Table Of Contents

Category

Artificial Intelligence

1. Understanding AI Risk Scoring in Modern Insurance

AI risk scoring insurance is transforming the insurance industry by leveraging advanced algorithms and data analytics to assess the risk associated with insuring individuals or entities. This innovative approach enhances traditional risk assessment methods, allowing insurers to make more informed decisions.

1.1. What is AI-Powered Insurance Risk Scoring?

AI-powered insurance risk scoring refers to the use of artificial intelligence technologies to evaluate and quantify the risk profile of potential policyholders. This process involves analyzing vast amounts of data to predict the likelihood of claims and losses. It utilizes machine learning algorithms to identify patterns in data, incorporates diverse data sources, including social media, credit scores, and historical claims data, and aims to provide a more accurate and dynamic assessment of risk compared to traditional methods.

1.1.1. Definition and Core Components of AI Risk Scoring

AI risk scoring is defined as a systematic approach to evaluating risk using AI technologies. It combines various components to create a comprehensive risk profile.

- Data Collection: Gathers data from multiple sources, such as public records, customer interactions, and IoT devices (e.g., telematics in auto insurance).

- Data Processing: Cleans and organizes data for analysis and uses natural language processing (NLP) to interpret unstructured data.

- Model Development: Employs machine learning models to analyze data and trains models on historical data to predict future outcomes.

- Risk Scoring: Generates a risk score based on the analysis, with scores that can be adjusted in real-time as new data becomes available.

- Decision-Making: Assists underwriters in making informed decisions and helps in pricing policies accurately based on risk levels.

- Continuous Learning: Models improve over time with new data and adapt to changing market conditions and emerging risks.

At Rapid Innovation, we harness the power of AI risk scoring insurance to help our clients in the insurance sector achieve greater ROI. By implementing tailored AI solutions, we enable insurers to enhance their risk assessment processes, reduce operational costs, and improve customer satisfaction through more personalized offerings. AI risk scoring not only enhances the accuracy of risk assessments but also streamlines the underwriting process, making it more efficient and responsive to customer needs.

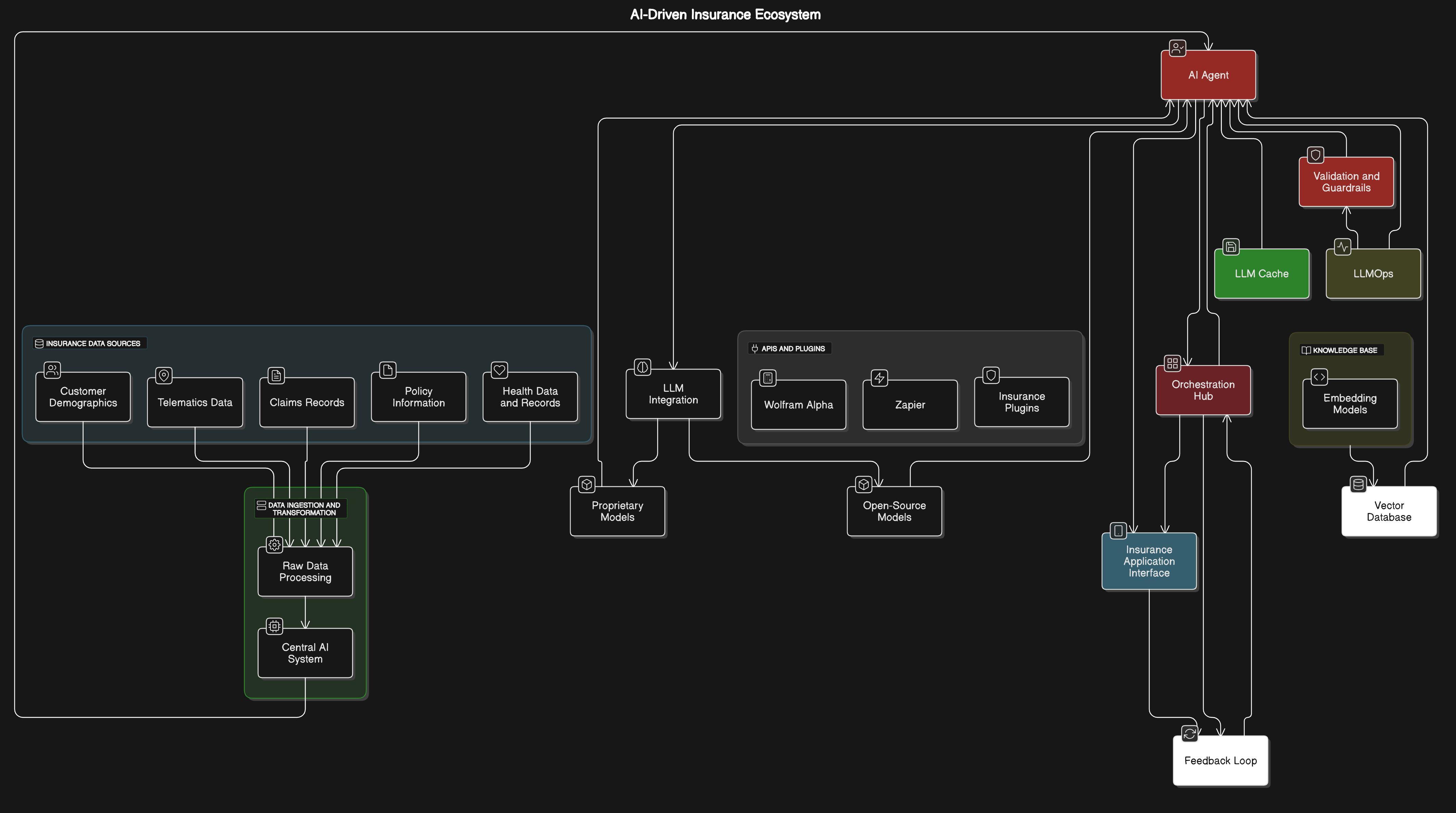

Refer to the image for a visual representation of AI risk scoring in modern insurance:

1.1.2. Evolution from Traditional Risk Assessment to AI-Driven Models

- Traditional risk assessment methods primarily relied on historical data and manual processes. Insurers used actuarial tables and statistical models to evaluate risk, which often involved significant time and labor. These methods were limited by the availability and quality of data, the ability to analyze complex variables, and human biases in decision-making.

- The introduction of AI risk assessment for insurance has transformed risk assessment by utilizing vast amounts of data from diverse sources, including social media, IoT devices, and public records. It employs machine learning algorithms to identify patterns and correlations that humans might overlook, enabling real-time risk evaluation and allowing for more dynamic pricing models. AI-driven models can adapt to new data continuously, improving their predictive accuracy over time. The shift to AI has led to a more nuanced understanding of risk, allowing insurers to tailor products to individual needs. At Rapid Innovation, we leverage our expertise in AI to help clients implement these advanced models, ensuring they can make data-driven decisions that enhance their operational efficiency and profitability. For more insights on this evolution, check out the future of personalized risk evaluation in insurance with AI agents.

1.1.3. Key Benefits of AI Risk Scoring for Insurance Providers

- Enhanced accuracy in risk evaluation: AI algorithms can analyze multiple data points simultaneously, leading to more precise risk assessments.

- Improved customer segmentation: Insurers can identify and categorize customers based on their unique risk profiles, allowing for personalized offerings.

- Faster decision-making: Automated risk scoring reduces the time taken to assess applications, leading to quicker policy issuance.

- Cost efficiency: By streamlining processes and reducing manual labor, AI can lower operational costs for insurance providers.

- Better fraud detection: AI systems can flag unusual patterns and behaviors, helping to identify potential fraudulent claims more effectively.

- Increased competitiveness: Insurers leveraging AI can offer more attractive premiums and coverage options, enhancing their market position.

- Continuous learning: AI systems improve over time, adapting to new trends and data, which helps insurers stay ahead of the curve.

At Rapid Innovation, we assist insurance providers in harnessing these benefits through tailored AI solutions that align with their specific business goals, ultimately driving greater ROI.

1.1.4. Impact of AI on Underwriting Efficiency and Accuracy: Rapid Innovation’s AI Agent Solution

- AI has revolutionized the insurance underwriting process by automating routine tasks. Data collection and analysis are streamlined, reducing the workload on underwriters. AI can quickly assess risk factors, allowing underwriters to focus on more complex cases.

- Enhanced data integration: AI systems can pull data from various sources, providing a comprehensive view of the applicant's risk profile.

- Improved accuracy in underwriting decisions: Machine learning models can identify subtle risk indicators that traditional methods might miss, leading to more informed decisions and reducing the likelihood of underwriting errors.

- Real-time risk assessment: AI allows for immediate evaluation of new information, enabling underwriters to adjust policies as needed.

- Predictive analytics: AI-powered predictive analytics solutions for insurance can forecast future risks based on historical data, helping insurers anticipate potential claims and adjust their strategies accordingly.

- Better customer experience: Faster underwriting processes lead to quicker policy approvals, enhancing customer satisfaction.

At Rapid Innovation, we leverage advanced AI agent solutions to transform underwriting efficiency and risk scoring accuracy. By utilizing our AI-powered agents, insurance providers can automate the risk assessment process, reducing manual effort and eliminating human error. Our AI agents continuously analyze vast amounts of data from multiple sources, including real-time customer behaviors, historical claims, and external risk factors, to generate more precise and dynamic risk scores. This enables underwriters to make faster, more accurate decisions while optimizing premium pricing strategies. The real-time insights provided by our AI agents not only improve underwriting efficiency but also enhance customer satisfaction through more personalized pricing models and tailored policy offerings. Rapid Innovation’s AI solution is designed to streamline workflows, reduce operational costs, and drive better outcomes for insurers and policyholders alike.

Refer to the image for a visual representation of the evolution from traditional risk assessment to AI-driven models in insurance.

1.2. The Business Case for AI Risk Assessment in Insurance

The insurance industry is increasingly adopting artificial intelligence (AI) to enhance risk assessment processes. AI can analyze vast amounts of data quickly and accurately, leading to better decision-making and improved customer experiences. The business case for AI risk assessment insurance includes several compelling factors:

- Enhanced accuracy in risk evaluation: AI improves the precision of risk assessments, allowing for more informed underwriting decisions.

- Improved efficiency in underwriting processes: Automation of routine tasks speeds up the underwriting process, enabling insurers to handle more applications in less time.

- Better customer insights and personalized offerings: AI analyzes customer data to provide tailored insurance products that meet individual needs.

- Increased competitiveness in a rapidly evolving market: By leveraging AI, insurers can stay ahead of competitors through innovative solutions and improved service delivery.

At Rapid Innovation, we specialize in developing AI-driven solutions that empower insurance companies to harness these advantages effectively, ensuring they achieve their business goals with greater efficiency and effectiveness. For more information on how AI impacts insurance policies and prices.

1.2.1. ROI Metrics and Performance Indicators for AI Solutions

To justify the investment in AI risk assessment tools, insurance companies must establish clear ROI metrics and performance indicators. These metrics help evaluate the effectiveness of AI solutions and their impact on the business.

- Cost Savings: Measure the reduction in operational costs due to automation and improved efficiency.

- Time Efficiency: Track the time taken for risk assessments before and after AI implementation. Faster processing can lead to quicker policy issuance.

- Accuracy Improvement: Assess the decrease in underwriting errors and claims fraud, which can lead to significant financial losses.

- Customer Satisfaction: Monitor customer feedback and retention rates, as improved risk assessment can lead to better policy offerings and customer experiences.

- Market Share Growth: Evaluate changes in market share as a result of enhanced product offerings and competitive pricing enabled by AI insights.

Rapid Innovation can assist in defining and tracking these metrics, ensuring that your investment in AI yields measurable results.

1.2.2. Cost Reduction through Automated Risk Scoring Processes

Automated risk scoring processes powered by AI can significantly reduce costs for insurance companies. By streamlining operations and minimizing manual intervention, insurers can achieve substantial savings.

- Labor Cost Savings: Automation reduces the need for extensive human resources in risk assessment, allowing companies to reallocate staff to more strategic roles.

- Reduced Processing Time: AI can analyze data and generate risk scores in real-time, leading to faster decision-making and reduced turnaround times for policy issuance.

- Minimized Errors: Automated systems are less prone to human error, which can lead to costly mistakes in underwriting and claims processing.

- Scalability: AI solutions can easily scale to handle increased volumes of data and transactions without a corresponding increase in costs.

- Enhanced Data Utilization: AI can leverage diverse data sources, improving risk assessment accuracy and reducing the likelihood of costly claims.

By focusing on these areas, insurance companies can build a strong business case for implementing AI risk assessment insurance solutions, ultimately leading to improved profitability and market positioning. At Rapid Innovation, we are committed to helping our clients navigate AI claim processing transformative landscape, ensuring they maximize their ROI through tailored AI solutions.

1.2.3. Competitive Advantages of AI in the Digital Insurance Landscape

- Enhanced Customer Experience

- AI enables personalized interactions through chatbots and virtual assistants, allowing insurers to engage with customers in real-time and provide tailored support, such as ai insurance near me.

- Predictive analytics can tailor insurance products to individual needs, ensuring that clients receive the most relevant coverage options, including options like ai life insurance.

- Improved Efficiency and Cost Reduction

- Automation of routine tasks reduces operational costs, freeing up resources for more strategic initiatives, such as ai underwriting.

- AI streamlines claims processing, leading to faster resolutions and improved customer satisfaction, particularly in areas like ai car insurance.

- Data-Driven Decision Making

- AI analyzes vast amounts of data for better risk assessment, enabling insurers to make informed decisions based on comprehensive insights, including those from artificial intelligence in insurance.

- Insurers can identify trends and adjust policies accordingly, enhancing their competitive edge in the market, especially in the ai insurance industry.

- Fraud Detection and Prevention

- Machine learning algorithms can detect unusual patterns indicative of fraud, significantly reducing the risk of financial losses, which is crucial for companies like ai united insurance.

- Real-time monitoring helps in mitigating fraudulent claims, ensuring that resources are allocated efficiently.

- Competitive Pricing Models

- AI allows for dynamic pricing based on real-time data, enabling insurers to respond swiftly to market changes, including those in the ai auto insurance sector.

- Insurers can offer competitive rates while maintaining profitability, ultimately leading to greater customer retention.

1.2.4. Strategic Implementation Considerations for AI Risk Assessment

- Data Quality and Management

- Ensure high-quality data for accurate AI predictions, as the effectiveness of AI solutions is heavily reliant on the quality of input data, particularly for ai insurance companies.

- Implement robust data governance frameworks to maintain data integrity and compliance.

- Regulatory Compliance

- Stay updated on regulations regarding AI use in insurance to avoid potential legal pitfalls.

- Ensure transparency in AI decision-making processes, fostering trust among stakeholders.

- Integration with Existing Systems

- Assess compatibility of AI tools with current IT infrastructure to facilitate seamless integration, especially for companies like ai united insurance near me.

- Plan for gradual integration to minimize disruption and ensure a smooth transition.

- Talent and Skill Development

- Invest in training staff to work effectively with AI technologies, enhancing overall organizational capability.

- Consider hiring data scientists and AI specialists to drive innovation and implementation.

- Continuous Monitoring and Improvement

- Regularly evaluate AI models for performance and accuracy, ensuring they remain effective over time.

- Adapt strategies based on feedback and changing market conditions to stay ahead of the competition.

2. Comprehensive Use Cases for AI Risk Scoring in Insurance

- Underwriting Automation

- AI can analyze applicant data to assess risk levels quickly, streamlining the underwriting process and reducing time and costs, ultimately leading to improved ROI, particularly in the context of ai in insurance.

- Claims Processing

- AI algorithms can evaluate claims for legitimacy and severity, automating initial assessments and speeding up payouts, which enhances customer satisfaction and loyalty.

- Customer Segmentation

- AI helps insurers categorize customers based on risk profiles, enabling targeted marketing and tailored insurance products that meet specific client needs, including those interested in insurance for ai.

- Predictive Analytics for Loss Prevention

- AI analyzes historical data to predict potential losses, allowing insurers to proactively address risks before they materialize, thereby reducing claims costs.

- Dynamic Pricing Models

- AI adjusts premiums based on real-time data and behavior, encouraging safer practices among policyholders through incentives, which can lead to lower loss ratios.

- Risk Assessment for Emerging Technologies

- AI evaluates risks associated with new technologies like autonomous vehicles, helping insurers adapt policies to cover innovative products and services, thus opening new revenue streams, including those related to skywatch ai.

At Rapid Innovation, we leverage our expertise in AI and Blockchain to help clients in the insurance sector implement these strategies effectively, ensuring they achieve their business goals efficiently and realize greater ROI.

2.1. Automated Underwriting and Policy Issuance Using AI

Automated underwriting and policy issuance using artificial intelligence (AI) is transforming the insurance industry. This technology enhances efficiency, accuracy, and customer satisfaction by streamlining processes that were traditionally manual and time-consuming.

2.1.1. Streamlining Underwriting through Automated Risk Assessments

- AI algorithms analyze vast amounts of data quickly, allowing for real-time risk assessments.

- Automated systems can evaluate various factors, including:

- Historical claims data

- Customer demographics

- Behavioral data

- Machine learning models continuously improve by learning from new data, enhancing predictive accuracy.

- Insurers can offer personalized policies based on individual risk profiles, leading to:

- More competitive pricing

- Tailored coverage options

- The use of automated underwriting AI in underwriting reduces the need for extensive manual reviews, which can be slow and prone to inconsistencies.

- Insurers can respond to customer inquiries and applications faster, improving overall customer experience.

- According to a report, automated underwriting can reduce the time taken to issue a policy from days to mere minutes.

2.1.2. Reducing Human Error and Turnaround Time in Underwriting

- Human error is a significant risk in traditional underwriting processes, often leading to incorrect risk assessments and mispriced policies.

- AI systems minimize these errors by relying on data-driven insights rather than subjective judgment.

- Automated processes ensure consistency in underwriting decisions, which helps maintain regulatory compliance.

- The speed of AI-driven underwriting significantly reduces turnaround times, allowing insurers to:

- Process applications more efficiently

- Improve customer satisfaction through quicker responses

- Insurers can allocate resources more effectively, focusing on complex cases that require human intervention.

- The reduction in turnaround time can lead to increased policy issuance, positively impacting revenue.

- Studies indicate that companies implementing automated underwriting AI in underwriting have seen a reduction in processing times by up to 80%.

At Rapid Innovation, we leverage our expertise in AI to help insurance companies implement automated underwriting solutions that not only enhance operational efficiency but also drive greater ROI. By integrating AI-driven risk assessments and reducing human error, our clients can achieve faster policy issuance and improved customer satisfaction, ultimately leading to increased revenue and market competitiveness. For more insights on AI in underwriting.

2.1.3. Personalized Premium Pricing Based on Real-Time Data Insights

- Personalized premium pricing leverages real-time data to tailor insurance premiums to individual customers. Insurers collect data from various sources, including social media activity, wearable devices, and driving behavior through telematics. This data allows insurers to assess risk more accurately and offer customized pricing, which can significantly impact the cost individual health insurance.

- Benefits of personalized premium pricing include:

- Increased customer satisfaction due to tailored offerings.

- Enhanced competitiveness in the market.

- Improved risk management through better data analysis.

- Real-time insights enable insurers to adjust premiums dynamically based on changing customer behavior or circumstances. For example, a customer who drives safely may receive lower premiums, while those with riskier behaviors may see increases. This approach can lead to higher retention rates as customers feel valued and understood. Insurers can also use predictive analytics to forecast future risks and adjust pricing accordingly, which is essential for understanding the average cost of health insurance individual.

2.2. Claims Processing and AI-Powered Fraud Detection

- Claims processing is a critical function in the insurance industry, and AI is transforming this area significantly. AI-powered systems streamline the claims process by:

- Automating data entry and document verification via NLP.

- Reducing processing times from days to minutes.

- Enhancing accuracy in claims assessment.

- Automating data entry and document verification via NLP.

- Fraud detection is a major concern for insurers, with estimates suggesting that fraudulent claims can account for up to 10% of all claims (source: Insurance Information Institute). Leveraging AI development for fraud detection in insurance development, companies are now able to use machine learning and natural language processing technologies to identify patterns indicative of fraud. These advanced AI solutions allow insurers to analyze vast amounts of data in real time, helping detect anomalies and prevent fraudulent claims, ultimately reducing costs and improving operational efficiency.

- Benefits of AI in claims processing and fraud detection include:

- Increased efficiency in handling claims.

- Reduction in operational costs.

- Improved accuracy in identifying legitimate claims versus fraudulent ones.

- Insurers can analyze vast amounts of data quickly, allowing for real-time decision-making. The integration of AI also helps in identifying emerging fraud trends, enabling proactive measures.

2.2.1. Identifying Fraudulent Claims Using AI Pattern Recognition

- AI pattern recognition is a powerful tool in identifying fraudulent claims by analyzing historical data and detecting anomalies. Key features of AI pattern recognition in fraud detection include:

- Analyzing claim submissions for inconsistencies.

- Comparing claims against known fraud patterns.

- Utilizing algorithms to flag suspicious activities for further investigation.

- Machine learning models can be trained on large datasets to recognize patterns that may indicate fraud, such as:

- Repeated claims from the same individual or entity.

- Claims that deviate significantly from the norm for similar cases.

- The use of AI reduces the reliance on manual reviews, which can be time-consuming and prone to human error.

- Benefits of AI pattern recognition in fraud detection include:

- Faster identification of fraudulent claims.

- Enhanced accuracy in distinguishing between legitimate and fraudulent claims.

- Lower costs associated with fraud investigations.

- Insurers can also implement real-time monitoring systems that alert them to potential fraud as claims are submitted. By continuously learning from new data, AI systems improve their detection capabilities over time, adapting to evolving fraud tactics.

At Rapid Innovation, we specialize in integrating AI technologies for claim processing. Our solutions can help insurers implement personalized premium pricing models and streamline claims processing, ultimately leading to greater ROI and improved customer satisfaction. By leveraging our expertise, clients can stay ahead in a competitive market while effectively managing risks and reducing operational costs.

2.2.2. Enhancing Customer Satisfaction with Quick Claims Processing

- Quick claims processing is crucial for customer satisfaction in the insurance industry. Customers expect timely responses and resolutions when they file claims. Efficient claims processing, such as automated insurance claims processing, can lead to increased customer loyalty, positive word-of-mouth referrals, and higher retention rates.

- Technology plays a significant role in speeding up claims processing. Automation tools, including automated claims processing and claim automation, can streamline workflows, while AI can assist in assessing claims and determining payouts. Rapid Innovation leverages AI-driven solutions to enhance the efficiency of claims processing, enabling insurers to implement self-service options for customers, such as online portals that allow for easy insurance claim automation and mobile apps that enable real-time tracking of claim status. For more insights on how AI is transforming pricing strategies, check out how artificial intelligence is reshaping price optimization.

- Training staff to handle claims efficiently is essential. Well-trained employees can resolve issues faster, and empathy along with communication skills enhances customer interactions. Regular feedback from customers can help improve the claims process; surveys can identify pain points, and continuous improvement based on customer input can enhance satisfaction.

2.2.3. Reducing False Positives in Fraud Detection and Improving Outcomes

- Fraud detection is a critical aspect of the insurance industry, but false positives can hinder operations. False positives occur when legitimate claims are flagged as fraudulent, leading to delays in processing, customer dissatisfaction, and increased operational costs.

- Advanced analytics and machine learning can help reduce false positives. Rapid Innovation employs sophisticated algorithms that analyze patterns and identify genuine fraud more accurately, with continuous learning from past claims to improve detection models. Collaboration between departments can enhance fraud detection; claims, underwriting, and fraud investigation teams should share insights to create a holistic view of customer behavior, leading to better outcomes.

- Educating customers about fraud prevention can also help. Clear communication about what constitutes fraud can reduce misunderstandings, and encouraging customers to report suspicious activities can aid in detection. Regular audits and updates to fraud detection systems are necessary; keeping systems current with emerging fraud tactics is essential, and periodic reviews can identify areas for improvement in detection processes.

2.3. Dynamic Pricing and Personalized Insurance Policies

- Dynamic pricing allows insurers to adjust premiums based on real-time data and individual risk profiles. Personalized insurance policies cater to the unique needs of each customer, leading to better coverage options and increased customer satisfaction.

- Key factors influencing dynamic pricing include customer behavior and lifestyle choices, real-time data from IoT devices (e.g., telematics in auto insurance), and market trends along with competitor pricing.

- Benefits of dynamic pricing and personalized policies include more accurate risk assessment leading to fairer pricing and customers feeling valued when policies are tailored to their needs.

- Technology enables the implementation of dynamic pricing; big data analytics can process vast amounts of information quickly, and machine learning algorithms can predict risk more effectively. Rapid Innovation's expertise in AI and data analytics empowers insurers to harness these technologies for optimal pricing strategies.

- Challenges include ensuring transparency in pricing models to maintain trust and balancing profitability with competitive pricing strategies.

- Continuous engagement with customers is vital. Regular communication about policy changes and pricing adjustments can enhance trust, and feedback mechanisms can help insurers refine their offerings.

- 2.3.1. Leveraging Customer Data for Customized Premium Offers

- Customer data is a valuable asset for insurance companies, enabling them to create personalized premium offers. By analyzing data such as demographics, purchase history, and behavior patterns, insurers can identify specific customer needs and preferences. Customized premium offers can lead to higher conversion rates as they resonate more with individual customers.

- Techniques for leveraging customer data include:

- Data mining to uncover trends and insights.

- Machine learning algorithms to predict customer behavior and preferences.

- Segmentation of customers into distinct groups for targeted marketing.

- Examples of data sources include:

- Social media activity.

- Online browsing behavior.

- Customer feedback and surveys.

- The use of customer data not only enhances the customer experience but also fosters loyalty and trust. At Rapid Innovation, we utilize advanced AI techniques to help insurance companies harness their customer data effectively, leading to customized premium offers that drive higher ROI.

2.3.2. Real-Time Policy Pricing Adjustments Based on Risk Factors

- Real-time pricing adjustments allow insurers to respond quickly to changing risk factors. Factors influencing risk can include changes in a customer's driving behavior (for auto insurance), environmental factors (for property insurance), and health metrics (for life insurance).

- Technologies such as telematics and IoT devices provide continuous data streams that inform pricing models.

- Benefits of real-time adjustments include:

- More accurate pricing that reflects current risk levels.

- Increased competitiveness in the market by offering fairer rates.

- Enhanced customer satisfaction as clients feel they are being charged appropriately.

- Insurers can implement dynamic pricing strategies that adjust premiums based on real-time data analysis. This approach can lead to improved risk management and reduced claims costs. Rapid Innovation's expertise in AI and blockchain technology enables insurers to integrate these systems seamlessly, ensuring that pricing models are both agile and data-driven.

2.3.3. Improving Customer Retention through Tailored Pricing Strategies

- Tailored pricing strategies are essential for enhancing customer retention in the insurance industry. By understanding individual customer profiles, insurers can offer personalized pricing that meets specific needs.

- Key strategies for improving retention include:

- Offering loyalty discounts for long-term customers.

- Implementing usage-based pricing models that reward safe behavior.

- Providing flexible payment options to accommodate different financial situations.

- Regular communication with customers about their policies and potential savings can strengthen relationships. Data analytics can help identify at-risk customers who may be considering switching providers, allowing for proactive engagement.

- Retaining existing customers is often more cost-effective than acquiring new ones, making tailored pricing a strategic priority. Insurers that focus on customer-centric pricing are likely to see higher retention rates and increased customer lifetime value. At Rapid Innovation, we empower insurers with AI-driven insights and blockchain solutions that enhance customer engagement and retention strategies, ultimately leading to greater ROI.

2.4. Catastrophe Risk Management and Disaster Preparedness

Effective catastrophe risk management and disaster preparedness are essential for minimizing the impact of natural disasters on communities, economies, and infrastructure. This involves a combination of predictive analytics, strategic planning, and resource allocation to ensure that organizations and governments can respond swiftly and effectively when disasters strike. The concept of catastrophe risk management encompasses various strategies, including catastrophe modeling a new approach to managing risk.

2.4.1. Predicting Risks with Geospatial Data for Proactive Coverage

Geospatial data plays a crucial role in predicting risks associated with natural disasters. By analyzing spatial information, organizations can identify vulnerable areas and develop proactive strategies to mitigate risks. Geographic Information Systems (GIS) are used to visualize and analyze data related to hazards such as floods, earthquakes, and hurricanes. Historical data can be combined with real-time information to create predictive models that forecast potential disaster scenarios. Risk assessments can be conducted to determine the likelihood of various disasters occurring in specific regions. This data-driven approach allows for targeted resource allocation to high-risk areas, the development of early warning systems to alert communities before disasters occur, and enhanced urban planning to reduce vulnerability in infrastructure. Collaboration with local governments and organizations can improve data accuracy and response strategies. Additionally, the integration of satellite imagery and remote sensing technology provides real-time updates on environmental changes and disaster impacts.

At Rapid Innovation, we leverage advanced AI algorithms to enhance the predictive capabilities of geospatial data analysis. By employing machine learning techniques, we can refine predictive models, enabling organizations to make informed decisions that lead to greater efficiency and reduced costs in disaster preparedness. This is particularly relevant in the context of natural catastrophe risk management.

2.4.2. Optimizing Reinsurance Strategies for Regional Threats

Reinsurance is a critical component of catastrophe risk management, allowing insurers to spread risk and maintain financial stability in the face of large-scale disasters. Optimizing reinsurance strategies is essential for addressing regional threats effectively. Understanding regional risks helps insurers tailor their reinsurance programs to specific threats, such as hurricanes in coastal areas or wildfires in arid regions. Data analytics can be employed to assess the potential financial impact of disasters, guiding reinsurance purchasing decisions. Key strategies include utilizing catastrophe models to estimate losses and determine appropriate coverage levels, engaging in portfolio diversification to minimize exposure to any single event or region, and establishing partnerships with reinsurers who have expertise in specific regional risks. Continuous monitoring of emerging risks, such as climate change, is vital for adjusting reinsurance strategies over time. Regulatory considerations and compliance with local laws can influence reinsurance arrangements, necessitating a thorough understanding of regional regulations. Effective communication with stakeholders, including policyholders and investors, is essential for maintaining trust and transparency in reinsurance practices.

Rapid Innovation's expertise in blockchain technology can further enhance the reinsurance process by providing a secure and transparent platform for data sharing among stakeholders. This ensures that all parties have access to accurate information, facilitating better decision-making and ultimately leading to improved ROI for insurers. By integrating AI and blockchain solutions, we empower organizations to optimize their catastrophe risk management strategies and achieve greater resilience in the face of disasters.

2.4.3. Tailoring Policies Based on Specific Environmental Risks

- Environmental risks vary significantly by region, necessitating customized insurance policies. Factors to consider include:

- Geographic location (e.g., flood zones, earthquake-prone areas)

- Local climate conditions (e.g., hurricanes, wildfires)

- Historical data on natural disasters and their impact on communities.

- Insurers can utilize advanced data analytics to assess these risks more accurately, including cyber insurance risk assessment and insurance risk assessment. Tailored policies can include:

- Adjusted premiums based on specific risk factors.

- Coverage options that address unique local threats.

- Incentives for policyholders to adopt risk-reduction measures (e.g., home fortification, flood barriers).

- Collaboration with local governments and environmental agencies can enhance risk assessment. Insurers can also leverage technology, such as satellite imagery and IoT devices, to monitor environmental changes and adjust policies accordingly. This can include insurance risk analysis and own risk and solvency assessment.

- By aligning policies with specific environmental risks, insurers can improve customer satisfaction and reduce claims. Rapid Innovation can assist insurers in implementing AI-driven data analytics solutions that provide real-time insights into environmental risks, enabling more accurate policy customization and risk assessment, including insurance underwriting risk assessment and loss control assessment.

2.5. Customer Behavior Analysis for Proactive Risk Mitigation

- Understanding customer behavior is crucial for insurers to identify potential risks before they manifest. Key aspects of customer behavior analysis include:

- Monitoring claims history to identify patterns and trends.

- Analyzing customer interactions with the insurance provider (e.g., inquiries, complaints).

- Utilizing social media and online reviews to gauge customer sentiment and behavior.

- Data analytics tools can help insurers segment customers based on risk profiles. Proactive risk mitigation strategies may involve:

- Offering personalized advice on risk management.

- Implementing educational programs to inform customers about risk factors.

- Providing discounts for policyholders who engage in risk-reducing activities, such as those identified in workers compensation risk assessment.

- By focusing on customer behavior, insurers can enhance their risk assessment processes and improve overall portfolio performance. Rapid Innovation's expertise in AI can empower insurers to leverage machine learning algorithms for deeper insights into customer behavior, leading to more effective risk mitigation strategies, including cyber insurance assessment and insurance risk evaluation.

2.5.1. Tracking Policyholder Activities to Predict High-Risk Behaviors

- Tracking policyholder activities allows insurers to identify behaviors that may lead to increased risk. Methods for tracking include:

- Monitoring usage patterns of insured assets (e.g., vehicles, homes).

- Analyzing data from connected devices (e.g., smart home technology, telematics).

- Conducting regular surveys to assess lifestyle changes and risk factors.

- Key indicators of high-risk behavior may include:

- Frequent claims for similar incidents (e.g., water damage, theft).

- Changes in driving habits (e.g., increased mileage, aggressive driving).

- Lack of maintenance on insured properties (e.g., roof repairs, plumbing issues).

- Insurers can use predictive analytics to forecast potential claims based on tracked activities. By identifying high-risk behaviors early, insurers can:

- Adjust premiums or coverage options accordingly.

- Offer targeted interventions to encourage safer practices.

- Foster a more engaged relationship with policyholders through personalized communication.

- Ultimately, tracking policyholder activities enhances risk management and can lead to lower claims costs for insurers. Rapid Innovation can support insurers in developing blockchain-based solutions for secure and transparent tracking of policyholder activities, ensuring data integrity and fostering trust between insurers and their clients, including the implementation of risk assessment by insurance firms from data.

- 2.5.2. Providing Personalized Recommendations for Risk Reduction

- Personalized recommendations are essential in helping customers mitigate risks associated with their assets or health through personalized risk management.

- Utilizing data analytics, insurers can analyze individual customer profiles, including:

- Historical claims data

- Lifestyle choices

- Asset conditions

- Based on this analysis, insurers can offer tailored advice, such as:

- Home safety improvements (e.g., installing smoke detectors, security systems)

- Health and wellness programs (e.g., fitness plans, nutrition advice)

- Regular maintenance schedules for vehicles or properties

- These recommendations not only help reduce the likelihood of claims but also enhance customer satisfaction and loyalty.

- Insurers can leverage technology, such as mobile apps, to deliver these recommendations directly to customers, making it easier for them to implement changes.

- By providing personalized insights, insurers can foster a proactive approach to risk management, ultimately leading to lower premiums and fewer claims. For more information on how AI can enhance personalized recommendations in banking and insurance.

2.5.3. Implementing Early Intervention Strategies for High-Risk Customers

- Identifying high-risk customers is crucial for insurers to minimize potential losses.

- Early intervention strategies can include:

- Regular check-ins with customers who have a history of claims or risky behavior

- Offering educational resources about risk management tailored to specific customer needs

- Providing incentives for customers to engage in safer practices (e.g., discounts for completing safety courses)

- Insurers can utilize predictive analytics to identify customers who may be at risk of filing a claim based on their behavior or circumstances.

- By intervening early, insurers can:

- Address potential issues before they escalate into claims

- Build stronger relationships with customers through personalized support

- Reduce overall claims costs and improve profitability

- Effective communication channels, such as email, SMS, or app notifications, can facilitate timely interventions and keep customers informed about their risk status.

2.6. Predictive Maintenance for Insured Assets Using AI

- Predictive maintenance leverages artificial intelligence (AI) to anticipate when an asset may require maintenance, reducing the risk of unexpected failures.

- Insurers can apply predictive maintenance strategies to various insured assets, including:

- Vehicles

- Homes

- Commercial properties

- Key components of predictive maintenance include:

- Data collection from sensors and IoT devices to monitor asset conditions in real-time

- Machine learning algorithms that analyze historical data to identify patterns and predict future maintenance needs

- Benefits of predictive maintenance for insurers:

- Decreased claim frequency due to proactive maintenance

- Enhanced customer satisfaction as clients experience fewer disruptions

- Improved asset longevity, leading to lower overall costs for both insurers and customers

- Insurers can offer predictive maintenance services as part of their policy packages, providing added value to customers and differentiating themselves in a competitive market.

- By integrating predictive maintenance into their operations, insurers can create a more sustainable and efficient risk management framework.

At Rapid Innovation, we specialize in harnessing the power of AI and data analytics to help insurers implement these strategies effectively. Our expertise in developing tailored solutions enables clients to achieve greater ROI by reducing claims, enhancing customer satisfaction, and streamlining operations. By leveraging our advanced technologies, insurers can not only mitigate risks but also foster long-term relationships with their customers, ultimately driving business growth.

2.6.1. Monitoring Assets (e.g., Vehicles, Property) for Predictive Insights

Monitoring assets such as vehicles and property is crucial for organizations aiming to optimize their operations and reduce costs. Predictive insights derived from data analytics can significantly enhance asset management, particularly through the use of asset management software and enterprise asset management solutions.

- Real-time tracking: Utilizing GPS and IoT devices allows for real-time monitoring of vehicles and properties, ensuring that organizations have up-to-date information on their assets. This is often facilitated by fleet management software and GPS fleet tracking systems.

- Data collection: Continuous data collection on asset usage, condition, and performance helps identify patterns and trends, enabling organizations to make informed decisions. Software asset management software can assist in this process.

- Predictive analytics: Advanced algorithms analyze historical data to forecast potential issues, enabling proactive management and reducing the risk of unexpected failures. Maintenance management software, such as CMMS, can be instrumental in this area.

- Cost reduction: By predicting maintenance needs and potential failures, organizations can minimize downtime and repair costs, leading to a greater return on investment (ROI). Digital asset management tools can also contribute to this goal.

- Enhanced decision-making: Insights from data analytics support informed decisions regarding asset utilization and lifecycle management, ultimately driving efficiency and effectiveness. This is where enterprise asset management systems come into play.

2.6.2. Offering Maintenance Reminders Based on Predictive Data

Maintenance reminders based on predictive data can significantly improve asset longevity and performance. By leveraging technology, organizations can ensure timely maintenance and reduce the risk of unexpected failures through effective inventory management software.

- Automated alerts: Systems can be set up to send automated reminders for scheduled maintenance based on usage patterns and predictive analytics, ensuring that assets are maintained proactively. This can be integrated into maintenance management software.

- Customization: Maintenance schedules can be tailored to individual asset needs, considering factors like age, usage frequency, and environmental conditions, which enhances operational efficiency. Software inventory management software can help in tracking these variables.

- Increased efficiency: Timely maintenance reduces the likelihood of major repairs, leading to more efficient operations and improved asset performance. Utilizing warehouse inventory management software can streamline this process.

- User engagement: Providing users with maintenance reminders fosters a culture of proactive care and responsibility for assets, which can lead to better overall management.

- Data-driven insights: Organizations can analyze maintenance history to refine future schedules and improve overall asset management strategies, ultimately enhancing ROI. This is where tools like maximo software can be beneficial.

2.6.3. Minimizing Claims by Preventing Asset-Related Incidents

Preventing asset-related incidents is essential for minimizing claims and associated costs. By implementing proactive measures, organizations can significantly reduce the likelihood of incidents occurring.

- Risk assessment: Regular assessments of assets help identify vulnerabilities and potential risks that could lead to incidents, allowing organizations to take preventive action. This can be supported by enterprise asset management systems.

- Training and education: Providing training for employees on proper asset usage and safety protocols can prevent accidents and damage, contributing to a safer work environment.

- Predictive maintenance: Utilizing predictive analytics to foresee potential failures allows organizations to address issues before they escalate, reducing the risk of costly incidents. Maintenance management software, such as CMMS, plays a key role here.

- Incident response plans: Developing and implementing comprehensive incident response plans ensures quick action in case of an asset-related incident, minimizing potential losses.

- Insurance benefits: A proactive approach to asset management can lead to lower insurance premiums and fewer claims, benefiting the organization financially and enhancing overall ROI.

At Rapid Innovation, we leverage our expertise in AI and Blockchain technologies to provide tailored solutions that empower organizations to optimize asset management, enhance operational efficiency, and achieve their business goals effectively. By integrating advanced analytics and real-time monitoring through tools like digital asset management and fleet management software, we help clients unlock the full potential of their assets, driving greater returns on their investments.

2.7. Health Monitoring and Wellness in Life and Health Insurance

Health monitoring and wellness initiatives are becoming increasingly important in the life and health insurance sectors. Insurers are recognizing the value of proactive health management, which not only benefits policyholders but also helps reduce overall healthcare costs. By integrating technology and wellness programs, such as bcbs wellness program and bcbs health and wellness program, insurers can create a more personalized experience for their clients.

2.7.1. Integrating Wearables to Monitor Policyholders' Health Trends

Wearable technology has revolutionized the way individuals track their health and fitness. Insurers are leveraging this technology to gain insights into policyholders' health trends.

- Wearables can track various health metrics, including:

- Heart rate

- Physical activity levels

- Sleep patterns

- Stress levels

- Benefits of integrating wearables in insurance:

- Real-time data collection allows for timely interventions.

- Insurers can offer personalized health recommendations based on data.

- Enhanced engagement with policyholders through gamification and challenges, such as cigna global wellness challenge.

- Examples of wearable integration:

- Some insurers provide discounts or rewards for policyholders who meet specific health goals tracked by wearables, including gym discounts with health insurance.

- Programs that encourage regular health check-ups and screenings based on data collected from devices, like the bcbs wellness plan.

- Challenges to consider:

- Data privacy and security concerns regarding sensitive health information.

- Ensuring that wearables are accessible and user-friendly for all policyholders.

2.7.2. Adjusting Health Insurance Premiums Based on Lifestyle Improvements

Health insurance premiums are traditionally based on risk assessments and demographic factors. However, insurers are now exploring ways to adjust premiums based on individual lifestyle improvements.

- Key aspects of this approach include:

- Incentivizing healthy behaviors, such as regular exercise, balanced nutrition, and routine medical check-ups, supported by programs like bcbs gym reimbursement and bcbs wellness incentive program.

- Utilizing data from wearables and health apps to assess lifestyle changes.

- Benefits of adjusting premiums:

- Encourages policyholders to adopt healthier lifestyles, leading to better health outcomes.

- Reduces the overall risk pool for insurers, potentially lowering costs for everyone.

- Creates a more personalized insurance experience, fostering loyalty among policyholders.

- Implementation strategies:

- Offering premium discounts for achieving specific health milestones, such as weight loss or improved fitness levels, through initiatives like cigna reward program and aetna gym membership reimbursement.

- Providing wellness programs and resources to support policyholders in making lifestyle changes, such as the united healthcare wellness program and humana go365 wellness program.

- Considerations for insurers:

- Establishing clear metrics for measuring lifestyle improvements.

- Balancing the need for data collection with respect for privacy and consent.

- Ensuring that adjustments are fair and equitable for all policyholders, regardless of their starting point.

At Rapid Innovation, we specialize in integrating AI and blockchain technologies to enhance health monitoring and wellness initiatives in the insurance sector. By utilizing AI algorithms, we can analyze vast amounts of health data collected from wearables to provide insurers with actionable insights, enabling them to tailor their offerings and improve customer engagement.

2.7.3. Encouraging Healthier Behaviors through Incentivized Premiums

Incentivized premiums for health insurance are a strategy used by insurance companies to promote healthier behaviors among policyholders. By offering financial rewards or discounts, insurers encourage individuals to adopt healthier lifestyles, which can lead to lower claims and overall healthcare costs.

- Health assessments: Insurers may require policyholders to undergo health assessments to determine their current health status.

- Premium discounts: Individuals who meet certain health criteria, such as maintaining a healthy weight or not smoking, can receive discounts on their premiums.

- Wellness programs: Many insurers offer wellness programs that include gym memberships, health coaching, and nutrition counseling.

- Tracking progress: Policyholders may be asked to track their health metrics, such as exercise frequency or weight loss, to qualify for incentives.

- Long-term benefits: Encouraging healthier behaviors can lead to reduced healthcare costs for both insurers and policyholders in the long run.

2.8. Telematics and Usage-Based Insurance (UBI) for Auto Insurance

Telematics and usage-based insurance (UBI) are innovative approaches in the auto insurance industry that utilize technology to assess driving behavior and adjust premiums accordingly. This model allows insurers to offer personalized rates based on actual driving habits rather than traditional risk factors.

- Data collection: Telematics devices collect data on driving behaviors, including speed, braking patterns, and acceleration.

- Real-time feedback: Drivers receive feedback on their driving habits, which can help them improve safety and reduce risks.

- Personalized premiums: Insurers can adjust premiums based on individual driving behavior, rewarding safe drivers with lower rates.

- Enhanced risk assessment: Telematics provides insurers with a more accurate picture of risk, allowing for better underwriting decisions.

- Increased engagement: UBI encourages drivers to be more mindful of their driving habits, fostering a culture of safety on the roads.

2.8.1. Using Vehicle Telematics for Behavior-Based Auto Premiums

Vehicle telematics plays a crucial role in the implementation of behavior-based auto premiums. By leveraging technology, insurers can create a more equitable pricing model that reflects individual driving behaviors.

- Monitoring driving habits: Telematics devices track various aspects of driving, such as speeding incidents, hard braking, and cornering behavior.

- Data analysis: Insurers analyze the collected data to identify patterns and assess risk levels associated with each driver.

- Premium adjustments: Based on the analysis, insurers can offer discounts or increase premiums depending on the driver's behavior.

- Incentives for safe driving: Safe drivers can benefit from lower premiums, while risky behaviors can lead to higher costs.

- Consumer acceptance: Many drivers appreciate the potential for savings and are more willing to adopt telematics solutions for insurance purposes.

At Rapid Innovation, we harness the power of AI and blockchain technology to enhance these insurance models. By implementing AI-driven analytics, we help insurers better understand and predict policyholder behaviors, leading to more accurate risk assessments and tailored premium structures. This combination of AI and blockchain not only improves operational efficiency but also drives greater ROI for our clients in the insurance sector. For more information on technology and AI-based insurance solutions.

2.8.2. Adjusting Rates Based on Safe Driving Habits

Insurance companies are increasingly using data from telematics and other technologies to adjust rates based on individual driving behaviors. This approach allows insurers to offer more personalized premiums that reflect the actual risk posed by a driver.

- Telematics devices track driving habits such as speed, braking patterns, and acceleration.

- Safe driving behaviors can lead to lower premiums, incentivizing drivers to adopt safer practices.

- Insurers may offer discounts for drivers who maintain a clean driving record over a specified period.

- The use of mobile apps allows drivers to monitor their own driving habits and receive feedback.

- Adjustments to rates can be made in real-time, providing immediate financial benefits for safe driving.

2.8.3. Rewarding Safe Drivers with Competitive Premiums

Insurance companies are recognizing the importance of rewarding safe drivers as a strategy to retain customers and reduce claims. By offering competitive premiums, insurers can encourage safer driving habits and foster loyalty among policyholders.

- Discounts for safe driving can be significant, sometimes reaching up to 30% off the standard premium.

- Programs may include rewards for maintaining a clean driving record or completing defensive driving courses.

- Insurers often use gamification techniques, where drivers can earn points for safe driving that can be redeemed for discounts or rewards.

- Competitive premiums can also be tied to mileage, with lower rates for drivers who use their vehicles less frequently.

- By promoting safe driving, insurers can reduce overall claims, benefiting both the company and the policyholders.

3. AI Risk Scoring Technologies and Frameworks in Insurance

Artificial Intelligence (AI) is transforming the insurance industry by providing advanced risk scoring technologies and frameworks. These innovations help insurers assess risk more accurately and efficiently.

- AI algorithms analyze vast amounts of data, including driving history, weather conditions, and traffic patterns.

- Risk scoring models can predict the likelihood of accidents or claims based on historical data and real-time information.

- Insurers can use AI to segment customers into different risk categories, allowing for more tailored insurance products.

- Machine learning techniques enable continuous improvement of risk assessment models as new data becomes available.

- AI-driven insights can enhance underwriting processes, leading to faster approvals and more accurate pricing.

By leveraging these technologies, insurance companies can create a more dynamic and responsive pricing model that benefits both the insurer and the insured.

At Rapid Innovation, we specialize in integrating AI and blockchain solutions that empower insurance companies to harness these advanced technologies. Our expertise in AI can help you develop predictive models that enhance risk assessment, while our blockchain solutions ensure data integrity and transparency in transactions. By partnering with us, you can achieve greater ROI through improved customer satisfaction, reduced operational costs, and enhanced risk management strategies.

Additionally, understanding the implications of medicare and irmaa, such as the medicare high income surcharge and the income related medicare part b premiums, can also play a role in how individuals manage their insurance costs. The medicare magi calculation and the irmaa for medicare are essential for those who may be affected by these adjustments. In 2023, the medicare premium increase and the income limits for medicare irmaa are critical factors to consider for high-income earners. By integrating these insights, insurers can better tailor their offerings to meet the needs of their clients.

For those looking to enhance their capabilities in this area, consider hiring generative AI engineers to drive innovation and improve your insurance solutions.

3.1. Machine Learning Models for Insurance Risk Analysis

Machine learning (ML) has become a pivotal tool in the insurance industry, particularly for insurance risk analysis. By leveraging vast amounts of data, ML models can identify patterns, predict outcomes, and enhance decision-making processes. The application of these models helps insurers to better assess risks, set premiums, and manage claims. The key advantages of using ML in this context include:

- Enhanced data processing capabilities

- Improved accuracy in risk assessment

- Ability to adapt to new data trends

3.1.1. Supervised Learning Techniques for Risk Prediction

Supervised learning involves training a model on a labeled dataset, where the outcome is known. This approach is particularly useful in insurance for predicting risks associated with policyholders and claims. Common algorithms used in supervised learning include:

- Decision Trees: These models split data into branches to make predictions based on feature values.

- Random Forests: An ensemble method that combines multiple decision trees to improve accuracy and reduce overfitting.

- Logistic Regression: A statistical method used for binary classification, often applied to predict the likelihood of a claim.

Applications of supervised learning in insurance include:

- Claim prediction: Models can forecast the probability of a claim being filed based on historical data.

- Fraud detection: Supervised learning can identify patterns indicative of fraudulent activities by analyzing past claims.

- Customer segmentation: Insurers can categorize customers based on risk profiles, allowing for tailored premium pricing.

The benefits of using supervised learning techniques are:

- Increased precision in risk assessment

- Ability to handle large datasets efficiently

- Continuous improvement through model retraining with new data

3.1.2. Unsupervised Learning Applications in Pattern Detection

Unsupervised learning differs from supervised learning in that it deals with unlabeled data. This approach is valuable for discovering hidden patterns and insights that may not be immediately apparent. Common algorithms used in unsupervised learning include:

- K-Means Clustering: This algorithm groups data points into clusters based on similarity, helping to identify distinct segments within the data.

- Hierarchical Clustering: A method that builds a hierarchy of clusters, useful for understanding relationships between different data points.

- Principal Component Analysis (PCA): A dimensionality reduction technique that simplifies data while retaining essential features, aiding in visualization and analysis.

Applications of unsupervised learning in insurance include:

- Risk segmentation: Insurers can identify groups of policyholders with similar risk characteristics, allowing for more accurate pricing strategies.

- Anomaly detection: Unsupervised learning can flag unusual patterns in claims data that may indicate fraud or errors. For more information on anomaly detection.

- Market analysis: By analyzing customer behavior and preferences, insurers can tailor products and services to meet market demands.

The benefits of using unsupervised learning techniques are:

- Discovery of new insights without prior assumptions

- Enhanced ability to identify emerging trends

- Cost-effective analysis of large datasets without the need for labeled data

In conclusion, both supervised and unsupervised learning techniques play crucial roles in insurance risk analysis. By harnessing these machine learning models, insurers can improve their risk assessment processes, enhance customer satisfaction, and ultimately drive profitability. At Rapid Innovation, we specialize in implementing these advanced machine learning solutions, ensuring that our clients achieve greater ROI through enhanced operational efficiency and informed decision-making.

3.1.3. Deep Learning Innovations in Insurance Risk Assessment

Deep learning has revolutionized the way insurance companies assess risk, including areas such as cyber insurance risk assessment and insurance risk analysis. By leveraging complex algorithms and large datasets, insurers can gain deeper insights into potential risks associated with policyholders.

- Enhanced predictive accuracy: Deep learning models can analyze vast amounts of data, identifying patterns that traditional models might miss. These models can improve the accuracy of risk predictions, leading to better underwriting decisions and ultimately enhancing the return on investment (ROI) for insurers.

- Real-time data processing: Insurers can utilize real-time data from various sources, such as IoT devices, to assess risk dynamically. This allows for timely adjustments in policy terms and premiums based on current risk levels, ensuring that insurers remain competitive and responsive to market changes.

- Fraud detection: Deep learning algorithms can identify unusual patterns in claims data, helping to flag potential fraudulent activities. By analyzing historical claims and customer behavior, these models can enhance fraud detection rates, reducing losses and improving profitability.

- Customer segmentation: Deep learning enables insurers to segment customers more effectively based on risk profiles, including those identified in insurance risk assessment jobs. This leads to personalized insurance products and pricing, improving customer satisfaction and retention, which in turn drives higher revenue.

3.1.4. Model Selection and Optimization Strategies for Insurance

Choosing the right model and optimizing it is crucial for effective risk assessment in insurance, including own risk and solvency assessment and underwriting risk analysis. Various strategies can be employed to ensure that the selected model performs at its best.

- Understanding the problem: Clearly define the risk assessment problem to determine the most suitable model. Consider factors such as the type of data available and the specific outcomes desired, ensuring alignment with business objectives.

- Model evaluation metrics: Use metrics like accuracy, precision, recall, and F1 score to evaluate model performance. These metrics help in comparing different models and selecting the one that best meets the business objectives, ultimately leading to improved ROI.

- Cross-validation techniques: Implement cross-validation to ensure that the model generalizes well to unseen data. This technique helps in identifying overfitting and ensures robust model performance, which is essential for maintaining trust in risk assessments.

- Hyperparameter tuning: Optimize model parameters to enhance performance. Techniques such as grid search or random search can be employed to find the best combination of parameters, ensuring that the model operates at peak efficiency.

- Ensemble methods: Consider using ensemble methods, which combine multiple models to improve prediction accuracy. Techniques like bagging and boosting can help in reducing variance and bias in predictions, leading to more reliable risk assessments.

3.2. Data Sources and Integration for AI Risk Scoring

Data is the backbone of AI-driven risk scoring in insurance, including cyber insurance assessment and builders risk assessment. Integrating diverse data sources is essential for creating comprehensive risk profiles.

- Internal data sources: Insurers can leverage historical claims data, customer demographics, and policy information. This data provides a foundation for understanding past behaviors and predicting future risks, which is critical for effective risk management.

- External data sources: Incorporate data from third-party providers, such as credit scores, social media activity, and public records. These sources can offer additional insights into customer behavior and risk factors, enhancing the overall risk assessment process.

- IoT and telematics: Utilize data from IoT devices, such as telematics in vehicles, to assess real-time risk. This data can help insurers understand driving behavior, leading to more accurate risk assessments and tailored insurance solutions.

- Data integration techniques: Employ data integration tools and platforms to consolidate data from various sources. Ensure that the data is clean, consistent, and accessible for analysis, which is vital for effective decision-making.

- Privacy and compliance: Adhere to data privacy regulations, such as GDPR, when collecting and using customer data. Implement robust data governance practices to protect sensitive information and maintain customer trust, which is essential for long-term business success.

At Rapid Innovation, we specialize in harnessing the power of AI and blockchain technologies to help insurance companies optimize their risk assessment processes, including insurance underwriting risk assessment and loss control assessment, ultimately driving greater ROI and enhancing operational efficiency.

3.2.1. Utilizing Internal Data for Enhanced Risk Assessment

- Internal data refers to the information generated within an organization, including historical records, transaction data, and customer interactions. This data can provide valuable insights into patterns and trends that are specific to the organization.

- By analyzing internal data, companies can:

- Identify risk factors unique to their operations, such as those highlighted in data risk assessments.

- Monitor performance metrics over time to detect anomalies, which is crucial in data breach risk assessments.

- Enhance predictive modeling by using historical data to forecast future risks, as seen in data privacy risk assessments.

- Techniques such as data mining and machine learning can be employed to extract meaningful insights from internal datasets. Regularly updating and maintaining internal databases ensures that the risk assessment process remains relevant and accurate, particularly in the context of data security risk assessments.

- Organizations can also leverage internal data to:

- Improve decision-making processes through comprehensive risk management data analysis.

- Tailor risk management strategies to their specific context, including data classification risk assessments.

- Foster a culture of data-driven decision-making across departments, which is essential for effective data risk analysis.

3.2.2. Partnering with External Data Sources for Comprehensive Insights

- External data sources provide additional context and information that can enhance an organization’s understanding of risk. These sources can include:

- Market research reports.

- Economic indicators.

- Industry benchmarks.

- Social media sentiment analysis.

- Collaborating with external data providers allows organizations to:

- Gain insights into broader market trends and competitive landscapes, which can be critical for data loss risk assessments.

- Validate internal findings with external benchmarks, particularly in risk assessment data analytics.

- Identify emerging risks that may not be visible through internal data alone, as seen in data leakage risk assessments.

- Utilizing external data can also help organizations:

- Enhance their risk models by incorporating diverse datasets, including those from data management risk assessments.

- Improve regulatory compliance by staying informed about industry standards and changes, especially in the context of GDPR risk analysis.

- Foster relationships with data partners to access real-time information.

- Organizations should ensure that external data is reliable and relevant to their specific risk assessment needs, including data breach risk assessments.

Rapid Innovation can assist clients in identifying and integrating the most relevant external data sources, ensuring a comprehensive understanding of risk that drives better business outcomes.

3.2.3. Incorporating Alternative Data Sources for Better Predictions

- Alternative data refers to non-traditional data sources that can provide unique insights into risk assessment. Examples of alternative data include:

- Social media activity.

- Geolocation data.

- Web scraping for consumer behavior analysis.

- By incorporating alternative data, organizations can:

- Enhance their predictive analytics capabilities, which is vital for data science risk analysis.

- Identify risks that may not be captured through conventional data sources, as highlighted in risk analysis data.

- Gain a competitive edge by leveraging unique insights, particularly in the context of risk analysis GDPR.

- Alternative data can help organizations:

- Understand customer sentiment and behavior in real-time, which is crucial for data collection risk assessments.

- Monitor market trends and shifts more effectively, aiding in data analytics risk assessments.

- Assess creditworthiness and risk profiles in innovative ways, relevant to data privacy risk assessments.

- Understand customer sentiment and behavior in real-time, which is crucial for data collection risk assessments.

- However, organizations must be cautious about the ethical implications and data privacy concerns associated with using alternative data. Establishing clear guidelines and compliance measures is essential to ensure responsible use of alternative data sources.

At Rapid Innovation, we guide our clients in responsibly leveraging alternative data to enhance their predictive analytics, ultimately leading to improved risk assessment and greater ROI.

3.2.4. Real-Time Data Processing Capabilities for Immediate Risk Assessment

Real-time data processing is crucial for organizations aiming to assess risks promptly and effectively. This capability allows businesses to analyze data as it is generated, leading to quicker decision-making and enhanced risk management.

- Immediate insights: Real-time processing enables organizations to receive instant feedback on potential risks, allowing for timely interventions. Techniques such as real time data analysis and real time data enrichment can be employed to enhance this capability.

- Enhanced accuracy: Continuous data analysis helps in identifying patterns and anomalies that may indicate emerging risks. Real time data integration plays a key role in ensuring that data from various sources is accurately combined for analysis.

- Improved responsiveness: Organizations can react swiftly to changing conditions, minimizing potential losses or damages. Real time stream processing allows for immediate action based on the latest data.

- Integration with IoT: Real-time data processing can leverage Internet of Things (IoT) devices to gather data from various sources, enhancing risk assessment accuracy. Real time data ingestion from these devices can provide valuable insights.

- Use of machine learning: Algorithms can be employed to analyze data streams, learning from historical data to predict future risks. For instance, using kafka real time streaming can facilitate the processing of large volumes of data in real time.

- Regulatory compliance: Real-time capabilities help organizations stay compliant with regulations by providing timely reporting and monitoring of risk factors. Real time analytics processing ensures that organizations can meet compliance requirements effectively. For more insights on the advantages and future of generative AI in finance and banking applications.

4. Implementation Strategies and Best Practices for AI Risk Scoring

Implementing AI risk scoring requires a strategic approach to ensure effectiveness and reliability. Organizations should consider the following best practices:

- Define clear objectives: Establish what you aim to achieve with AI risk scoring, such as reducing fraud or improving credit assessments.

- Data quality: Ensure that the data used for training AI models is accurate, relevant, and up-to-date to enhance the model's predictive capabilities. Utilizing real time data processing can significantly improve data quality.

- Collaborate with stakeholders: Involve various departments, including IT, compliance, and risk management, to align AI initiatives with organizational goals.

- Continuous monitoring: Regularly assess the performance of AI models to ensure they adapt to changing risk landscapes and maintain accuracy.

- Ethical considerations: Address potential biases in AI algorithms to ensure fair and equitable risk assessments.

- Training and education: Provide training for staff on AI tools and methodologies to foster a culture of data-driven decision-making.

4.1. Technical Integration Framework for AI Solutions

A robust technical integration framework is essential for the successful deployment of AI solutions in risk scoring. This framework should encompass several key components:

- API integration: Utilize Application Programming Interfaces (APIs) to connect AI systems with existing data sources and applications, facilitating seamless data flow.

- Data architecture: Design a scalable data architecture that supports real-time data processing and storage, ensuring that AI models have access to the necessary information. Real time etl processes can be implemented to streamline data flow.

- Security protocols: Implement strong security measures to protect sensitive data and ensure compliance with regulations.

- Cloud infrastructure: Leverage cloud computing to enhance scalability and flexibility, allowing organizations to adjust resources based on demand.

- Interoperability: Ensure that AI solutions can work with various systems and platforms, promoting collaboration across departments.

- Monitoring tools: Deploy monitoring tools to track the performance of AI models and the overall system, enabling quick identification of issues and areas for improvement.