 Availability: Unlike human agents, chatbots can operate around the clock, offering support at any time.

- Handling Transactions: Some chatbots can assist with transactions, such as booking appointments or processing orders.

- Advantages:

- Cost-Effective: Reduces the need for a large customer support team, lowering operational costs.

- Scalability: Can handle multiple inquiries simultaneously, making it easier to manage high volumes of requests.

- Consistency: Provides uniform responses, ensuring that customers receive the same information regardless of when they ask.

- Limitations:

- Lack of Human Touch: Chatbots may struggle with complex issues that require empathy or nuanced understanding.

- Misinterpretation: They may misinterpret customer queries, leading to frustration.

- Dependence on Technology: Technical issues can disrupt service, impacting customer experience.

- Future Trends:

- Enhanced AI Capabilities: Continued advancements in AI will improve chatbot performance and understanding.

- Integration with Other Systems: Chatbots will increasingly integrate with CRM systems for personalized interactions.

- Voice Recognition: The rise of voice-activated technology will lead to more conversational interfaces in customer support.

At Rapid Innovation, we leverage AI and blockchain technologies to streamline endorsement processing and enhance customer communication. By implementing AI-driven chatbots, we help businesses reduce operational costs while improving customer engagement. Our blockchain solutions ensure secure and transparent processing of endorsements, fostering trust and compliance in the financial and insurance sectors. Through our expertise, clients can achieve greater ROI by optimizing their processes and enhancing customer satisfaction.

2.3.2. Automated Email Responses and Follow-Ups

Automated email responses and follow-ups are essential tools for enhancing customer engagement and streamlining communication. They help businesses maintain a consistent presence in their customers' inboxes without requiring constant manual effort.

- Immediate Acknowledgment: Automated responses can confirm receipt of inquiries, providing customers with reassurance that their message has been received. For instance, an automatic response outlook can be set up to acknowledge customer emails promptly.

- 24/7 Availability: Customers can receive responses at any time, improving satisfaction and reducing frustration. An outlook automated reply ensures that customers are never left waiting for a response.

- Personalization: Automated emails can be tailored to include the customer's name and specific details about their inquiry, making the communication feel more personal. For example, a gmail auto reply can be customized to address individual customer needs.

- Follow-Up Reminders: Automated follow-ups can remind customers about pending actions, such as completing a purchase or responding to a survey. An auto responder gmail can be programmed to send these reminders effectively.

- Efficiency: This approach reduces the workload on customer service teams, allowing them to focus on more complex issues. Implementing an auto reply for gmail can significantly streamline communication processes.

- Analytics: Automated systems can track open rates and responses, providing valuable insights into customer engagement. An auto responder on gmail can help analyze customer interactions over time.

At Rapid Innovation, we leverage AI-driven automation tools to implement these email strategies effectively, ensuring that our clients can enhance their customer interactions while optimizing operational efficiency.

2.3.3. Sentiment Analysis of Customer Feedback

Sentiment analysis involves using natural language processing (NLP) to evaluate customer feedback and determine the overall sentiment—positive, negative, or neutral. This analysis is crucial for understanding customer perceptions and improving products or services.

- Real-Time Insights: Businesses can quickly gauge customer sentiment from reviews, social media, and surveys.

- Identifying Trends: Analyzing feedback over time helps identify trends in customer satisfaction or dissatisfaction.

- Actionable Data: Sentiment analysis provides actionable insights that can inform product development, marketing strategies, and customer service improvements.

- Crisis Management: Negative sentiment can be detected early, allowing businesses to address issues before they escalate.

- Competitive Advantage: Understanding customer sentiment can help businesses differentiate themselves from competitors by addressing pain points effectively.

- Enhanced Customer Experience: By responding to feedback, companies can improve their offerings and foster loyalty.

Rapid Innovation employs advanced NLP techniques to conduct sentiment analysis, enabling our clients to make informed decisions that enhance customer satisfaction and drive business growth.

2.3.4. Tailored Marketing Campaigns Based on Insights

Tailored marketing campaigns leverage customer data and insights to create personalized marketing strategies that resonate with specific audience segments. This approach enhances engagement and conversion rates.

- Data-Driven Decisions: Utilizing customer data allows businesses to understand preferences, behaviors, and demographics.

- Segmentation: Customers can be grouped based on various criteria, such as purchase history, interests, or engagement levels, enabling targeted messaging.

- Personalized Content: Tailored campaigns can deliver relevant content, offers, and recommendations that align with individual customer needs.

- Increased Engagement: Personalized marketing messages are more likely to capture attention and drive action compared to generic communications.

- Higher Conversion Rates: Targeted campaigns often result in higher conversion rates, as they address specific customer pain points and desires.

- Customer Retention: Tailored marketing fosters a sense of connection and loyalty, encouraging repeat business and long-term relationships.

At Rapid Innovation, we harness the power of AI analytics to create tailored marketing campaigns that not only resonate with target audiences but also maximize ROI for our clients. By integrating these advanced strategies, we help businesses achieve their marketing goals efficiently and effectively.

2.4. Risk Assessment and Underwriting Automation

Risk assessment and underwriting automation are transforming the insurance industry by enhancing efficiency, accuracy, and decision-making processes. These advancements leverage technology to streamline operations and improve customer experiences, including the use of automated risk assessment tools.

2.4.1. Data-Driven Risk Profiling

Data-driven risk profiling involves using vast amounts of data to evaluate and categorize risks associated with insuring individuals or entities. This approach allows insurers to make informed decisions based on empirical evidence rather than relying solely on traditional methods.

- Utilization of Big Data: Insurers collect data from various sources, including social media, IoT devices, and public records. This data helps create a comprehensive profile of potential policyholders.

- Enhanced Accuracy: Data-driven profiling reduces human error and bias in risk assessment. Algorithms analyze patterns and trends to predict risk more accurately, which is essential for automated risk assessment tools information security.

- Real-Time Analysis: Continuous data collection allows for real-time risk assessment. Insurers can adjust policies and premiums based on the latest information.

- Customization of Policies: Insurers can tailor policies to fit the specific risk profiles of individuals or businesses, leading to more competitive pricing and better coverage options.

- Improved Customer Experience: Faster underwriting processes result in quicker policy issuance, allowing customers to benefit from personalized services and transparent pricing.

At Rapid Innovation, we harness the power of AI to implement data-driven risk profiling solutions that enable insurers to achieve greater ROI through enhanced decision-making and operational efficiency, including the use of tools to automate risk assessment.

2.4.2. Automated Risk Scoring Systems

Automated risk scoring systems utilize algorithms and machine learning to evaluate the risk associated with potential policyholders. These systems streamline the underwriting process and enhance decision-making capabilities.

- Algorithmic Risk Assessment: Automated systems analyze data points to generate risk scores. Factors considered may include credit history, claims history, and demographic information.

- Speed and Efficiency: Automated systems significantly reduce the time required for risk assessment, enabling insurers to process applications faster and leading to improved customer satisfaction. This is particularly relevant in the context of rpa risk assessment.

- Consistency in Decision-Making: Automated systems provide standardized evaluations, minimizing discrepancies in underwriting decisions. This consistency helps maintain regulatory compliance and reduces the risk of litigation.

- Predictive Analytics: Advanced algorithms can predict future claims based on historical data, allowing insurers to proactively manage risks and adjust their strategies accordingly.

- Integration with Other Systems: Automated risk scoring can be integrated with other underwriting tools and customer relationship management systems, enhancing overall operational efficiency and data sharing across departments. This includes automating vendor risk management.

- Continuous Learning: Machine learning algorithms improve over time as they process more data, leading to increasingly accurate risk assessments and better underwriting outcomes, which is crucial for automating security risk assessments.

Rapid Innovation's expertise in AI and machine learning allows us to develop automated risk scoring systems that not only streamline underwriting processes but also drive significant ROI for our clients by improving accuracy and reducing operational costs, including the implementation of automated vendor risk assessment tools.

2.4.3. Predictive Analytics for Underwriting Decisions

Predictive analytics is transforming the underwriting process by leveraging data to make informed decisions. This approach utilizes historical data, statistical algorithms, and machine learning techniques to predict future outcomes, particularly in predictive analytics in insurance underwriting.

- Enhances risk assessment:

- Analyzes past claims and underwriting data to identify patterns.

- Helps underwriters evaluate the likelihood of claims based on various factors.

- Improves decision-making speed:

- Automates data analysis, allowing underwriters to focus on complex cases.

- Reduces the time taken to assess applications, leading to quicker approvals.

- Increases accuracy:

- Minimizes human error by relying on data-driven insights.

- Provides a more objective basis for underwriting decisions.

- Customizes insurance products:

- Allows insurers to tailor products to specific customer segments.

- Enhances customer satisfaction by offering personalized solutions.

- Supports regulatory compliance:

- Helps ensure that underwriting practices align with industry regulations.

- Provides documentation and data trails for audits.

2.4.4. Streamlining Document Submission and Review

Streamlining document submission and review processes is essential for improving efficiency in underwriting. By adopting modern technologies, insurers can enhance the overall experience for both customers and underwriters.

- Simplifies submission processes:

- Utilizes online portals for easy document uploads.

- Reduces the need for physical paperwork, making it more convenient for applicants.

- Automates document verification:

- Employs optical character recognition (OCR) to extract data from submitted documents.

- Validates information against existing databases to ensure accuracy.

- Enhances collaboration:

- Facilitates real-time communication between underwriters and applicants.

- Allows for quick clarification of any missing or unclear information.

- Reduces processing time:

- Streamlines workflows to minimize bottlenecks in document review.

- Enables faster turnaround times for underwriting decisions.

- Improves customer experience:

- Provides applicants with clear guidelines on required documents.

- Offers status updates throughout the submission process, increasing transparency.

3. Advanced Document Processing Capabilities

Advanced document processing capabilities are crucial for modern underwriting practices. These technologies enable insurers to handle large volumes of documents efficiently and accurately.

- Utilizes artificial intelligence (AI):

- AI algorithms can analyze and categorize documents automatically.

- Reduces the need for manual sorting and processing, saving time and resources.

- Incorporates machine learning:

- Learns from past document processing experiences to improve accuracy over time.

- Adapts to new document types and formats, enhancing flexibility.

- Enhances data extraction:

- Advanced tools can extract relevant information from unstructured data.

- Ensures that critical data points are captured for underwriting analysis.

- Supports integration with existing systems:

- Seamlessly connects with underwriting platforms and customer relationship management (CRM) systems.

- Facilitates a holistic view of customer data, improving decision-making.

- Ensures compliance and security:

- Implements robust security measures to protect sensitive information.

- Maintains compliance with data protection regulations, safeguarding customer data.

- Provides analytics and reporting:

- Generates insights from processed documents to inform underwriting strategies.

- Helps identify trends and areas for improvement in document handling processes.

At Rapid Innovation, we leverage our expertise in AI and blockchain technologies to enhance these processes, ensuring that our clients achieve greater ROI through improved efficiency, accuracy, and customer satisfaction. By integrating predictive analytics insurance underwriting and advanced document processing capabilities, we empower insurers to make data-driven decisions that align with their business goals.

3.1. Intelligent Document Understanding

Intelligent Document Understanding (IDU) refers to the use of advanced technologies, such as artificial intelligence (AI) and machine learning (ML), to analyze, interpret, and extract meaningful information from various types of documents. This process enhances the efficiency of data processing and enables organizations to automate workflows, reduce manual errors, and improve decision-making. At Rapid Innovation, we leverage IDU to help our clients achieve greater ROI by streamlining their document processing capabilities. Key components of IDU include:

- Natural Language Processing (NLP) for understanding text.

- Optical Character Recognition (OCR) for digitizing printed text.

- Machine learning algorithms for data classification and extraction.

3.1.1. Handwritten Text Recognition

Handwritten Text Recognition (HTR) is a subset of IDU that focuses on converting handwritten text into machine-readable formats. This technology is crucial for processing documents that contain handwritten notes, signatures, or forms. At Rapid Innovation, we implement HTR solutions that enhance operational efficiency for our clients. Key aspects include:

- Technology: HTR uses deep learning models, particularly convolutional neural networks (CNNs), to recognize and interpret handwritten characters.

- Applications: HTR is commonly used in digitizing historical documents, processing handwritten forms in healthcare and finance, and automating data entry tasks, thereby reducing labor costs and improving accuracy.

- Challenges: Variability in handwriting styles can lead to recognition errors, and contextual understanding is often required to improve accuracy.

- Advancements: Recent developments in HTR have led to improved accuracy rates, with some systems achieving over 90% accuracy in recognizing handwritten text, allowing our clients to trust the data extracted for critical decision-making.

3.1.2. Complex Table Extraction

Complex Table Extraction involves the ability to identify, interpret, and extract data from tables within documents, which can often be challenging due to varying formats and structures. This capability is essential for organizations that rely on data from reports, invoices, and spreadsheets. Rapid Innovation's expertise in this area enables our clients to maximize their data utilization. Key points include:

- Technology: This process utilizes advanced algorithms and machine learning techniques to detect table structures and extract relevant data.

- Applications: It is used in financial reporting and analysis, data extraction from research papers and academic articles, and automating invoice processing in accounts payable, leading to faster turnaround times and reduced operational costs.

- Challenges: Tables can vary significantly in layout, making it difficult to create a one-size-fits-all extraction model. Additionally, nested tables and merged cells can complicate data extraction efforts.

- Advancements: Recent innovations in IDU, including the integration of UiPath Document Understanding architecture, have led to the development of systems that can handle complex table structures with higher accuracy, enabling better data extraction and analysis, ultimately driving better business insights and ROI for our clients.

By integrating IDU solutions, such as UiPath Document Understanding languages, into their operations, organizations can not only enhance their data processing capabilities but also achieve significant cost savings and improved decision-making efficiency. Rapid Innovation is committed to guiding our clients through this transformative journey, including our MLOps consulting services and AI for financial document processing applications.

3.1.3. Multi-Language Document Processing

Multi-language document processing refers to the ability to analyze and extract information from documents written in various languages. This capability is essential in today's globalized world, where businesses and organizations often deal with documents in multiple languages.

- Enhances accessibility: Organizations can reach a broader audience by processing multilanguage documents, thereby expanding their market reach and customer base.

- Increases efficiency: Automated systems can quickly analyze and extract relevant information from multilanguage documents, significantly reducing the time spent on manual processing and allowing teams to focus on strategic initiatives.

- Supports diverse industries: Multi-language processing is crucial for sectors like finance, healthcare, and legal, where documents may originate from different countries and languages, ensuring compliance and effective communication.

- Utilizes advanced technologies: Machine learning and natural language processing (NLP) techniques are employed to improve accuracy and understanding of various languages in multilanguage document processing, enabling organizations to leverage data more effectively.

- Addresses challenges: Multi-language processing must overcome issues such as idiomatic expressions, cultural nuances, and varying document formats, ensuring that the extracted information is contextually relevant and accurate.

At Rapid Innovation, we harness these capabilities to help our clients streamline their operations, enhance customer engagement, and ultimately achieve greater ROI through efficient multilanguage document processing solutions.

3.1.4. Template-Free Document Analysis

Template-free document analysis is a method that allows for the extraction of information from documents without relying on predefined templates. This approach is particularly useful for handling unstructured data.

- Flexibility: It can adapt to various document types and formats, making it suitable for diverse applications across industries.

- Reduces manual effort: Eliminates the need for creating and maintaining templates, saving time and resources, and allowing teams to allocate their efforts to more value-added tasks.

- Improves accuracy: Advanced algorithms can identify patterns and extract relevant information without being constrained by templates, leading to more reliable data insights.

- Supports real-time processing: Template-free systems can analyze documents on-the-fly, providing immediate insights and data extraction that can inform timely decision-making.

- Facilitates integration: This method can easily integrate with other systems and technologies, enhancing overall data processing capabilities and ensuring seamless workflows.

At Rapid Innovation, we implement template-free document analysis to empower our clients with the agility and precision needed to navigate complex data landscapes, driving efficiency and profitability.

3.2. Natural Language Understanding for Insurance

Natural Language Understanding (NLU) in the insurance sector involves the application of NLP techniques to interpret and analyze human language in documents and communications. This technology is transforming how insurance companies interact with customers and process claims.

- Enhances customer service: NLU enables chatbots and virtual assistants to understand customer inquiries, providing quick and accurate responses that improve customer satisfaction.

- Streamlines claims processing: Automated systems can analyze claims documents, extracting relevant information and identifying potential fraud, which reduces processing time and enhances accuracy.

- Improves risk assessment: NLU can analyze customer communications to assess risk factors and tailor insurance products accordingly, allowing companies to offer more personalized services.

- Facilitates compliance: Insurance companies can use NLU to ensure that communications and documents adhere to regulatory requirements, minimizing legal risks.

- Supports data-driven decision-making: By analyzing large volumes of text data, NLU provides insights that can inform strategic decisions and improve operational efficiency.

At Rapid Innovation, we leverage NLU to help insurance companies optimize their operations, enhance customer interactions, and achieve significant ROI through data-driven insights and automation.

3.2.1. Context-Aware Text Analysis

Context-aware text analysis refers to the ability of systems to understand and interpret text based on the surrounding context. This approach enhances the accuracy and relevance of text processing by considering various factors that influence meaning.

- Contextual factors include:

- User location: Understanding where a user is can change the interpretation of a message.

- Time of day: Certain phrases or requests may have different meanings depending on the time.

- User history: Previous interactions can provide insights into current queries or messages.

- Applications of context-aware text analysis:

- Personalized recommendations: Systems can suggest products or services based on user behavior and context, leading to increased customer satisfaction and higher conversion rates.

- Improved search results: Search engines can deliver more relevant results by considering user context, which can enhance user engagement and retention.

- Enhanced customer support: Support systems can tailor responses based on the user's previous interactions and current situation, resulting in quicker resolution times and improved customer loyalty.

- Technologies involved:

- Natural Language Processing (NLP): Techniques that help machines understand human language, enabling more effective communication between businesses and customers.

- Machine Learning: Algorithms that learn from data to improve context recognition over time, allowing businesses to adapt to changing user needs.

- Semantic Analysis: Understanding the meaning behind words and phrases in context, which can lead to more accurate insights and decision-making.

At Rapid Innovation, we leverage these advanced techniques in AI and Blockchain to help our clients achieve greater ROI by enhancing customer engagement, streamlining operations, and providing actionable insights that drive business growth through context-aware text analysis..

3.2.2. Sentiment Analysis in Customer Communications

Sentiment analysis is the process of determining the emotional tone behind a series of words. It is widely used in customer communications to gauge customer feelings and opinions about products or services.

- Key aspects of sentiment analysis:

- Emotion detection: Identifying emotions such as happiness, anger, or frustration in customer messages, which can inform product development and marketing strategies.

- Polarity classification: Categorizing sentiments as positive, negative, or neutral, enabling businesses to prioritize responses and actions.

- Aspect-based sentiment analysis: Evaluating sentiments related to specific features or aspects of a product, allowing for targeted improvements and enhancements.

- Benefits of sentiment analysis:

- Customer insights: Businesses can understand customer satisfaction and areas for improvement, leading to better product offerings and services.

- Real-time feedback: Companies can respond quickly to negative sentiments, improving customer relations and reducing churn.

- Market trends: Analyzing sentiments over time can reveal trends in customer preferences and behaviors, guiding strategic planning and marketing efforts.

- Tools and techniques:

- Text mining: Extracting useful information from text data, which can be leveraged for competitive analysis and market positioning.

- Lexicon-based approaches: Using predefined lists of words associated with sentiments to streamline analysis and improve accuracy.

- Machine learning models: Training algorithms to recognize sentiments based on labeled data, enhancing the scalability and effectiveness of sentiment analysis.

3.2.3. Intent Recognition in Queries

Intent recognition involves identifying the purpose behind a user's query. This is crucial for providing relevant responses in various applications, such as chatbots, search engines, and virtual assistants.

- Importance of intent recognition:

- User satisfaction: Accurately understanding intent leads to better user experiences, fostering brand loyalty and repeat business.

- Efficiency: Reduces the time taken to find relevant information or complete tasks, which can enhance operational efficiency and reduce costs.

- Personalization: Tailors responses based on user intent, enhancing engagement and driving higher conversion rates.

- Common intents in queries:

- Informational: Users seeking information (e.g., "What is the weather today?") can be provided with quick and accurate responses.

- Transactional: Users looking to make a purchase or complete a task (e.g., "Book a flight to New York") can be guided through the process seamlessly.

- Navigational: Users trying to find a specific website or location (e.g., "Go to Amazon") can be directed efficiently, improving user experience.

- Techniques for intent recognition:

- Keyword extraction: Identifying key terms that indicate user intent, which can inform content strategy and marketing efforts.

- Natural Language Understanding (NLU): A subset of NLP focused on understanding user intent, enabling more sophisticated interactions with users.

- Contextual analysis: Considering the context of the query to improve accuracy, which can lead to more relevant and timely responses.

- Challenges in intent recognition:

- Ambiguity: Queries can have multiple interpretations, making it difficult to determine intent, which can lead to user frustration.

- Variability in language: Different users may express the same intent in various ways, necessitating robust models to handle diverse expressions.

- Evolving language: Slang and new phrases can change over time, requiring continuous updates to models to maintain accuracy and relevance. 3.2.4. Entity Extraction and Relationship Mapping

Entity extraction and relationship mapping are crucial components in the field of natural language processing (NLP) and data analysis. These processes help in identifying and categorizing key elements from unstructured data, such as text, and understanding how these elements relate to one another.

- Entity Extraction: Involves identifying and classifying key entities in text, such as names, organizations, locations, dates, and other relevant information. Techniques used include Named Entity Recognition (NER), which employs machine learning algorithms to detect entities. Tools like SpaCy, NLTK, and Stanford NLP are commonly used for entity extraction. The accuracy of entity extraction can significantly impact downstream applications, such as search engines and recommendation systems. At Rapid Innovation, we leverage advanced machine learning techniques to enhance the precision of entity extraction, ensuring that our clients can derive actionable insights from their data.

- Relationship Mapping: Focuses on understanding the connections between extracted entities. This can involve identifying relationships such as "works for," "located in," or "is a part of." Graph databases like Neo4j can be utilized to visualize and analyze these relationships effectively. Relationship mapping aids in building knowledge graphs, which are essential for enhancing search capabilities and providing context in AI applications. By implementing relationship mapping, Rapid Innovation helps clients create comprehensive knowledge graphs that improve their decision-making processes and operational efficiencies.

- Applications: Used in various domains, including customer relationship management (CRM), social media analysis, and healthcare. It helps organizations gain insights from large volumes of unstructured data, leading to better decision-making. Our solutions have enabled clients in these sectors to optimize their strategies and achieve greater ROI through enhanced data-driven insights. For advanced solutions, consider our transformer model development services.

4. Implementation Strategies and Best Practices

Implementing entity extraction and relationship mapping requires careful planning and execution. Here are some strategies and best practices to consider:

- Define Clear Objectives: Establish what you aim to achieve with entity extraction and relationship mapping. Identify specific use cases, such as improving customer insights or enhancing product recommendations.

- Choose the Right Tools: Select appropriate tools and technologies based on your requirements. Consider factors like scalability, ease of integration, and community support when choosing NLP libraries or platforms.

- Data Quality and Preprocessing: Ensure that the data used for extraction is clean and well-structured. Implement preprocessing steps such as tokenization, normalization, and removal of stop words to enhance extraction accuracy.

- Iterative Development: Adopt an agile approach to development, allowing for continuous improvement and adaptation. Regularly test and refine your entity extraction and relationship mapping models based on feedback and performance metrics.

- Collaboration Across Teams: Foster collaboration between data scientists, domain experts, and IT teams to ensure alignment on goals and methodologies. Encourage knowledge sharing to enhance the overall understanding of the data and its context.

- Monitor and Evaluate Performance: Establish metrics to evaluate the effectiveness of your entity extraction and relationship mapping efforts. Use feedback loops to continuously monitor performance and make necessary adjustments.

4.1. Technology Integration Framework

A technology integration framework is essential for successfully implementing entity extraction and relationship mapping within an organization. This framework outlines how various technologies and processes work together to achieve desired outcomes.

- Architecture Design: Develop a robust architecture that supports data ingestion, processing, and storage. Consider using microservices architecture to allow for flexibility and scalability.

- Data Sources: Identify and integrate multiple data sources, including structured and unstructured data. Ensure that the framework can handle diverse data formats, such as text, images, and databases.

- APIs and Middleware: Utilize APIs to facilitate communication between different components of the system. Middleware can help in managing data flow and ensuring that various technologies work seamlessly together.

- Machine Learning Models: Integrate machine learning models for entity extraction and relationship mapping. Ensure that these models are regularly updated and retrained to maintain accuracy.

- User Interface: Design user-friendly interfaces for stakeholders to interact with the system. Provide visualization tools to help users understand the extracted entities and their relationships.

- Security and Compliance: Implement security measures to protect sensitive data and ensure compliance with regulations. Regularly audit the system to identify and mitigate potential vulnerabilities.

- Documentation and Training: Maintain comprehensive documentation of the integration framework and processes. Provide training for users to ensure they can effectively utilize the system and understand its capabilities.

At Rapid Innovation, we are committed to guiding our clients through the implementation of these strategies, ensuring that they achieve their business goals efficiently and effectively while maximizing their return on investment.

4.1.1. System Requirements and Architecture

- Hardware Requirements:

- Minimum CPU specifications to ensure efficient processing, enabling rapid data analysis and decision-making.

- Adequate RAM to support multitasking and data handling, crucial for AI applications that require real-time processing.

- Sufficient storage capacity for data retention and backups, ensuring that critical information is always accessible.

- Software Requirements:

- Operating system compatibility (e.g., Windows, Linux) to facilitate seamless integration with various platforms.

- Necessary software frameworks and libraries (e.g., .NET, Java) that support the development of robust applications.

- Database management systems (e.g., MySQL, PostgreSQL) to efficiently manage and retrieve large datasets

- Autocad architecture requirements for a comprehensive understanding of the software's needs.

- Autocad architecture system requirements to ensure optimal performance and functionality.

- Virtual architect ultimate home design system requirements for users interested in home design applications.

- Network Requirements:

- Reliable internet connection for cloud-based applications, ensuring uninterrupted access to services and data.

- Bandwidth considerations for data transfer and real-time processing, particularly important for applications that leverage AI analytics.

- Firewall and security protocols to protect data in transit, safeguarding sensitive information from potential breaches.

- Architecture Design:

- Client-server architecture for distributed systems, allowing for efficient resource allocation and management.

- Microservices architecture for scalability and flexibility, enabling Rapid Innovation to adapt to changing business needs.

- Use of APIs for communication between different system components, facilitating integration and interoperability.

- Scalability and Performance:

- Ability to scale horizontally or vertically based on demand, ensuring that systems can grow alongside business requirements.

- Load balancing techniques to manage traffic efficiently, optimizing performance during peak usage times.

- Performance monitoring tools to identify bottlenecks, allowing for proactive adjustments to maintain system efficiency.

4.1.2. Data Security and Privacy Considerations

- Data Encryption:

- Use of encryption protocols (e.g., AES, TLS) to protect data at rest and in transit, ensuring confidentiality and integrity.

- Implementation of end-to-end encryption for sensitive information, providing an additional layer of security.

- Access Control:

- Role-based access control (RBAC) to limit data access based on user roles, enhancing security and compliance.

- Multi-factor authentication (MFA) to enhance user verification, reducing the risk of unauthorized access.

- Data Anonymization:

- Techniques to anonymize personal data to protect user identities, crucial for compliance with privacy regulations.

- Use of pseudonymization to reduce risks associated with data breaches, ensuring that sensitive information remains protected.

- Compliance with Regulations:

- Adherence to data protection regulations (e.g., GDPR, HIPAA) to ensure legal compliance and build trust with clients.

- Regular audits to ensure compliance and identify vulnerabilities, allowing for timely remediation.

- Incident Response Plan:

- Development of a clear incident response strategy for data breaches, ensuring rapid and effective action.

- Regular training for staff on data security best practices, fostering a culture of security awareness.

4.1.3. Integration with Existing Workflows

- Assessment of Current Workflows:

- Analysis of existing processes to identify integration points, ensuring a smooth transition to new systems.

- Mapping out workflows to understand data flow and dependencies, facilitating effective integration.

- Compatibility with Existing Systems:

- Ensuring new systems can communicate with legacy systems, minimizing disruption during implementation.

- Use of middleware solutions to bridge gaps between different technologies, enhancing overall system functionality.

- User Training and Support:

- Providing training sessions for users to familiarize them with new tools, ensuring effective utilization of resources.

- Ongoing support to address integration challenges and user concerns, promoting user satisfaction and productivity.

- Feedback Mechanisms:

- Establishing channels for user feedback on integration effectiveness, allowing for continuous improvement.

- Iterative improvements based on user experiences and suggestions, ensuring that systems evolve to meet user needs.

- Monitoring and Evaluation:

- Continuous monitoring of integrated workflows for efficiency, enabling Rapid Innovation to optimize processes.

- Regular evaluation of system performance and user satisfaction, ensuring that business goals are met effectively and efficiently. 4.1.4. Scalability Planning

Scalability planning is essential for organizations aiming to grow and adapt to changing market demands. It involves preparing systems, processes, and resources to handle increased workloads without compromising performance.

- Assess current capacity:

- Evaluate existing infrastructure and resources.

- Identify bottlenecks that may hinder growth.

- Define growth projections:

- Analyze market trends and customer demands.

- Set realistic targets for expansion based on data.

- Design flexible systems:

- Implement modular architectures that can be easily upgraded.

- Utilize cloud services for on-demand resource allocation.

- Develop a phased approach:

- Plan incremental changes to avoid overwhelming the system.

- Test scalability in stages to ensure stability.

- Monitor performance:

- Use analytics tools to track system performance and user experience.

- Adjust strategies based on real-time data and feedback.

- Prepare for resource allocation:

- Ensure that financial and human resources are available for scaling.

- Create a budget that accommodates potential growth.

4.2. Change Management and Training

Change management is the structured approach to transitioning individuals, teams, and organizations from a current state to a desired future state. Effective change management ensures that changes are implemented smoothly and successfully.

- Communicate effectively:

- Keep all stakeholders informed about upcoming changes.

- Use multiple channels (emails, meetings, newsletters) for communication.

- Involve employees in the process:

- Encourage feedback and suggestions from team members.

- Create a sense of ownership among employees regarding the changes.

- Develop a change management plan:

- Outline the steps needed to implement changes.

- Identify potential risks and mitigation strategies.

- Provide training and resources:

- Offer training sessions to equip employees with necessary skills.

- Create accessible resources (guides, FAQs) for ongoing support.

- Monitor and evaluate:

- Assess the effectiveness of the change management process.

- Make adjustments based on employee feedback and performance metrics.

4.2.1. Employee Adoption Strategies

Employee adoption strategies are crucial for ensuring that new systems, processes, or technologies are embraced by the workforce. Successful adoption leads to improved productivity and morale.

- Foster a positive culture:

- Promote an environment that encourages innovation and adaptability.

- Recognize and reward employees who embrace change.

- Provide comprehensive training:

- Offer hands-on training sessions tailored to different learning styles.

- Use real-life scenarios to demonstrate the benefits of new systems.

- Communicate benefits clearly:

- Highlight how changes will improve daily tasks and overall efficiency.

- Share success stories from early adopters to motivate others.

- Create support networks:

- Establish mentorship programs where experienced employees assist others.

- Form user groups for sharing tips and best practices.

- Gather feedback continuously:

- Conduct surveys to understand employee concerns and suggestions.

- Use feedback to refine training programs and support resources.

- Set clear expectations:

- Define what successful adoption looks like for the organization.

- Communicate timelines and milestones to keep everyone aligned.