Table Of Contents

Category

Artificial Intelligence

Computer Vision

Blockchain

1. Understanding AI in Claims Processing

1.1. What is AI in Claims Processing

- AI, or Artificial Intelligence, refers to the simulation of human intelligence in machines programmed to think and learn. In claims processing, AI utilizes algorithms and data analysis to automate and enhance various tasks, including ai in healthcare claims processing.

- Key components of AI in this context include:

- Machine Learning: Algorithms that improve through experience and data, which is crucial for machine learning in claims processing.

- Natural Language Processing (NLP): Enables machines to understand and interpret human language.

- Computer Vision: Allows systems to analyze and interpret visual data, such as images and videos.

- AI can streamline the claims process by:

- Automating data entry and document verification, a key aspect of ai claims processing.

- Analyzing claims for fraud detection, which is essential for ai insurance claims processing.

- Providing real-time assistance to claims adjusters.

- The integration of AI can lead to faster claim resolutions and improved customer satisfaction, ultimately enhancing the overall efficiency of the claims processing system, particularly in ai for claims processing.

1.2. The Importance of AI in Modernizing Insurance Claims: Rapid Innovation’s AI Agent Solutions

- AI plays a crucial role in transforming the insurance industry by:

- Enhancing efficiency: Automating repetitive tasks reduces processing time and operational costs, allowing companies to allocate resources more effectively, especially in ai claims management.

- Improving accuracy: AI algorithms can analyze vast amounts of data to identify patterns and anomalies, minimizing human error and ensuring more reliable outcomes, which is vital for machine learning in insurance claims.

- Enabling better customer service: AI-powered chatbots and virtual assistants provide 24/7 support, answering queries and guiding customers through the claims process, which enhances customer engagement.

- The benefits of AI in claims processing include:

- Faster claim settlements: AI can expedite the review and approval process, leading to quicker payouts and improved cash flow for both insurers and policyholders, a significant advantage of claims automation ai.

- Fraud detection: AI systems can flag suspicious claims by analyzing historical data and identifying unusual patterns, significantly reducing losses due to fraudulent activities, which is a focus of machine learning in claims processing.

- Personalization: AI can tailor communication and services based on individual customer profiles and preferences, fostering stronger relationships and customer loyalty.

- Rapid Innovation provides cutting-edge AI agent solutions tailored for the insurance industry, transforming the way claims are handled. Our AI-driven systems streamline the entire claims process, from automated intake and data extraction to intelligent triage and fraud detection. By integrating advanced AI technologies, we enable insurance companies to significantly reduce operational costs, enhance claims accuracy, and improve customer satisfaction. Our solutions ensure seamless integration with existing workflows, allowing insurers to harness the full potential of AI to automate and optimize their claims processing, ultimately delivering faster, more reliable, and scalable outcomes for policyholders and businesses alike.

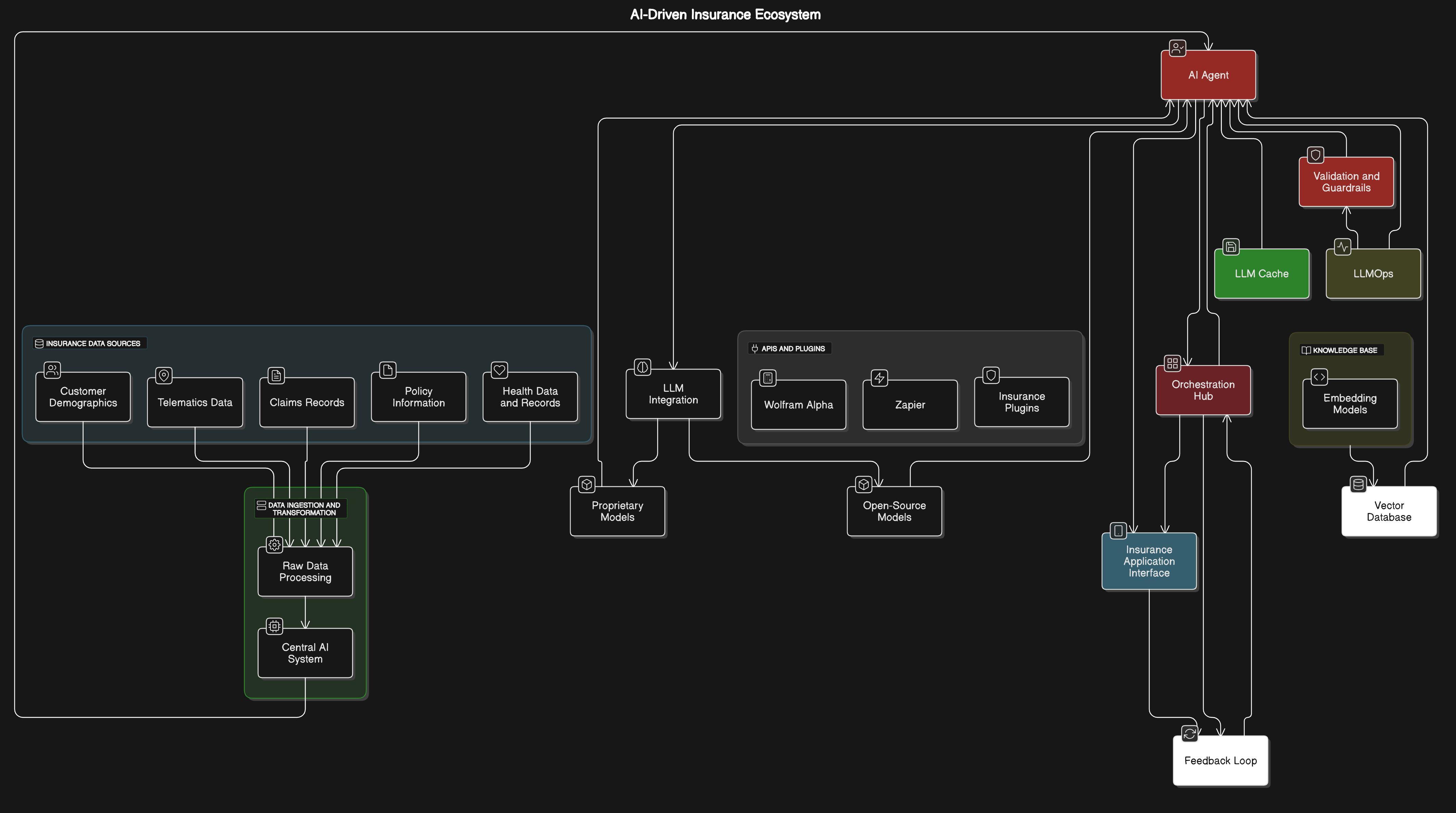

Refer to the image for a visual representation of AI in claims processing:

1.3. Why AI is a Game-Changer for Insurance Workflows

- Enhanced Efficiency: AI in insurance workflows automates repetitive tasks, allowing insurance professionals to focus on more complex issues. This leads to faster processing times and reduced operational costs, ultimately driving greater ROI for insurance companies.

- Improved Accuracy: Machine learning algorithms can analyze vast amounts of data with high precision, minimizing human error in data entry and analysis. This accuracy not only enhances operational efficiency but also builds trust with clients.

- Predictive Analytics: AI can forecast trends and customer behavior, enabling insurers to tailor their products and services more effectively. By leveraging these insights, companies can optimize their offerings and improve customer retention.

- Customer Experience: AI-driven chatbots and virtual assistants provide 24/7 support, improving customer engagement and satisfaction. This level of service can lead to increased customer loyalty and higher lifetime value.

- Fraud Detection: AI systems can identify unusual patterns and flag potential fraudulent claims, enhancing security and reducing losses. By mitigating fraud, insurers can protect their bottom line and improve overall profitability.

- Data Management: AI helps in organizing and analyzing large datasets, making it easier for insurers to derive actionable insights. This capability allows for more informed decision-making and strategic planning.

- Regulatory Compliance: AI can assist in monitoring compliance with regulations, ensuring that insurers adhere to industry standards. This not only reduces the risk of penalties but also fosters a culture of accountability and transparency. For more insights on how AI agents can personalize risk evaluation in insurance, check out this article on the future of personalized risk evaluation in insurance with AI agents.

1.4. The Evolution of Claims Processing Technology

- Early Manual Processes: Initially, claims processing relied heavily on paper-based systems and manual data entry, which were time-consuming and prone to errors.

- Introduction of Digital Tools: The late 20th century saw the advent of basic digital tools that streamlined data entry and storage, but many processes remained manual.

- Automation and Workflow Management: The 2000s introduced more sophisticated software solutions that automated various aspects of claims processing, improving speed and efficiency.

- Cloud Computing: The rise of cloud technology allowed for better data storage and accessibility, enabling insurers to manage claims from anywhere.

- AI and Machine Learning: Recent advancements have integrated AI into claims processing, allowing for real-time data analysis, predictive modeling, and enhanced decision-making.

- Mobile Technology: The proliferation of smartphones has enabled customers to file claims via mobile apps, making the process more convenient and accessible.

- Future Trends: Ongoing developments in AI, blockchain, and IoT are expected to further revolutionize claims processing, making it more transparent and efficient.

1.5. AI vs. Traditional Claims Handling: Key Differences

- Speed of Processing: AI can process claims in real-time, significantly reducing the time taken compared to traditional methods, which often involve multiple manual steps.

- Data Analysis: AI utilizes advanced algorithms to analyze large datasets quickly, while traditional methods rely on human analysis, which can be slower and less comprehensive.

- Decision-Making: AI can provide data-driven recommendations, whereas traditional claims handling often depends on subjective judgment from claims adjusters.

- Customer Interaction: AI-powered chatbots offer immediate responses to customer inquiries, while traditional claims handling may involve longer wait times for human representatives.

- Cost Efficiency: AI reduces operational costs by automating tasks, while traditional methods require more manpower and resources, leading to higher expenses.

- Fraud Detection: AI systems can continuously learn and adapt to new fraud patterns, while traditional methods may rely on static rules that can be circumvented.

- Scalability: AI solutions can easily scale to handle increased claims volume, while traditional systems may struggle to keep up without additional resources.

At Rapid Innovation, we harness the power of AI in insurance workflows to transform insurance workflows, ensuring our clients achieve their business goals efficiently and effectively. By integrating AI insurance solutions, we help our clients realize greater ROI and stay ahead in a competitive market.

1.6. Major Benefits of AI for Insurance Companies and Policyholders

- Enhanced Efficiency: AI automates routine tasks, significantly reducing the time taken for processing claims, including machine learning in insurance claims and underwriting. This leads to faster service delivery, ultimately improving customer satisfaction and retention.

- Improved Accuracy: AI algorithms analyze vast amounts of data to identify patterns and anomalies, minimizing human error. This results in more accurate risk assessments and pricing models, allowing insurers to make better-informed decisions.

- Cost Reduction: The automation of processes leads to a reduction in operational costs for insurance companies. These savings can be passed on to policyholders through lower premiums, enhancing competitiveness in the market.

- Personalized Customer Experience: AI can analyze customer data to tailor insurance products to individual needs. This level of personalization enhances customer engagement and loyalty, fostering long-term relationships.

- Fraud Detection: AI systems can detect fraudulent claims by analyzing historical data and identifying suspicious patterns. This capability helps in reducing losses due to fraud, benefiting both insurers and honest policyholders.

- Predictive Analytics: AI can forecast future trends and risks, allowing insurers to proactively manage their portfolios. This leads to better decision-making and strategic planning, ultimately driving greater ROI. For more insights on how AI can transform the insurance industry, check out the Visionary Shield.

2. Core Use Cases of AI in Claims Processing

- Claims Automation: AI streamlines the entire claims process, from submission to settlement. This reduces the workload on claims adjusters and speeds up resolution times, enhancing operational efficiency.

- Data Analysis: AI tools analyze claims data to identify trends and insights. This helps insurers improve their claims handling processes and policies, leading to better outcomes for both the company and its clients, including machine learning insurance claims.

- Chatbots and Virtual Assistants: AI-powered chatbots provide 24/7 support to policyholders, answering queries and guiding them through the claims process. This enhances customer service and reduces the need for human intervention, allowing staff to focus on more complex tasks.

- Image Recognition: AI can analyze images submitted with claims to assess damage and determine payouts. This technology speeds up the evaluation process and improves accuracy, ensuring timely settlements.

- Risk Assessment: AI evaluates the risk associated with claims by analyzing various data points. This helps insurers make informed decisions regarding claims approval and payouts, ultimately leading to better financial performance.

2.1. Automated Claims Intake and First Notice of Loss (FNOL)

- Streamlined Process: Automated systems allow policyholders to submit claims online or via mobile apps. This reduces the need for phone calls and paperwork, making the process more efficient and user-friendly.

- Immediate Acknowledgment: AI systems can instantly acknowledge receipt of a claim, providing reassurance to policyholders. This immediate response enhances customer satisfaction and trust in the insurer.

- Data Collection: Automated intake systems gather essential information from policyholders, such as incident details and supporting documents. This ensures that all necessary data is collected upfront, reducing back-and-forth communication and expediting the claims process.

- Integration with Other Systems: Automated FNOL systems can integrate with existing claims management software. This allows for seamless data transfer and processing, improving overall efficiency and accuracy.

- Enhanced Accuracy: AI can validate the information provided during the claims intake process. This reduces the likelihood of errors and ensures that claims are processed based on accurate data, further enhancing operational efficiency.

- Improved Customer Experience: By simplifying the FNOL process, policyholders experience less frustration and confusion. A user-friendly interface and clear instructions contribute to a positive claims experience, reinforcing customer loyalty and satisfaction.

At Rapid Innovation, we leverage our expertise in AI to help insurance companies implement these solutions effectively, including AI in insurance claims processing, driving greater ROI and achieving business goals efficiently.

Refer to the image for a visual representation of the benefits and use cases of AI in insurance companies and claims processing.

2.2. Intelligent Document Processing and Data Extraction

Intelligent Document Processing (IDP) refers to the use of advanced technologies, including artificial intelligence (AI) and machine learning, to automate the extraction, classification, and processing of data from various document types. IDP can handle a wide range of documents, such as invoices, contracts, and forms. It utilizes Optical Character Recognition (OCR) to convert different types of documents into machine-readable formats. Machine learning algorithms improve the accuracy of data extraction over time by learning from previous data sets. IDP reduces manual data entry, which minimizes human error and increases efficiency. It can integrate with existing systems, allowing for seamless data flow and processing. Organizations can achieve significant cost savings and faster turnaround times by implementing IDP solutions. According to a report, businesses can save up to 80% of the time spent on document processing through automation (source: McKinsey).

- IDP can handle a wide range of documents, such as invoices, contracts, and forms, including intelligent document processing solutions.

- It utilizes Optical Character Recognition (OCR) to convert different types of documents into machine-readable formats.

- Machine learning algorithms improve the accuracy of data extraction over time by learning from previous data sets.

- IDP reduces manual data entry, which minimizes human error and increases efficiency.

- It can integrate with existing systems, allowing for seamless data flow and processing.

- Organizations can achieve significant cost savings and faster turnaround times by implementing IDP solutions, such as automated document processing and ai document processing.

- According to a report, businesses can save up to 80% of the time spent on document processing through automation (source: McKinsey).

2.3. AI in Fraud Detection and Prevention

AI plays a crucial role in enhancing fraud detection and prevention strategies across various industries, particularly in finance and insurance. AI systems analyze vast amounts of data in real-time to identify patterns and anomalies that may indicate fraudulent activity. Machine learning models can adapt and improve as they are exposed to new data, making them more effective over time. AI can flag suspicious transactions for further investigation, reducing the workload on human analysts. Predictive analytics helps organizations anticipate potential fraud before it occurs, allowing for proactive measures. Natural Language Processing (NLP) can be used to analyze unstructured data, such as emails and social media, to detect fraudulent behavior. According to a study, AI can reduce false positives in fraud detection by up to 50% (source: Accenture). Implementing AI-driven fraud detection systems can lead to significant financial savings and improved customer trust.

- AI systems analyze vast amounts of data in real-time to identify patterns and anomalies that may indicate fraudulent activity.

- Machine learning models can adapt and improve as they are exposed to new data, making them more effective over time.

- AI can flag suspicious transactions for further investigation, reducing the workload on human analysts.

- Predictive analytics helps organizations anticipate potential fraud before it occurs, allowing for proactive measures.

- Natural Language Processing (NLP) can be used to analyze unstructured data, such as emails and social media, to detect fraudulent behavior.

- According to a study, AI can reduce false positives in fraud detection by up to 50% (source: Accenture).

- Implementing AI-driven insurance fraud detection systems can lead to significant financial savings and improved customer trust.

2.4. Claims Triage and Assignment Powered by AI

Claims triage and assignment involve the process of evaluating and categorizing insurance claims to determine their validity and the appropriate course of action. AI technologies streamline this process, enhancing efficiency and accuracy. AI algorithms can quickly assess claims based on predefined criteria, categorizing them as low, medium, or high risk. Automated systems can prioritize claims that require immediate attention, ensuring timely responses to policyholders. Machine learning models can analyze historical claims data to identify trends and predict outcomes, aiding in decision-making. AI can assist in routing claims to the appropriate adjusters or departments based on their complexity and required expertise. This technology reduces the time taken to process claims, leading to improved customer satisfaction. By automating routine tasks, human adjusters can focus on more complex claims that require personal attention. A report indicates that AI can improve claims processing speed by up to 30% (source: Deloitte).

- AI algorithms can quickly assess claims based on predefined criteria, categorizing them as low, medium, or high risk.

- Automated systems can prioritize claims that require immediate attention, ensuring timely responses to policyholders.

- Machine learning models can analyze historical claims data to identify trends and predict outcomes, aiding in decision-making.

- AI can assist in routing claims to the appropriate adjusters or departments based on their complexity and required expertise.

- This technology reduces the time taken to process claims, leading to improved customer satisfaction.

- By automating routine tasks, human adjusters can focus on more complex claims that require personal attention.

- A report indicates that AI can improve claims processing speed by up to 30% (source: Deloitte).

At Rapid Innovation, we leverage these advanced AI technologies for AI claim processing to help our clients streamline their operations, reduce costs, and enhance overall efficiency. By implementing Intelligent Document Processing, including ai contract review software and contract review ai, AI-driven fraud detection, and claims triage solutions, we empower organizations to achieve greater ROI and meet their business goals effectively. For more information on AI's role in anomaly detection.

Refer to the image for a visual representation of Intelligent Document Processing and its applications.

2.5. Predictive Analytics for Claims Severity and Reserving

Predictive analytics plays a crucial role in the insurance industry, particularly in claims severity and reserving. By leveraging historical data and advanced statistical techniques, insurers can forecast potential claims costs and set aside appropriate reserves.

- Identifying patterns: Predictive analytics helps in recognizing trends and patterns in claims data, allowing insurers to anticipate future claims severity. This is particularly relevant in predictive analytics insurance and predictive analytics in insurance claims.

- Risk assessment: Insurers can evaluate the risk associated with different policies and adjust premiums accordingly. Predictive analytics in insurance underwriting is essential for this process.

- Improved accuracy: By using predictive models, companies can enhance the accuracy of their reserving processes, ensuring they have sufficient funds to cover future claims. This is evident in insurance predictive modeling and predictive analytics insurance pricing.

- Data sources: Insurers utilize various data sources, including historical claims data, customer demographics, and external factors like economic conditions. Predictive analytics insurance case study examples illustrate the effectiveness of these data sources.

- Machine learning: Advanced algorithms can analyze vast amounts of data to improve predictions over time, adapting to new information and changing market conditions. This is a key aspect of predictive analytics for insurance companies.

- Regulatory compliance: Accurate reserving practices help insurers meet regulatory requirements and maintain financial stability. Predictive analytics in life insurance and predictive analytics in workers compensation are critical for compliance.

At Rapid Innovation, we specialize in implementing predictive analytics solutions that empower insurers to optimize their claims management processes. By harnessing our expertise in AI and machine learning, we help clients achieve greater ROI through enhanced risk assessment and improved accuracy in reserving practices, including claims predictive analytics and predictive analytics health insurance.

3. Advanced AI Technologies in Claims Processing

The integration of advanced AI technologies in claims processing is transforming the insurance landscape. These technologies streamline operations, enhance customer experience, and improve decision-making.

- Automation: AI automates repetitive tasks, reducing the time and effort required for claims processing.

- Natural language processing (NLP): NLP enables systems to understand and process human language, facilitating better communication with customers and faster claims handling.

- Chatbots: AI-powered chatbots provide instant support to policyholders, answering queries and guiding them through the claims process.

- Fraud detection: Machine learning algorithms can identify unusual patterns in claims data, helping to detect and prevent fraudulent activities.

- Enhanced decision-making: AI systems analyze data quickly, providing insights that assist claims adjusters in making informed decisions.

- Cost reduction: By improving efficiency and accuracy, AI technologies can significantly lower operational costs for insurers.

3.1. Computer Vision for Damage Assessment

Computer vision is an innovative technology that uses artificial intelligence to interpret and analyze visual data. In the context of insurance claims, it plays a vital role in damage assessment.

- Image analysis: Computer vision algorithms can analyze images of damaged property, identifying the extent and type of damage.

- Speed and efficiency: Automated damage assessment reduces the time required for claims processing, allowing insurers to respond more quickly to policyholders.

- Consistency: AI-driven assessments provide consistent evaluations, minimizing human error and bias in damage assessments.

- Remote inspections: Insurers can utilize computer vision for remote inspections, enabling claims adjusters to assess damage without being physically present.

- Integration with drones: Drones equipped with computer vision technology can capture aerial images of large or hard-to-reach areas, providing comprehensive damage assessments.

- Cost savings: By streamlining the assessment process, computer vision can lead to significant cost savings for insurers and faster payouts for policyholders.

At Rapid Innovation, we leverage cutting-edge computer vision technologies to enhance damage assessment processes, ensuring our clients can deliver timely and accurate claims resolutions while maximizing their operational efficiency.

3.2. NLP (Natural Language Processing) for Customer Communication

Natural Language Processing (NLP) is a branch of artificial intelligence that focuses on the interaction between computers and humans through natural language. In customer communication, NLP plays a crucial role in enhancing the customer experience and streamlining interactions. Rapid Innovation leverages NLP to help businesses achieve their goals efficiently and effectively.

- Understanding Customer Intent: NLP algorithms can analyze customer inquiries to determine their intent, allowing businesses to respond more accurately and efficiently. This capability not only improves customer satisfaction but also enhances operational efficiency, leading to a greater return on investment (ROI).

- Sentiment Analysis: By evaluating the tone and sentiment of customer messages, companies can gauge customer satisfaction and address issues proactively. This proactive approach can reduce churn rates and foster customer loyalty, ultimately driving revenue growth.

- Automated Responses: NLP enables the creation of automated responses that can handle common queries, reducing wait times and improving service efficiency. This automation allows human agents to focus on more complex issues, optimizing resource allocation and enhancing productivity. The implementation of customer communication automation further enhances this process.

- Multilingual Support: NLP tools can translate and interpret multiple languages, making it easier for businesses to communicate with a diverse customer base. This capability opens up new markets and customer segments, contributing to business expansion.

- Data Extraction: NLP can extract relevant information from customer communications, helping companies to gather insights and improve their services. By utilizing these insights, businesses can refine their strategies and offerings, leading to increased customer engagement and sales.

3.3. Chatbots and Virtual Assistants in Claims Support

Chatbots and virtual assistants are increasingly being used in claims support to enhance customer service and streamline processes. These AI-driven tools can handle a variety of tasks, making them invaluable in the claims management process. Rapid Innovation implements these solutions to help clients achieve operational excellence.

- 24/7 Availability: Chatbots can provide round-the-clock support, allowing customers to file claims or ask questions at any time. This constant availability enhances customer satisfaction and can lead to higher claim submission rates.

- Guided Claims Process: Virtual assistants can guide customers through the claims process, ensuring they provide all necessary information and documentation. This guidance reduces errors and accelerates the claims process, improving overall efficiency.

- Instant Responses: Chatbots can deliver immediate answers to frequently asked questions, reducing the need for human intervention and speeding up the claims process. This efficiency translates to cost savings and improved customer experiences.

- Data Collection: These tools can collect and store customer data efficiently, which can be used for further analysis and improving service delivery. By harnessing this data, businesses can make informed decisions that drive growth.

- Integration with Systems: Chatbots can be integrated with existing claims management systems, allowing for seamless data transfer and updates. This integration ensures that businesses can maintain accurate records and streamline their operations.

3.4. Robotic Process Automation (RPA) for Repetitive Claims Tasks

Robotic Process Automation (RPA) is a technology that uses software robots to automate repetitive tasks. In the context of claims management, RPA can significantly enhance efficiency and accuracy. Rapid Innovation employs RPA to help clients reduce costs and improve service delivery.

- Automating Data Entry: RPA can handle data entry tasks, reducing the risk of human error and freeing up employees to focus on more complex issues. This shift in focus can lead to improved employee satisfaction and productivity.

- Processing Claims: RPA can automate the processing of claims by following predefined rules, ensuring consistency and speed in handling claims. This automation not only accelerates the claims lifecycle but also enhances accuracy, leading to better customer experiences.

- Document Management: RPA can assist in managing documents by automatically sorting, filing, and retrieving necessary paperwork related to claims. This capability reduces administrative burdens and allows organizations to operate more efficiently.

- Compliance and Reporting: RPA can help ensure compliance with regulations by automating reporting processes and maintaining accurate records. This compliance reduces the risk of penalties and enhances the organization's reputation.

- Cost Reduction: By automating repetitive tasks, RPA can lead to significant cost savings for organizations, allowing them to allocate resources more effectively. This cost efficiency contributes to a stronger bottom line and improved ROI.

Through the integration of NLP, chatbots, and RPA, Rapid Innovation empowers businesses to enhance their customer communication automation, streamline claims processes, and achieve greater operational efficiency, ultimately driving higher returns on investment.

3.5. Machine Learning Models for Predicting Claims Outcomes

Machine learning (ML) models are increasingly being utilized in the insurance industry to predict claims outcomes, including car insurance claim prediction, insurance claim prediction, and insurance claims prediction. These models analyze historical data to identify patterns and trends that can inform decision-making.

- Types of Models:

- Regression Models: Used to predict continuous outcomes, such as the amount of a claim payout.

- Classification Models: Help in categorizing claims into different risk levels or types, such as fraudulent or legitimate.

- Ensemble Models: Combine multiple algorithms to improve prediction accuracy.

- Data Utilization:

- Historical Claims Data: Analyzing past claims to identify factors that influence outcomes.

- Customer Data: Incorporating demographic and behavioral data to enhance predictions.

- External Data Sources: Utilizing data from social media, weather reports, and economic indicators to provide context.

- Benefits:

- Improved Accuracy: Machine learning models can achieve higher accuracy in predicting outcomes compared to traditional methods.

- Efficiency: Automating the claims process reduces the time and resources needed for manual assessments.

- Personalization: Tailoring insurance products and services based on predicted outcomes enhances customer satisfaction.

- Challenges:

- Data Quality: Inaccurate or incomplete data can lead to poor model performance.

- Regulatory Compliance: Ensuring that models comply with industry regulations is crucial.

- Model Interpretability: Understanding how models arrive at predictions is important for trust and accountability.

4. Specialized Use Cases for AI in Insurance Claims

AI technologies are transforming the insurance claims process by providing specialized solutions that enhance efficiency and accuracy.

- Claims Processing Automation:

- Chatbots: AI-driven chatbots can handle initial claims inquiries, providing quick responses and reducing the workload on human agents.

- Document Processing: AI can automate the extraction of information from claims documents, speeding up the processing time.

- Predictive Analytics:

- Risk Assessment: AI models can analyze data to predict the likelihood of claims, helping insurers adjust premiums accordingly.

- Customer Segmentation: Identifying high-risk customers allows for targeted interventions and tailored insurance products.

- Enhanced Customer Experience:

- Personalized Communication: AI can analyze customer interactions to provide personalized updates and support.

- Claims Status Tracking: Automated systems can keep customers informed about their claims status in real-time.

4.1. Real-Time Fraud Detection and Risk Assessment

Real-time fraud detection is a critical application of AI in the insurance claims process, helping insurers identify and mitigate fraudulent activities as they occur.

- Techniques Used:

- Anomaly Detection: Machine learning algorithms can identify unusual patterns in claims data that may indicate fraud.

- Predictive Modeling: Models can assess the likelihood of fraud based on historical data and current claim characteristics.

- Data Sources:

- Claims History: Analyzing past claims to identify common fraud indicators.

- Social Media and Online Behavior: Monitoring online activity for signs of fraudulent behavior.

- Third-Party Data: Integrating data from law enforcement and other agencies to enhance fraud detection capabilities.

- Benefits:

- Immediate Response: Real-time detection allows insurers to act quickly to prevent fraudulent payouts.

- Cost Savings: Reducing fraud can lead to significant savings for insurance companies, lowering overall costs for policyholders.

- Enhanced Trust: Effective fraud detection builds trust with customers, as they feel their claims are being handled fairly.

- Challenges:

- False Positives: High rates of false positives can lead to legitimate claims being flagged, causing customer dissatisfaction.

- Data Privacy: Ensuring compliance with data protection regulations while monitoring for fraud is essential.

- Evolving Fraud Tactics: Fraudsters continuously adapt their methods, requiring ongoing updates to detection algorithms.

At Rapid Innovation, we leverage our expertise in AI and machine learning to help insurance companies implement these advanced models effectively. By utilizing our tailored solutions, clients can enhance their claims processing capabilities, improve accuracy, and ultimately achieve greater ROI. Our commitment to data quality and regulatory compliance ensures that your organization can trust the insights generated by our models, paving the way for a more efficient and customer-centric insurance experience.

4.2. Accelerated Claims Processing for Catastrophic Events

- Catastrophic events, such as natural disasters, often lead to a surge in insurance claims. Traditional claims processing can be slow and cumbersome during these times, leading to customer dissatisfaction.

- AI technologies, including ai in healthcare claims processing and ai claims processing, can streamline the claims process by automating various tasks, such as initial claim assessments, document verification, and fraud detection.

- Machine learning algorithms, such as machine learning in claims processing, can analyze historical data to predict claim outcomes and prioritize urgent cases.

- Chatbots and virtual assistants can provide immediate responses to policyholders, guiding them through the claims process.

- By leveraging AI, including ai for claims processing and ai in claims management, insurers can reduce processing times significantly, ensuring that policyholders receive timely support and compensation. According to a report, AI can reduce claims processing time by up to 30% during catastrophic events. Rapid Innovation specializes in implementing these AI solutions, enabling insurers to enhance their operational efficiency and improve customer satisfaction. For more information on how we can assist with blockchain insurance solutions about generative AI in insurance.

4.3. AI for Personalized Policyholder Communication

- Personalized communication enhances the customer experience and builds trust between insurers and policyholders.

- AI can analyze customer data to tailor communications based on individual preferences and behaviors.

- Key benefits of AI-driven personalized communication include:

- Targeted messaging: Sending relevant information based on policyholder needs and life events.

- Proactive outreach: Notifying customers about policy updates, renewals, or potential coverage gaps.

- 24/7 availability: AI chatbots can answer queries at any time, providing instant support.

- Natural language processing (NLP) allows insurers to understand and respond to customer inquiries more effectively.

- Personalized communication can lead to higher customer satisfaction and retention rates. Studies show that personalized communication can increase engagement by up to 50%. Rapid Innovation's expertise in AI-driven communication strategies empowers insurers to foster stronger relationships with their policyholders.

4.4. Handling High-Volume Claims with AI Scalability

- High-volume claims situations, such as during disasters or large-scale incidents, can overwhelm traditional claims processing systems.

- AI offers scalability, allowing insurers to manage increased workloads without compromising service quality.

- Key features of AI scalability include:

- Automated claim triage: Quickly categorizing and prioritizing claims based on severity and complexity.

- Predictive analytics: Forecasting claim volumes and adjusting resources accordingly.

- Integration with existing systems: AI can work alongside legacy systems to enhance efficiency.

- Insurers can deploy AI solutions, including claims automation ai and ai insurance claims processing, that adapt to fluctuating claim volumes, ensuring that all claims are processed in a timely manner. By utilizing AI, insurers can maintain operational efficiency even during peak times, reducing backlogs and improving customer satisfaction. Research indicates that AI can handle up to 80% of routine claims processing tasks, freeing up human adjusters for more complex cases. Rapid Innovation's AI solutions are designed to help insurers navigate these challenges effectively, maximizing their return on investment while enhancing service delivery.

4.5. AI for Compliance and Regulatory Adherence in Claims

AI technologies play a crucial role in ensuring compliance with regulations in claims processing. They help organizations adhere to industry standards and legal requirements by automating compliance checks. Key benefits of AI in compliance include enhanced accuracy in data processing, which reduces human error, real-time monitoring of claims to identify potential compliance issues, and automated reporting capabilities that streamline the documentation process.

AI can analyze vast amounts of data to ensure that claims meet regulatory requirements, and machine learning algorithms can be trained to recognize patterns that may indicate non-compliance. By leveraging AI compliance in claims processing, organizations can significantly reduce the risk of penalties and fines associated with non-compliance, improve the speed and efficiency of compliance audits, and maintain a transparent audit trail for regulatory reviews. Additionally, AI tools can assist in training staff on compliance requirements, ensuring that everyone is up-to-date with the latest regulations. The integration of AI in compliance processes can lead to substantial cost savings and improved operational efficiency.

5. Implementing AI in Claims Processing: A Step-by-Step Guide

Implementing AI in claims processing requires a structured approach to ensure success. The following steps can guide organizations through the implementation process:

- Step 1: Define Objectives

Identify specific goals for AI implementation, such as reducing processing time or improving accuracy. - Step 2: Assess Current Processes

Evaluate existing claims processing workflows to identify areas for improvement. - Step 3: Choose the Right AI Tools

Research and select AI technologies that align with your objectives and current systems. - Step 4: Data Preparation

Gather and clean data to ensure it is suitable for AI training and analysis. - Step 5: Pilot Testing

Conduct a pilot program to test AI tools in a controlled environment before full-scale implementation. - Step 6: Training and Change Management

Train staff on new AI tools and processes, addressing any resistance to change. - Step 7: Monitor and Evaluate

Continuously monitor the performance of AI systems and evaluate their impact on claims processing. - Step 8: Scale Up

Once successful, scale the AI implementation across the organization for broader benefits.

Each step is critical to ensure that AI is effectively integrated into claims processing, leading to improved efficiency and accuracy.

5.1. Assessing AI Readiness in Your Organization

Assessing AI readiness is essential before implementing AI in claims processing. Key factors to consider include:

- Current Technology Infrastructure

Evaluate existing IT systems and software to determine compatibility with AI solutions. - Data Quality and Availability

Assess the quality, quantity, and accessibility of data needed for AI training and operation. - Staff Skills and Training

Identify gaps in staff skills related to AI and data analytics, and plan for necessary training. - Organizational Culture

Consider the organization's openness to adopting new technologies and processes. - Leadership Support

Ensure that leadership is committed to the AI initiative and willing to allocate resources. - Regulatory Compliance

Review compliance requirements to ensure that AI implementation aligns with legal standards. - Budget and Resources

Assess the financial resources available for AI implementation, including software, hardware, and training costs.

Conducting a thorough readiness assessment can help organizations identify potential challenges and develop strategies to address them, paving the way for successful AI integration in claims processing.

At Rapid Innovation, we specialize in guiding organizations through this transformative journey, ensuring that your AI implementation not only meets compliance standards but also drives significant ROI through enhanced operational efficiency and reduced risk.

5.2. Choosing the Right AI Tools and Solutions for Claims

Selecting the appropriate AI tools for claims processing is crucial for enhancing efficiency and accuracy. Here are key considerations:

- Identify Specific Needs: Assess the unique challenges faced in your claims process and determine whether you need tools for data extraction, fraud detection, or customer service.

- Evaluate Features: Look for AI solutions that offer features like natural language processing (NLP), machine learning, and predictive analytics. Ensure the tools can integrate with existing systems and databases.

- Scalability: Choose tools that can grow with your organization and consider whether the solution can handle increased claims volume over time.

- User-Friendliness: Opt for solutions that are intuitive and easy for your team to use. A user-friendly interface can reduce training time and increase adoption rates.

- Vendor Reputation: Research vendors’ track records and customer reviews. Look for case studies or testimonials that demonstrate successful implementations.

- Cost Considerations: Analyze the total cost of ownership, including licensing, maintenance, and potential hidden costs. Compare pricing models (subscription vs. one-time purchase) to find the best fit for your budget.

- Compliance and Security: Ensure that the AI tools comply with industry regulations and standards. Evaluate the security measures in place to protect sensitive data.

5.3. Roadmap for AI Implementation in Claims Workflows

Implementing AI in claims workflows requires a structured approach. Here’s a roadmap to guide the process:

- Define Objectives: Clearly outline what you aim to achieve with AI (e.g., reduce processing time, improve accuracy) and set measurable goals to track progress.

- Conduct a Needs Assessment: Analyze current workflows to identify bottlenecks and areas for improvement. Gather input from stakeholders to understand their needs and concerns.

- Select the Right Tools: Based on the assessment, choose AI tools for claims processing that align with your objectives. Consider pilot testing a few solutions before full-scale implementation.

- Develop a Project Plan: Create a timeline for implementation, including key milestones and deliverables. Assign roles and responsibilities to team members.

- Training and Support: Provide comprehensive training for staff on new tools and processes. Establish a support system for ongoing assistance and troubleshooting.

- Monitor and Evaluate: Continuously track the performance of AI tools against the defined objectives. Gather feedback from users to identify areas for further improvement.

- Iterate and Optimize: Use insights gained from monitoring to refine processes and tools. Stay updated on advancements in AI technology to enhance capabilities.

5.4. Managing Change: How to Upskill Your Team for AI Integration

Integrating AI into claims processing can be a significant change for your team. Here are strategies to effectively manage this transition:

- Communicate the Vision: Clearly articulate the benefits of AI integration to the team. Address any concerns and emphasize how AI will enhance their roles rather than replace them.

- Assess Current Skills: Evaluate the existing skill sets of your team members and identify gaps that need to be filled for successful AI adoption.

- Provide Training Programs: Offer training sessions focused on AI tools for claims processing and technologies, including hands-on workshops to allow team members to practice using the tools.

- Encourage Continuous Learning: Foster a culture of continuous improvement and learning by providing access to online courses, webinars, and industry conferences.

- Create Cross-Functional Teams: Form teams that include members from different departments to encourage knowledge sharing. This collaboration can lead to innovative solutions and a better understanding of AI’s impact.

- Recognize and Reward Efforts: Acknowledge team members who actively engage in upskilling and contribute to the AI integration process. Consider implementing incentive programs to motivate participation.

- Solicit Feedback: Regularly ask for feedback on the training and integration process. Use this input to make necessary adjustments and improvements.

- Lead by Example: Ensure leadership is actively involved in the AI integration process. Demonstrating commitment from the top can inspire the team to embrace change.

At Rapid Innovation, we specialize in guiding organizations through the selection and implementation of AI tools for claims processing tailored to their specific needs. Our expertise ensures that clients not only choose the right solutions but also achieve greater ROI through efficient claims processing and enhanced operational capabilities.

5.5. Ensuring a Smooth Transition to AI-enhanced Claims Processing

Transitioning to AI-enhanced claims processing requires careful planning and execution. Organizations must consider several factors to ensure a seamless integration of AI technologies.

- Stakeholder Engagement: Involve all relevant stakeholders early in the process and gather input from claims adjusters, IT staff, and management to understand their needs and concerns regarding AI in healthcare claims processing.

- Training and Development: Provide comprehensive training for employees on new AI tools and systems, focusing on both technical skills and change management to ease the transition to AI claims processing.

- Pilot Programs: Implement pilot programs to test AI solutions in a controlled environment and use feedback from these pilots to make necessary adjustments before full-scale deployment of AI for claims processing.

- Data Management: Ensure that data quality and integrity are maintained during the transition. Clean and organize existing data to facilitate effective AI training and operation, particularly for machine learning in claims processing.

- Change Management Strategy: Develop a clear change management strategy to address potential resistance and communicate the benefits of AI in claims management to all employees to foster a positive attitude towards the transition.

- Continuous Monitoring and Feedback: Establish mechanisms for ongoing monitoring of AI performance and encourage feedback from users to identify areas for improvement in claims automation AI.

6. Measuring the Success of AI in Claims Processing

Measuring the success of AI in claims processing is crucial for understanding its impact and effectiveness. Organizations should adopt a structured approach to evaluate AI performance.

- Defining Success Metrics: Clearly define what success looks like for AI implementation, considering both quantitative and qualitative metrics to get a comprehensive view of AI insurance claims processing.

- Regular Performance Reviews: Conduct regular reviews of AI systems to assess their performance against established metrics and use these reviews to identify trends and areas needing improvement.

- User Satisfaction Surveys: Implement surveys to gauge user satisfaction with AI tools and collect feedback on usability, efficiency, and overall experience in machine learning in insurance claims.

- Cost-Benefit Analysis: Perform a cost-benefit analysis to evaluate the financial impact of AI on claims processing, comparing costs associated with AI implementation against savings and efficiency gains.

- Benchmarking Against Industry Standards: Compare AI performance metrics with industry benchmarks to assess competitiveness and use insights from industry leaders to identify best practices in AI claims management.

6.1. Key Performance Indicators (KPIs) for AI in Claims

Key Performance Indicators (KPIs) are essential for measuring the effectiveness of AI in claims processing. Organizations should focus on specific KPIs that align with their goals.

- Claims Processing Time: Measure the average time taken to process claims before and after AI implementation. A reduction in processing time indicates improved efficiency in AI claims processing.

- Claim Accuracy Rate: Track the accuracy of claims processed using AI compared to traditional methods. Higher accuracy rates can lead to reduced errors and rework.

- Cost per Claim: Calculate the cost associated with processing each claim. A decrease in cost per claim post-AI implementation signifies financial benefits.

- Customer Satisfaction Scores: Monitor customer satisfaction through surveys and feedback mechanisms. Improved satisfaction scores reflect the positive impact of AI on customer experience.

- Fraud Detection Rate: Evaluate the effectiveness of AI in identifying fraudulent claims. An increase in fraud detection rates can enhance overall claims integrity.

- Employee Productivity: Assess changes in employee productivity levels after AI integration. Increased productivity can indicate that AI tools are effectively supporting staff in claims processing.

- Return on Investment (ROI): Calculate the ROI of AI initiatives by comparing the financial gains against the investment made. A positive ROI demonstrates the value of AI in claims processing.

At Rapid Innovation, we specialize in guiding organizations through this transformative journey. Our expertise in AI and Blockchain technologies enables us to tailor solutions that not only streamline claims processing but also enhance overall operational efficiency. By leveraging our ai consulting services, clients can expect to see significant improvements in their KPIs, ultimately leading to greater ROI and a competitive edge in the market.

6.2. Measuring Cost Savings and ROI from AI Implementation

- Cost savings from AI can be significant, but measuring them requires a structured approach.

- Key metrics to consider include:

- Reduction in operational costs

- Increased efficiency and productivity

- Decreased time spent on manual tasks

- To calculate ROI:

- Identify the initial investment in AI technology.

- Estimate ongoing operational costs versus savings generated.

- Use the formula:

ROI = (Net Profit / Cost of Investment) x 100.

- Consider both direct and indirect savings:

- Direct savings: Lower labor costs, reduced error rates.

- Indirect savings: Improved employee morale, enhanced decision-making capabilities.

- Case studies can provide insights into potential savings:

- For example, companies like Amazon have reported significant reductions in logistics costs due to AI-driven optimization. Rapid Innovation can help you implement similar AI solutions tailored to your business needs, ensuring you achieve comparable ai cost savings and roi.

- Regularly review and adjust metrics to reflect changing business conditions and technology advancements.

6.3. AI’s Impact on Customer Satisfaction and Retention

- AI can enhance customer satisfaction through personalized experiences.

- Key areas of impact include:

- Chatbots and virtual assistants providing 24/7 support.

- Personalized recommendations based on customer behavior and preferences.

- Predictive analytics to anticipate customer needs and preferences.

- Improved response times lead to higher satisfaction:

- Customers appreciate quick resolutions to their inquiries.

- AI can analyze data to provide instant answers, reducing wait times.

- Retention strategies powered by AI:

- Identifying at-risk customers through data analysis.

- Tailoring marketing efforts to re-engage disengaged customers.

- Companies leveraging AI for customer satisfaction often see increased loyalty:

- For instance, businesses using AI-driven insights report higher customer retention rates. Rapid Innovation can assist in developing these AI-driven strategies to enhance your customer engagement and loyalty.

- Continuous feedback loops can help refine AI systems to better meet customer expectations.

6.4. Monitoring AI System Accuracy and Reliability

- Ensuring the accuracy and reliability of AI systems is crucial for their success.

- Key monitoring practices include:

- Regularly evaluating model performance against established benchmarks.

- Implementing feedback mechanisms to capture real-world performance data.

- Metrics to track:

- Precision and recall for classification tasks.

- Mean absolute error for regression tasks.

- User satisfaction scores for AI-driven interactions.

- Continuous training and updating of AI models are essential:

- As new data becomes available, models should be retrained to maintain accuracy.

- This helps in adapting to changing patterns and trends in data.

- Establishing a governance framework can enhance reliability:

- Define roles and responsibilities for monitoring AI systems.

- Create protocols for addressing inaccuracies or failures.

- Transparency in AI decision-making can build trust:

- Providing explanations for AI-driven decisions can help users understand and accept outcomes.

- Regular audits and assessments can help identify potential biases and ensure ethical AI use. Rapid Innovation emphasizes the importance of transparency and governance in AI systems to foster trust and reliability in your business operations.

7. The Future of AI in Claims Processing and Insurance

The insurance industry is undergoing a significant transformation due to advancements in artificial intelligence (AI). As technology continues to evolve, AI is poised to enhance claims processing, improve customer experiences, and streamline operations. The future of AI in claims processing and insurance is bright, with numerous trends and innovations on the horizon.

7.1. Emerging AI Trends for the Insurance Industry

AI is reshaping the insurance landscape in various ways. Some of the emerging trends include:

- Predictive Analytics: Insurers are leveraging AI to analyze historical data and predict future claims, which helps in risk assessment and pricing strategies.

- Chatbots and Virtual Assistants: Many insurance companies are implementing AI-driven chatbots to handle customer inquiries, provide policy information, and assist in the claims process. This leads to improved customer service and reduced operational costs.

- Fraud Detection: AI algorithms can analyze patterns and detect anomalies in claims data, helping insurers identify fraudulent claims more effectively. This capability can save the industry billions annually.

- Automated Claims Processing: AI can automate routine tasks in claims processing, such as data entry and document verification. This speeds up the claims settlement process and reduces human error.

- Personalized Insurance Products: AI enables insurers to offer tailored products based on individual customer data, enhancing customer satisfaction and retention.

- Telematics and IoT Integration: The use of telematics devices and IoT technology allows insurers to gather real-time data on policyholders, leading to more accurate risk assessments and premium pricing.

- Enhanced Customer Experience: AI tools can analyze customer feedback and behavior, allowing insurers to improve their services and create a more personalized experience.

7.2. Blockchain and AI: A Powerful Combo for Claims Management

The integration of blockchain technology with AI presents a transformative opportunity for claims management in the insurance sector. This powerful combination offers several advantages:

- Transparency and Trust: Blockchain provides a decentralized ledger that ensures transparency in transactions. When combined with AI, it can enhance trust in the claims process by providing verifiable data.

- Smart Contracts: AI can automate the execution of smart contracts on a blockchain, ensuring that claims are processed automatically when predefined conditions are met. This reduces the need for manual intervention and speeds up the claims settlement process.

- Data Security: Blockchain's inherent security features protect sensitive customer data. AI can analyze this data while maintaining privacy, ensuring compliance with regulations.

- Streamlined Processes: The combination of AI and blockchain can streamline claims processing by reducing paperwork and manual tasks, leading to faster claims resolution and improved operational efficiency.

- Improved Fraud Prevention: AI can analyze data on the blockchain to identify patterns indicative of fraud. This proactive approach helps insurers mitigate risks and reduce losses.

- Enhanced Collaboration: Blockchain facilitates secure sharing of information among various stakeholders in the insurance ecosystem, including insurers, reinsurers, and third-party service providers. AI can analyze this shared data to improve decision-making.

- Cost Reduction: By automating processes and reducing fraud, the integration of AI and blockchain can lead to significant cost savings for insurance companies, ultimately benefiting policyholders through lower premiums.

The future of AI in claims processing and insurance is set to revolutionize the industry, making it more efficient, transparent, and customer-centric. As these technologies continue to evolve, insurers that embrace machine learning in insurance claims, machine learning insurance claims, and AI in insurance claims processing will likely gain a competitive edge in the market. At Rapid Innovation, we specialize in harnessing these cutting-edge technologies to help our clients achieve their business goals efficiently and effectively, ultimately driving greater ROI.

7.3. Ethical and Regulatory Challenges in AI-driven Claims

- Bias in Algorithms: AI systems can inadvertently perpetuate biases present in training data, leading to unfair treatment of certain groups in claims processing. Rapid Innovation emphasizes the importance of developing algorithms that are regularly audited and refined to mitigate bias, ensuring equitable outcomes for all customers. This is particularly relevant in areas like ai insurance claims and ai in healthcare claims processing.

- Transparency Issues: Many AI models operate as "black boxes," making it difficult for stakeholders to understand how decisions are made. This lack of transparency can erode trust among customers and regulators. At Rapid Innovation, we advocate for the implementation of explainable AI solutions that provide insights into decision-making processes, fostering trust and accountability, especially in contexts like artificial intelligence insurance claims.

- Data Privacy Concerns: The use of personal data in AI systems raises significant privacy issues. Insurers must navigate regulations like GDPR and CCPA to ensure compliance while leveraging data for claims processing. Our team at Rapid Innovation specializes in creating AI solutions that prioritize data privacy, ensuring that clients can utilize data responsibly and in compliance with regulations, particularly in ai claims processing and ai for claims processing.

- Accountability: Determining who is responsible for decisions made by AI systems can be complex. If an AI system denies a claim incorrectly, it raises questions about liability and accountability. Rapid Innovation helps clients establish clear accountability frameworks, ensuring that there are processes in place to address any discrepancies in AI-driven decisions, including those related to ai in insurance claims.

- Regulatory Compliance: Insurers must stay updated on evolving regulations regarding AI use, understanding how to implement AI responsibly while adhering to industry standards. Rapid Innovation provides consulting services that keep clients informed about regulatory changes, helping them adapt their strategies accordingly, especially in the realm of claims automation and machine learning in claims processing.

- Ethical Use of AI: Companies must establish ethical guidelines for AI use, ensuring that technology enhances rather than undermines customer trust and fairness in claims processing. Rapid Innovation collaborates with clients to develop ethical AI frameworks that align with their organizational values and customer expectations, particularly in the context of ai for insurance claims and machine learning in insurance claims. For more information on our services, visit our AI Technology Consulting Company and our successful AI integration strategies.

7.4. Preparing for the Next Wave of AI Innovations in Insurance

- Investing in Technology: Insurers should allocate resources to upgrade their technology infrastructure to support advanced AI applications. Rapid Innovation assists clients in identifying the right technologies and investments that will yield the highest ROI, including those related to ai insurance claims processing.

- Training and Development: Continuous training for employees on AI tools and their implications is essential to ensure that staff can effectively use AI in claims processing. We offer tailored training programs that empower employees to leverage AI effectively, enhancing operational efficiency, particularly in areas like machine learning insurance claims.

- Collaboration with Tech Firms: Partnering with technology companies can provide insurers access to cutting-edge AI solutions and expertise. Rapid Innovation facilitates strategic partnerships, enabling clients to harness the latest advancements in AI technology, including claims automation and ai in claims processing.

- Customer-Centric Approach: Insurers should focus on how AI can enhance customer experience, such as through faster claims processing and personalized services. Our solutions are designed with a customer-centric approach, ensuring that AI implementations lead to improved customer satisfaction and loyalty, particularly in the context of property damage insurance ai.

- Regulatory Awareness: Staying informed about regulatory changes related to AI will help insurers adapt their strategies and maintain compliance. Rapid Innovation provides ongoing support to keep clients updated on relevant regulations, ensuring they remain compliant while innovating.

- Pilot Programs: Implementing pilot programs can help insurers test AI innovations on a smaller scale before full deployment, allowing for adjustments based on real-world feedback. Rapid Innovation guides clients through the pilot process, ensuring that they can effectively evaluate the impact of AI solutions before broader implementation.

8. Real-World Success Stories of AI in Claims Processing

- Progressive Insurance: Progressive uses AI to streamline claims processing, allowing for quicker assessments and payouts. Their AI-driven system analyzes claims data to identify fraud and expedite legitimate claims.

- Lemonade: This insurtech company employs AI to handle claims in real-time. Their AI chatbot, Jim, can process claims in as little as three seconds, significantly improving customer satisfaction.

- Allstate: Allstate has integrated AI into its claims management system, which helps adjusters assess damages using image recognition technology. This speeds up the claims process and reduces the need for in-person inspections.

- State Farm: State Farm utilizes AI to analyze customer interactions and improve service delivery. Their AI tools help predict customer needs and streamline the claims process, enhancing overall efficiency.

- MetLife: MetLife has implemented AI to automate claims processing for its life insurance products, leading to faster claim resolutions and improved customer experience.

- Zurich Insurance: Zurich uses AI to analyze large volumes of claims data, identifying patterns that help in fraud detection and risk assessment, ultimately leading to more informed decision-making.

At Rapid Innovation, we are committed to helping our clients navigate the complexities of AI and blockchain technologies, ensuring they achieve their business goals efficiently and effectively while maximizing ROI.

8.1. Case Study: How Leading Insurers Use AI to Transform Claims

Leading insurers are increasingly adopting artificial intelligence (AI) to enhance their claims processing. Here are some notable examples:

- Progressive Insurance: Progressive uses AI in healthcare claims processing to streamline the claims process through its virtual assistant, which helps customers file claims quickly and efficiently. The AI analyzes data from the claim and provides real-time updates to customers, reducing the need for human intervention.

- Allstate: Allstate has implemented AI-driven tools to assess damages in auto claims. By using image recognition technology, the company can analyze photos of vehicle damage and estimate repair costs, significantly speeding up the claims processing.

- Lemonade: This insurtech company leverages AI for claims processing in a unique way. Lemonade uses chatbots to guide customers through the claims process, allowing for instant payouts in many cases. Their AI system can analyze claims and detect fraud, ensuring that legitimate claims are processed quickly.

These case studies illustrate how AI can lead to faster, more efficient claims processing, ultimately improving customer satisfaction and reducing operational costs. For more insights, you can read about learning from real-world AI implementations.

8.2. Lessons from Successful AI Implementations in Claims Departments

Successful AI implementations in claims departments offer valuable lessons for other businesses looking to adopt similar technologies:

- Start Small: Begin with pilot projects to test AI applications in a controlled environment. This allows for adjustments and learning before a full-scale rollout.

- Data Quality is Key: Ensure that the data used for training AI models is accurate and comprehensive. Poor data quality can lead to ineffective AI solutions, particularly in areas like machine learning in claims processing.

- Integrate with Existing Systems: AI should complement existing claims processing systems rather than replace them entirely. Integration helps maintain continuity and leverages current workflows.

- Focus on User Experience: Design AI tools with the end-user in mind. A user-friendly interface can enhance adoption rates among employees and customers.

- Continuous Learning and Improvement: AI systems should be regularly updated and trained with new data to improve their accuracy and effectiveness over time.

- Address Ethical Concerns: Be transparent about how AI is used in claims processing, especially regarding data privacy and bias. Establish guidelines to ensure ethical use of AI technologies.

8.3. Key Takeaways for Businesses Considering AI for Claims Processing

Businesses contemplating the integration of AI into their claims processing should consider the following key takeaways:

- Identify Clear Objectives: Define specific goals for AI implementation, such as reducing processing time, improving accuracy, or enhancing customer satisfaction.

- Invest in Training: Provide training for employees to ensure they understand how to use AI tools effectively. This can help mitigate resistance to change and improve overall efficiency.

- Monitor Performance Metrics: Establish metrics to evaluate the performance of AI systems. Regularly assess these metrics to identify areas for improvement.

- Engage Stakeholders: Involve key stakeholders, including claims adjusters and IT staff, in the planning and implementation process. Their insights can help tailor AI solutions to meet actual needs.

- Stay Informed on Regulations: Keep abreast of industry regulations regarding AI and data usage. Compliance is crucial to avoid legal issues and maintain customer trust.

- Plan for Scalability: Choose AI solutions that can scale with your business. As your claims volume grows, your AI systems should be able to handle increased demand without compromising performance.

At Rapid Innovation, we specialize in helping businesses like yours leverage AI technologies, including machine learning in insurance claims and claims automation AI, to achieve these objectives. Our expertise in AI development and consulting ensures that you can implement effective solutions tailored to your specific needs, ultimately driving greater ROI and operational efficiency.

9. Conclusion: Embracing AI for Competitive Advantage in Claims Processing

The integration of Artificial Intelligence (AI) into claims processing is not just a trend; it is a strategic move that can significantly enhance operational efficiency, customer satisfaction, and overall competitiveness in the insurance industry. As organizations face increasing pressure to streamline processes and reduce costs, AI offers a pathway to achieve these goals while also improving accuracy and speed.

9.1. Summary of AI Benefits for Claims Processing

AI brings numerous advantages to claims processing, transforming how insurers operate. Key benefits include:

- Increased Efficiency: AI can automate repetitive tasks, such as data entry and document verification, allowing claims adjusters to focus on more complex issues, particularly in areas like ai in healthcare claims processing.

- Enhanced Accuracy: Machine learning algorithms can analyze vast amounts of data to identify patterns and anomalies, reducing human error in claims assessments, especially in ai claims processing.

- Faster Processing Times: AI can expedite the claims process by quickly analyzing claims data and providing real-time insights, leading to quicker resolutions, which is crucial for ai for claims processing.

- Improved Customer Experience: AI-powered chatbots and virtual assistants can provide 24/7 support, answering customer queries and guiding them through the claims process, enhancing ai in claims processing.

- Fraud Detection: AI systems can detect fraudulent claims by analyzing historical data and identifying suspicious patterns, helping to mitigate losses in ai claims management.

- Cost Reduction: By automating processes and improving accuracy, AI can lead to significant cost savings in claims processing operations, particularly in ai insurance claims processing.

9.2. Strategic Next Steps for Integrating AI into Claims Workflows

To successfully integrate AI into claims workflows, organizations should consider the following strategic steps:

- Assess Current Processes: Evaluate existing claims processing workflows to identify areas where AI can add value, including understanding pain points and inefficiencies, such as in ai in claims management.

- Define Clear Objectives: Establish specific goals for AI implementation, such as reducing processing time by a certain percentage or improving customer satisfaction scores, particularly in claims automation ai.

- Invest in Technology: Choose the right AI tools and platforms that align with organizational needs. This may involve investing in machine learning software, natural language processing, or robotic process automation, including machine learning in claims processing.

- Train Staff: Provide training for employees to ensure they understand how to work alongside AI tools, including upskilling staff to interpret AI-generated insights effectively, especially in machine learning in insurance claims.

- Pilot Programs: Start with pilot projects to test AI applications in a controlled environment. Gather feedback and make necessary adjustments before a full-scale rollout, focusing on machine learning insurance claims.

- Monitor and Evaluate: Continuously monitor the performance of AI systems and evaluate their impact on claims processing. Use metrics to assess efficiency, accuracy, and customer satisfaction.

- Foster a Culture of Innovation: Encourage a mindset that embraces technology and innovation within the organization. This can help in adapting to changes and maximizing the benefits of AI.

By taking these strategic steps, organizations can effectively harness the power of AI to gain a competitive advantage in claims processing, ultimately leading to improved operational performance and enhanced customer experiences. At Rapid Innovation, we specialize in guiding organizations through this transformative journey, ensuring that they leverage concepts of AI technologies to achieve greater ROI and operational excellence.

9.3. How AI Sets Insurance Leaders Apart in the Digital Age

Artificial Intelligence (AI) is transforming the insurance industry, enabling companies to enhance their operations, improve customer experiences, and gain a competitive edge. Here are several ways AI sets insurance leaders apart in the digital age:

- Enhanced Customer Experience

AI-driven chatbots and virtual assistants provide 24/7 customer support, answering queries and processing claims quickly. Personalized insurance products are created using AI algorithms that analyze customer data, preferences, and behaviors. Additionally, predictive analytics help insurers anticipate customer needs, allowing for proactive engagement and tailored offerings. At Rapid Innovation, we implement AI solutions that empower insurers to deliver exceptional customer service, resulting in increased satisfaction and loyalty. This includes offerings like ai life insurance and ai insurance near me. - Improved Risk Assessment

AI models analyze vast amounts of data to identify risk factors more accurately than traditional methods. Machine learning algorithms can detect patterns in claims data, helping insurers refine their underwriting processes. Furthermore, real-time data from IoT devices (like telematics in cars) allows for dynamic risk assessment and pricing adjustments. Our expertise in AI development enables clients to leverage these technologies for more precise risk evaluation, ultimately leading to better pricing strategies and enhanced profitability, particularly in areas like ai underwriting and ai auto insurance. - Streamlined Operations

Automation of routine tasks, such as data entry and claims processing, reduces operational costs and minimizes human error. AI can optimize claims management by quickly assessing damages through image recognition technology. Predictive maintenance powered by AI can help insurers manage their assets more effectively, reducing downtime and costs. Rapid Innovation's AI solutions streamline operations, allowing insurers to focus on strategic initiatives rather than administrative burdens, including the integration of ai insurance company technologies. - Fraud Detection and Prevention

AI systems analyze transaction patterns to identify anomalies that may indicate fraudulent activity. Machine learning models continuously improve their detection capabilities by learning from new data and past fraud cases. Early detection of fraud can save insurers significant amounts of money and protect their reputation. Our advanced AI algorithms provide robust fraud detection mechanisms, ensuring that our clients can safeguard their assets and maintain trust with their customers, which is crucial for companies like ai united insurance. - Data-Driven Decision Making

AI enables insurers to harness big data, providing insights that inform strategic decisions. Advanced analytics tools help in market segmentation, allowing for more effective targeting of potential customers. Real-time data analysis supports agile decision-making, enabling insurers to respond quickly to market changes. At Rapid Innovation, we empower clients with data analytics solutions that drive informed decision-making, enhancing their competitive positioning, especially in the context of artificial intelligence in insurance. - Competitive Advantage