Table Of Contents

Category

Artificial Intelligence

Blockchain

FinTech

1. Introduction: AI in Banking and Finance

Artificial Intelligence (AI) is transforming the banking and finance sectors by enhancing efficiency, improving customer experiences, and enabling better decision-making. The integration of AI technologies, such as machine learning in investment banking and AI in finance and banking, is reshaping traditional practices, allowing institutions to leverage data in innovative ways. AI applications range from chatbots and virtual assistants to advanced analytics and machine learning algorithms. Financial institutions are increasingly adopting AI to stay competitive and meet evolving customer expectations. The shift towards digital banking has accelerated the need for AI development solutions to manage vast amounts of data and provide personalized services.

1.1. Opportunities for Process Optimization, Risk Management, and Customer Engagement

AI offers numerous opportunities for banks and financial institutions to optimize their processes, manage risks more effectively, and enhance customer engagement.

- Process Optimization: Automation of routine tasks such as data entry, transaction processing, and compliance checks streamlines operations through AI-driven analytics that identify inefficiencies and suggest improvements, reducing operational costs by minimizing human error and increasing processing speed. The role of AI in banking and finance is crucial for achieving these efficiencies.

- Risk Management: Enhanced fraud detection through machine learning algorithms that analyze transaction patterns in real-time, predictive analytics to assess credit risk and improve loan underwriting processes, and continuous monitoring of market conditions and customer behavior to identify potential risks early. The use of AI in investment banking is particularly significant in this area.

- Customer Engagement: Personalized banking experiences through AI-driven recommendations based on customer data and preferences, 24/7 customer support via chatbots that can handle inquiries and transactions without human intervention, and improved customer insights through data analysis, enabling targeted marketing and tailored financial products. AI for banking and finance is revolutionizing how institutions interact with their customers.

1.2. The Growing Role of AI in Financial Services

The role of AI in financial services is expanding rapidly, driven by technological advancements and changing consumer behaviors.

- Increased Investment: Financial institutions are investing heavily in AI technologies to enhance their service offerings and operational capabilities. According to a report, global investment in AI in financial services is projected to reach $22.6 billion by 2025, highlighting the growing importance of AI in banking and finance.

- Regulatory Compliance: AI tools assist in ensuring compliance with regulations by automating reporting and monitoring processes. Natural language processing (NLP) can analyze legal documents and identify compliance risks more efficiently, showcasing the use of AI in banking and finance.

- Enhanced Decision-Making: AI provides data-driven insights that support strategic decision-making in areas such as investment management and risk assessment. Machine learning models can analyze historical data to forecast market trends and inform trading strategies, emphasizing the role of AI in investment banking.

- Competitive Advantage: Institutions leveraging AI can differentiate themselves by offering innovative products and superior customer experiences. The ability to analyze large datasets quickly allows for more informed decisions and faster responses to market changes, making the integration of artificial intelligence in investment banking essential for success.

At Rapid Innovation, we understand the complexities of integrating AI into your financial operations. Our expertise in AI and blockchain development enables us to provide tailored solutions that not only enhance efficiency but also drive greater ROI for our clients. By partnering with us, you can expect improved operational performance, reduced costs, and a significant boost in customer satisfaction. Let us help you navigate the future of banking and finance with innovative AI solutions that align with your strategic goals, including AI Services for Banking and Finance. At Rapid Innovation, we recognize the transformative power of AI in banking and blockchain technologies in the financial sector. Our expertise allows us to guide clients through the complexities of digital transformation, ensuring they achieve their goals efficiently and effectively.

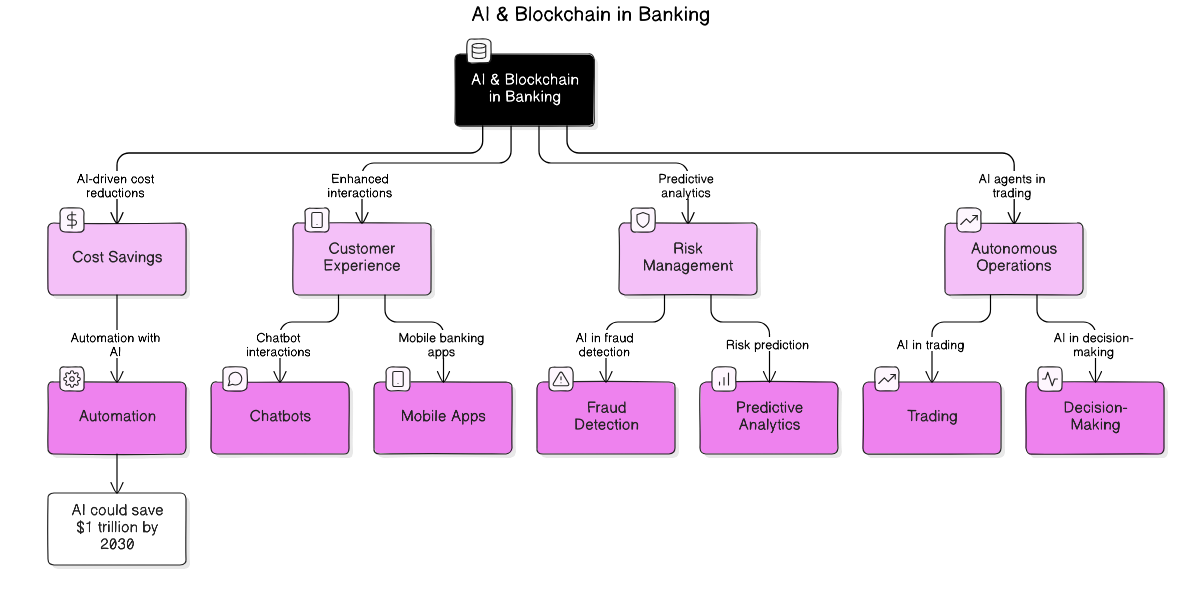

1.3 AI-Driven Cost Savings in Banking

The banking sector is increasingly adopting AI technologies to enhance efficiency and reduce operational costs. By automating routine tasks such as data entry and transaction processing, our clients can experience significant labor cost reductions. For instance, we have helped banks implement AI-driven solutions that streamline their operations, leading to a more agile workforce and reduced overhead.

Predictive analytics powered by AI is another area where we excel. By assisting banks in risk assessment and fraud detection, we help minimize losses and improve decision-making. Our tailored solutions have enabled clients to leverage data effectively, resulting in enhanced security and operational integrity.

Moreover, the integration of chatbots and virtual assistants into customer service frameworks has proven invaluable. By reducing the need for large call centers, our clients have improved response times and customer satisfaction. According to a report by McKinsey, AI could potentially save the banking industry up to $1 trillion by 2030 through these efficiencies, and we are committed to helping our clients capture a share of these savings.

1.4 The Digital Age: Shifting Customer Expectations and AI Adoption

As customer expectations evolve, so too must the strategies employed by banks. The digital transformation has significantly altered how customers interact with financial institutions. Our expertise in AI technologies enables banks to analyze customer data and provide tailored services, enhancing customer satisfaction and loyalty.

With the rise of mobile banking apps, customers now expect instant access to services and information. We help banks develop user-friendly applications that meet these demands, ensuring they remain competitive in a fast-paced digital landscape. Additionally, our AI-driven chatbots provide 24/7 support, allowing banks to cater to customer needs at any time.

By utilizing AI in customer relationship management (CRM) systems, we empower banks to anticipate customer needs and preferences, fostering deeper relationships and driving retention. As customers become more tech-savvy, our clients are well-positioned to adopt innovative technologies that meet these expectations, including generative AI in banking and conversational AI for banking.

1.5 Autonomous Operations and AI Agents in Finance

The future of finance lies in AI based autonomous operations, where AI systems perform tasks without human intervention. At Rapid Innovation, we specialize in deploying AI agents for various functions, including trading, risk management, and customer service.

Our algorithmic trading solutions analyze vast amounts of data in real-time, enabling investment decisions that are faster and more informed than those made by human traders. By optimizing investment strategies through AI in investment banking, our clients can achieve greater returns on their investments.

In risk management, we provide AI-driven insights that assess potential risks by analyzing historical data and market trends. This allows firms to make better-informed decisions and allocate resources effectively. The use of AI in financial forecasting further enhances accuracy, enabling our clients to navigate market fluctuations with confidence.

Ultimately, autonomous operations lead to significant cost savings and increased efficiency. AI agents can work continuously without breaks or downtime, allowing our clients to focus on strategic initiatives rather than routine tasks.

Partnering with Rapid Innovation

When you partner with Rapid Innovation, you can expect a range of benefits, including:

- Increased Efficiency: Streamlined operations through automation and AI-driven solutions.

- Cost Savings: Significant reductions in operational costs and improved ROI.

- Enhanced Customer Experience: Personalized services that meet evolving customer expectations.

- Data-Driven Insights: Advanced analytics that inform decision-making and risk management.

- Continuous Support: 24/7 customer service capabilities through AI technologies.

By leveraging our expertise in AI and blockchain, including applications of AI in banking and the use of artificial intelligence in banking, we empower our clients to navigate the complexities of the financial landscape and achieve their goals with confidence. Let us help you unlock the full potential of your organization.

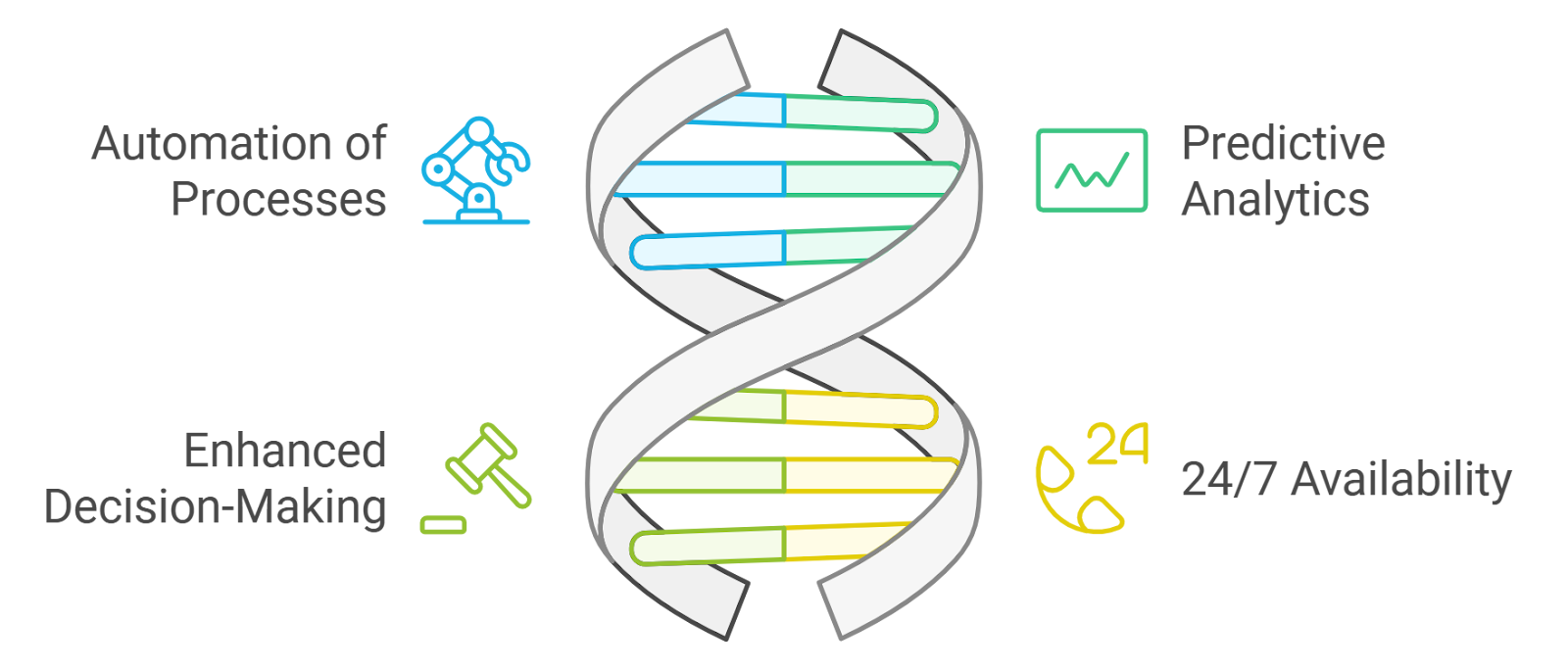

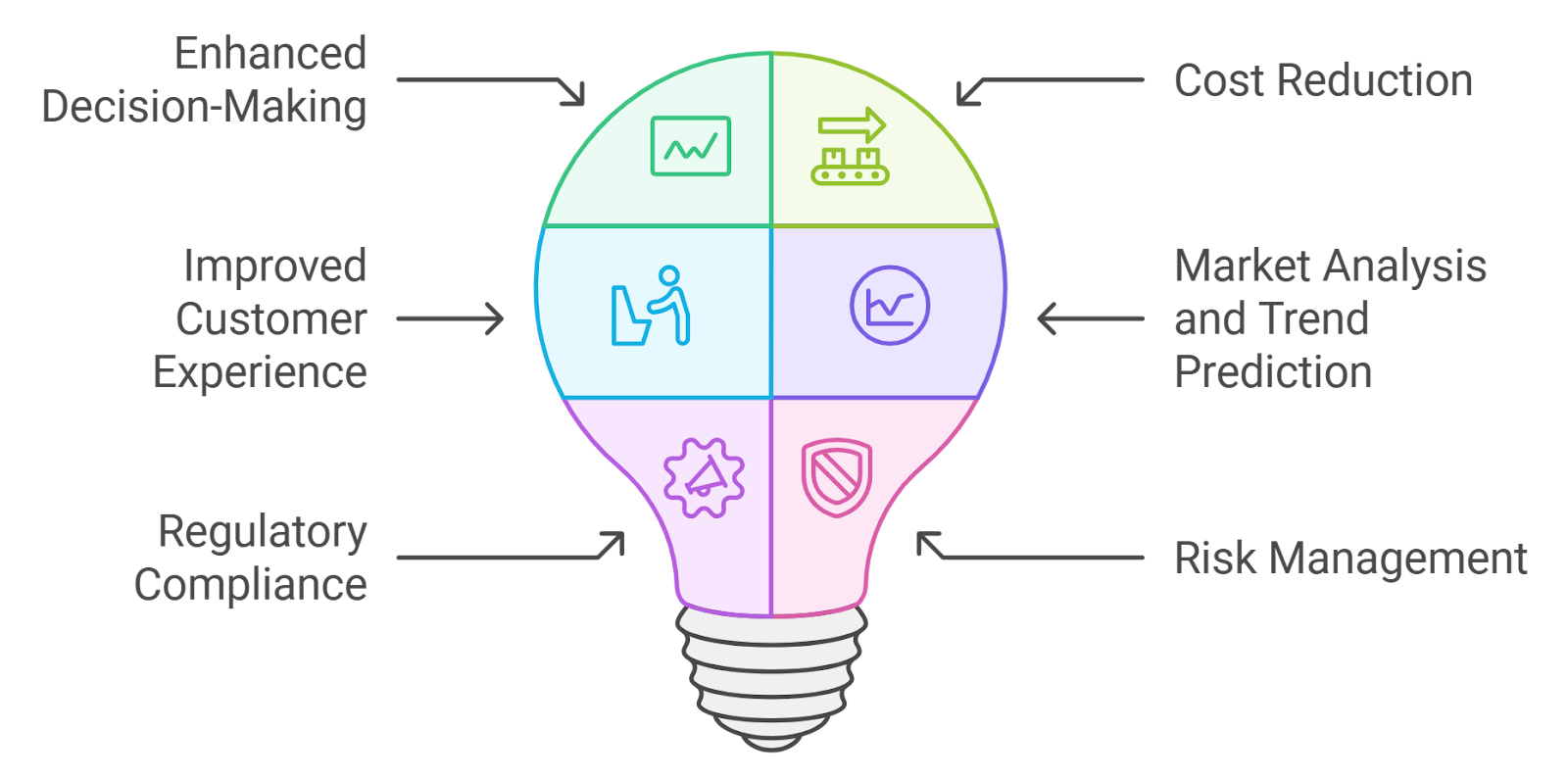

Refer to the image for a visual representation of how AI is transforming the banking sector.

2. AI-Driven Customer Service in Banking

The banking industry is increasingly adopting AI-driven customer service solutions to enhance efficiency, improve customer satisfaction, and streamline operations. AI technologies, such as chatbots and virtual assistants, like kasisto westpac and westpac kasisto, are transforming how banks interact with their customers.

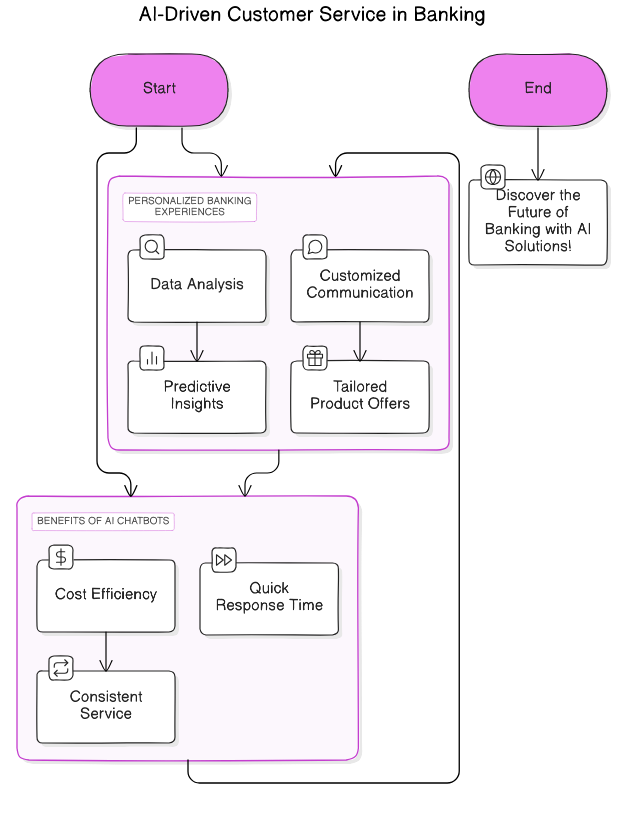

2.1. Benefits of AI Chatbots and Virtual Assistants

AI chatbots and virtual assistants are becoming essential tools in the banking sector. They offer numerous benefits, including:

- 24/7 Availability: Chatbots can provide round-the-clock service, allowing customers to access assistance at any time.

- Quick Response Times: AI can process inquiries and provide answers almost instantaneously, reducing wait times for customers.

- Cost Efficiency: By automating routine inquiries, banks can reduce operational costs associated with human customer service representatives.

- Handling High Volumes: AI can manage multiple customer interactions simultaneously, making it easier to handle peak times without additional staffing.

- Consistency in Service: Chatbots deliver uniform responses, ensuring that all customers receive the same level of service and information.

- Data Collection and Analysis: AI systems can gather and analyze customer data, providing insights that help banks improve their services and tailor offerings.

- Language Support: Many chatbots can communicate in multiple languages, catering to a diverse customer base.

2.2. Personalized Banking Experiences Using AI

AI technology enables banks to offer personalized experiences that cater to individual customer needs. This personalization is achieved through:

- Customer Data Analysis: AI systems analyze transaction history, spending patterns, and preferences to create tailored banking experiences.

- Targeted Product Recommendations: Based on customer behavior, AI can suggest relevant financial products, such as loans or investment opportunities, enhancing customer engagement.

- Customized Communication: Banks can use AI to send personalized messages and offers, improving customer relationships and satisfaction.

- Proactive Customer Support: AI can identify potential issues or needs before customers even reach out, allowing banks to offer solutions proactively.

- Behavioral Insights: AI can track customer interactions and preferences, enabling banks to adjust their services to better meet customer expectations.

- Enhanced Security: AI can monitor transactions for unusual activity, providing personalized alerts and enhancing overall security for customers.

AI solutions like the zenith intelligent virtual assistant and ai customer service banking are paving the way for a more efficient banking experience. By leveraging AI-driven customer service, banks can not only improve operational efficiency but also create a more engaging and personalized experience for their customers. At Rapid Innovation, we specialize in implementing these advanced AI solutions, ensuring that our clients achieve greater ROI through enhanced customer engagement and streamlined operations. Partnering with us means you can expect increased efficiency, reduced costs, and a significant boost in customer satisfaction, ultimately driving your business success.

Refer to the image for a visual representation of AI-driven customer service in banking.

2.3. Improving Customer Satisfaction with AI Automation

AI automation plays a crucial role in enhancing customer satisfaction across various industries. By streamlining processes and personalizing interactions, businesses can create a more positive experience for their customers.

- 24/7 Availability: AI-powered chatbots and virtual assistants can provide round-the-clock support, addressing customer inquiries and issues at any time. This ensures that customers feel valued and supported, regardless of when they reach out.

- Personalized Experiences: AI can analyze customer data to tailor recommendations and services, making interactions more relevant and engaging. This level of personalization fosters loyalty and encourages repeat business, ultimately improving AI customer satisfaction.

- Faster Response Times: Automation reduces wait times for customers, allowing for quicker resolutions to their problems. This efficiency not only enhances satisfaction but also improves overall operational productivity.

- Consistent Service Quality: AI ensures that customers receive the same level of service regardless of when or how they interact with the business. This consistency builds trust and reliability in the brand.

- Feedback Analysis: AI tools can analyze customer feedback and sentiment, helping businesses identify areas for improvement and adapt their strategies accordingly. This proactive approach to customer service can lead to higher retention rates and increased AI customer satisfaction.

- Cost Efficiency: By automating routine tasks, businesses can allocate resources more effectively, ultimately leading to better service delivery. This cost efficiency translates into greater ROI for the organization.

3. Fraud Detection and Prevention with AI

Fraud detection and prevention have become increasingly sophisticated with the integration of AI technologies. These systems can analyze vast amounts of data to identify patterns and anomalies that may indicate fraudulent activity.

- Data Analysis: AI algorithms can process large datasets quickly, identifying unusual patterns that may suggest fraud. This capability allows businesses to stay one step ahead of potential threats.

- Machine Learning Models: These models learn from historical data, improving their accuracy over time in detecting fraudulent transactions. This continuous learning process enhances the effectiveness of fraud prevention strategies.

- Behavioral Analytics: AI can monitor user behavior to establish a baseline, making it easier to spot deviations that could indicate fraud. This insight allows for more targeted and effective responses to suspicious activities.

- Real-Time Alerts: AI systems can provide immediate alerts to businesses when suspicious activity is detected, allowing for prompt action. This rapid response capability is crucial in mitigating potential losses.

- Reduced False Positives: Advanced AI techniques help minimize false positives, ensuring that legitimate transactions are not mistakenly flagged as fraudulent. This accuracy improves customer experience and operational efficiency.

- Cost Savings: By preventing fraud, businesses can save significant amounts of money that would otherwise be lost to fraudulent activities. This financial protection contributes to a healthier bottom line.

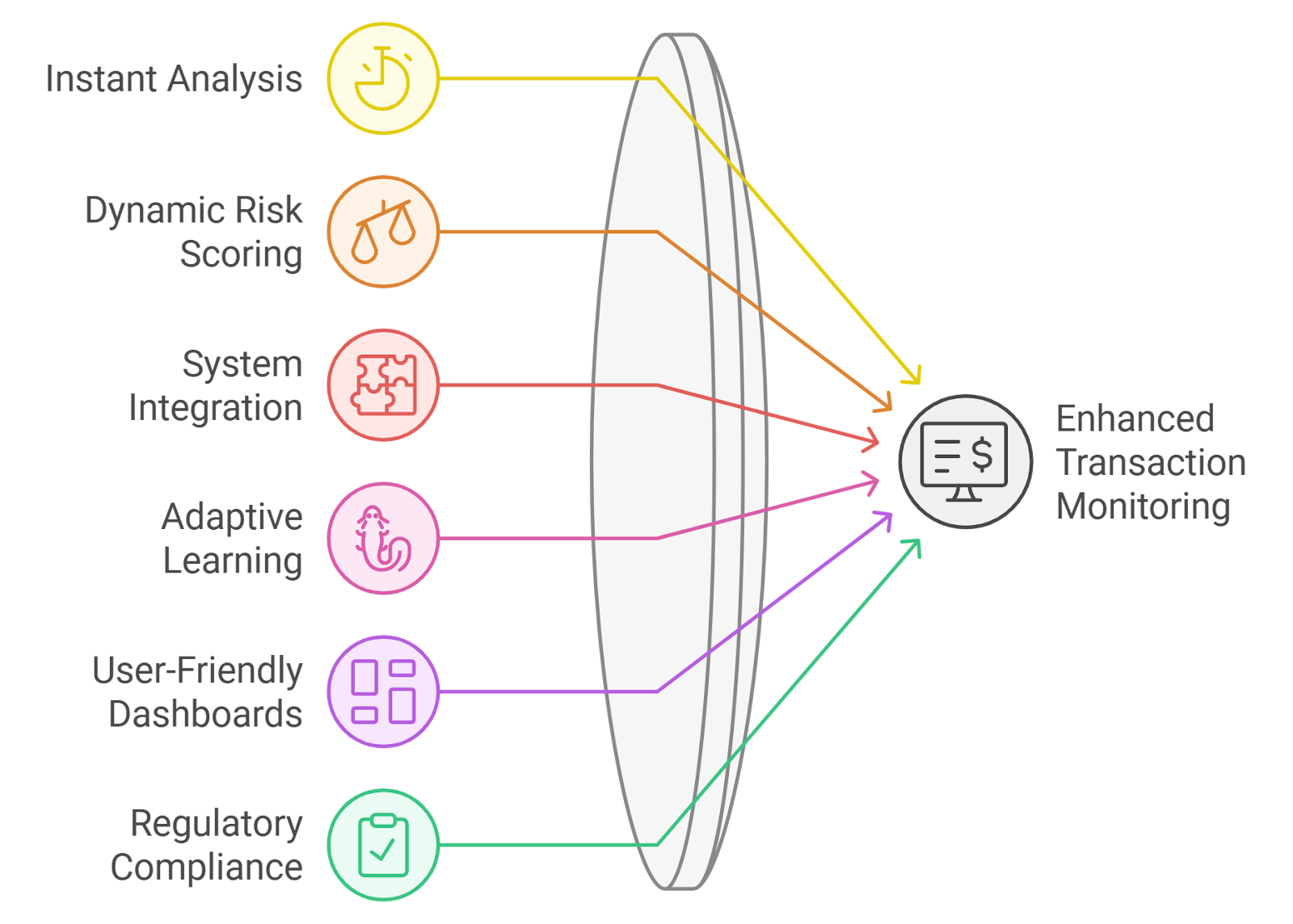

3.1. Real-Time Transaction Monitoring Using AI

Real-time transaction monitoring is a critical component of fraud prevention strategies. AI technologies enable businesses to monitor transactions as they occur, providing immediate insights and responses.

- Instant Analysis: AI can analyze transactions in real-time, assessing risk factors and flagging suspicious activities instantly. This capability allows businesses to act swiftly and decisively.

- Dynamic Risk Scoring: Transactions can be assigned risk scores based on various parameters, allowing for quick decision-making. This dynamic approach enhances the agility of fraud prevention efforts.

- Integration with Existing Systems: AI can be integrated into existing payment processing systems, enhancing their capabilities without requiring a complete overhaul. This seamless integration minimizes disruption while maximizing effectiveness.

- Adaptive Learning: AI systems continuously learn from new data, improving their ability to detect emerging fraud patterns. This adaptability ensures that businesses remain resilient against evolving threats.

- User-Friendly Dashboards: Many AI solutions offer intuitive dashboards that provide insights and alerts, making it easier for teams to respond to potential fraud. This user-centric design enhances operational efficiency.

- Regulatory Compliance: Real-time monitoring helps businesses comply with regulations by ensuring that suspicious transactions are reported promptly. This compliance not only protects the business but also builds trust with customers.

By leveraging AI in these areas, businesses can significantly enhance their customer satisfaction and fraud prevention efforts, leading to a more secure and enjoyable experience for all stakeholders. Partnering with Rapid Innovation allows organizations to harness the power of AI and blockchain technologies, driving greater ROI and achieving their strategic goals efficiently and effectively.

3.2. Reducing Fraud with AI-Powered Detection Systems

At Rapid Innovation, we understand that fraud is a significant concern for businesses across various industries. Our AI-powered detection systems are designed to combat fraud effectively and efficiently. These systems leverage advanced algorithms and machine learning techniques to identify suspicious activities and patterns that may indicate fraudulent behavior, including ai fraud detection and ai in fraud detection.

- Real-time monitoring: Our AI systems analyze transactions in real-time, allowing for immediate detection of anomalies, which can prevent potential losses before they escalate. This is particularly important in sectors like banking, where ai fraud detection banking can make a significant difference.

- Pattern recognition: By utilizing machine learning algorithms, we can learn from historical data to identify patterns associated with fraud, thereby improving detection rates over time. Our approach to fraud detection using ai in banking is designed to enhance these capabilities.

- Reduced false positives: Our AI solutions minimize the number of legitimate transactions flagged as fraudulent, enhancing customer experience and operational efficiency. This is crucial for maintaining trust in ai fraud prevention strategies.

- Adaptive learning: Our systems continuously learn from new data, adapting to evolving fraud tactics and improving their detection capabilities, ensuring that your business stays one step ahead of fraudsters. This adaptability is key in the context of artificial intelligence fraud detection in banking.

- Cost-effectiveness: Implementing our AI solutions can significantly reduce the costs associated with manual fraud detection processes and investigations, leading to a higher return on investment. Companies focused on ai fraud detection companies can benefit greatly from our expertise.

According to a report by the Association of Certified Fraud Examiners, organizations that use data analytics to detect fraud can reduce their losses by up to 50%. Partnering with Rapid Innovation means you can leverage these insights to protect your bottom line.

3.3. Preventing Financial Crime with AI Algorithms

In the realm of financial crime prevention, Rapid Innovation employs AI algorithms that play a crucial role in analyzing vast amounts of data to identify potential risks and suspicious activities. Our solutions enhance compliance and risk management efforts in financial institutions.

- Enhanced due diligence: Our AI systems automate the process of customer verification and risk assessment, ensuring compliance with regulations and reducing the burden on your compliance teams.

- Transaction monitoring: Our algorithms analyze transaction patterns to flag unusual activities that may indicate money laundering or other financial crimes, allowing for timely intervention. This is where ai and fraud detection come into play.

- Predictive analytics: By forecasting potential risks through historical data analysis, our AI solutions help you stay ahead of trends that may lead to financial crime.

- Improved reporting: Our systems generate detailed reports on suspicious activities, aiding regulatory compliance and investigations, which can save your organization time and resources.

- Collaboration with law enforcement: We facilitate information sharing between financial institutions and law enforcement agencies, improving the overall response to financial crime.

A study by the International Monetary Fund estimates that money laundering costs the global economy between $800 billion and $2 trillion annually, underscoring the importance of effective prevention measures. By partnering with Rapid Innovation, you can implement robust solutions that protect your organization and enhance your reputation.

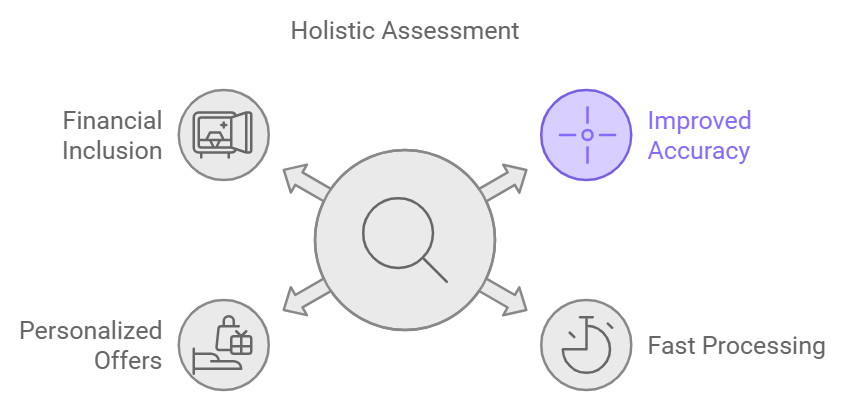

4. AI in Credit Scoring and Loan Decision Making

Rapid Innovation is at the forefront of transforming credit scoring and loan decision-making processes through AI. Our solutions provide more accurate assessments of borrowers' creditworthiness, moving beyond traditional methods that often rely on limited data.

- Comprehensive data analysis: Our AI can evaluate various data points, including transaction history, social media activity, and alternative credit data, to assess credit risk more holistically.

- Improved accuracy: Our machine learning models identify patterns and correlations that traditional scoring methods may overlook, leading to more accurate credit assessments and better lending decisions.

- Faster decision-making: Our AI algorithms process applications quickly, significantly reducing the time it takes for borrowers to receive loan approvals, enhancing customer satisfaction.

- Personalized lending: We tailor loan offers based on individual borrower profiles, improving customer satisfaction and increasing the likelihood of repayment.

- Financial inclusion: By considering alternative data sources, our AI solutions help extend credit to underserved populations who may lack traditional credit histories, opening new markets for your business.

According to a report by McKinsey, AI-driven credit scoring models can reduce default rates by up to 20% compared to traditional methods. By choosing Rapid Innovation, you are not just adopting technology; you are investing in a future of smarter, more responsible lending practices that drive greater ROI for your organization.

4.1. AI-Based Credit Scoring Models

AI-based credit scoring models are transforming the way lenders assess the creditworthiness of borrowers. Traditional credit scoring often relies on a limited set of data, which can lead to inaccurate assessments. AI models, on the other hand, utilize a broader range of data sources and advanced algorithms to evaluate credit risk.

- Enhanced Data Utilization: AI can analyze non-traditional data such as social media activity, payment histories, and even utility bills, allowing for a more comprehensive view of a borrower's financial behavior. This leads to better-informed lending decisions and ultimately reduces the risk of defaults.

- Improved Accuracy: Machine learning algorithms can identify patterns and correlations that human analysts might miss, leading to more accurate predictions of a borrower’s likelihood to default. This increased accuracy translates into higher approval rates for creditworthy borrowers, enhancing customer satisfaction.

- Real-Time Analysis: AI models can process data in real-time, allowing lenders to make quicker decisions, which is particularly beneficial in fast-paced lending environments. This agility can significantly improve operational efficiency and customer experience.

- Customization: AI can tailor credit scoring models to specific demographics or market segments, helping lenders better understand the unique risks associated with different borrower profiles. This customization can lead to more targeted marketing strategies and improved customer engagement.

4.2. AI Loan Underwriting for Faster Approvals

AI loan underwriting is revolutionizing the approval process by streamlining operations and reducing the time it takes to assess loan applications. Traditional underwriting can be slow and cumbersome, often requiring extensive documentation and manual reviews.

- Automation of Processes: AI can automate repetitive tasks such as data entry and document verification, reducing the workload on human underwriters and speeding up the overall process. This not only enhances productivity but also allows underwriters to focus on more complex cases.

- Predictive Analytics: AI uses predictive analytics to assess risk and determine loan eligibility, allowing lenders to make informed decisions based on data-driven insights. This capability can lead to a more efficient allocation of resources and improved risk management.

- Enhanced Decision-Making: AI can provide underwriters with recommendations based on historical data and trends, supporting faster and more accurate decision-making. This results in a more streamlined approval process and a better experience for borrowers.

- 24/7 Availability: AI systems can operate around the clock, allowing for continuous processing of applications, meaning borrowers can receive approvals outside of traditional business hours. This flexibility can significantly enhance customer satisfaction and loyalty.

4.3. Reducing Bias in Loan Decision Making with AI

One of the significant challenges in traditional lending practices is the potential for bias in decision-making. AI has the potential to reduce bias by relying on data-driven approaches rather than subjective judgments.

- Objective Data Analysis: AI models analyze data without the influence of human emotions or biases, leading to more equitable assessments of borrowers. This objectivity can help lenders build a more diverse customer base and improve their reputation in the market.

- Continuous Monitoring: AI systems can continuously monitor and adjust algorithms to identify and mitigate bias, ensuring that the models remain fair and accurate over time. This proactive approach can enhance compliance with regulatory standards and foster trust among stakeholders.

- Diverse Data Sources: By incorporating a wide range of data points, AI can provide a more balanced view of a borrower’s creditworthiness, helping to counteract biases that may arise from traditional credit scoring methods. This inclusivity can open up lending opportunities for underserved populations.

- Transparency and Accountability: AI systems can be designed to provide explanations for their decisions, which helps build trust and allows for accountability in the lending process. This transparency can enhance customer confidence and lead to stronger relationships between lenders and borrowers.

By partnering with Rapid Innovation, clients can leverage these advanced AI credit scoring models and blockchain solutions to achieve greater ROI, streamline operations, and enhance customer satisfaction. Our expertise in these domains ensures that we deliver tailored solutions that meet the unique needs of each client, driving efficiency and effectiveness in their operations.

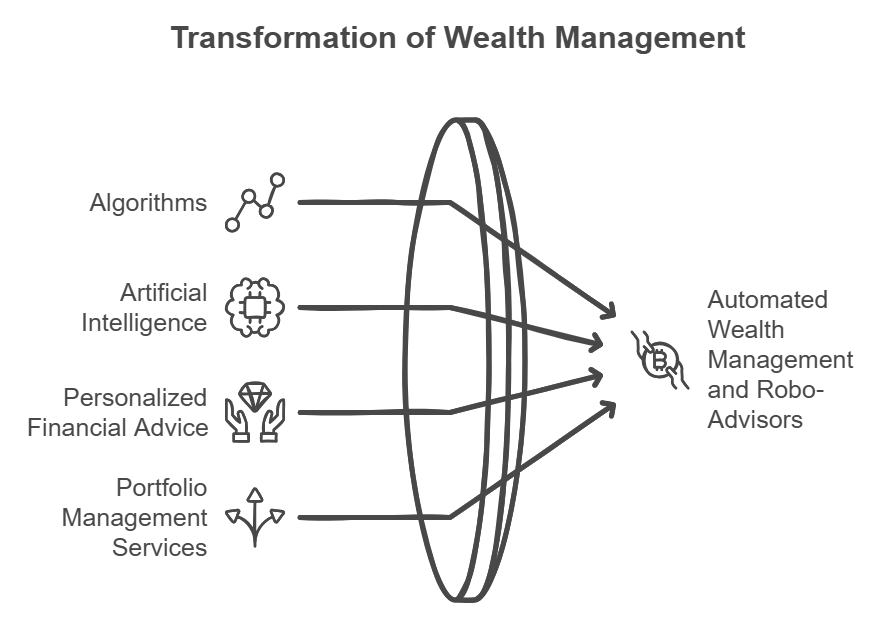

5. Automated Wealth Management and Robo-Advisors

Automated wealth management and robo-advisors have transformed the financial landscape, making investment management more accessible and efficient. These technologies leverage algorithms and artificial intelligence (AI) to provide personalized financial advice and portfolio management services, including wealth management automation.

5.1. The Rise of AI in Wealth Management

AI has significantly impacted wealth management by enhancing decision-making processes and improving client experiences.

- Increased Efficiency: AI algorithms can analyze vast amounts of data quickly, allowing for faster decision-making and execution of trades. This means that clients can capitalize on market opportunities in real-time, leading to potentially higher returns on their investments.

- Personalized Investment Strategies: AI can assess individual client profiles, including risk tolerance and investment goals, to create tailored investment strategies. This personalized approach ensures that clients' portfolios align with their unique financial objectives, enhancing overall satisfaction and performance.

- Predictive Analytics: AI tools can forecast market trends and asset performance, helping advisors make informed investment choices. By leveraging predictive analytics, clients can stay ahead of market fluctuations and adjust their strategies accordingly, maximizing their ROI.

- Cost Reduction: Automated systems reduce the need for human advisors, lowering fees for clients and making wealth management services more affordable. This cost efficiency allows clients to retain more of their investment returns, further enhancing their financial growth.

- Enhanced Client Engagement: AI-driven chatbots and virtual assistants provide clients with real-time information and support, improving overall satisfaction. This level of engagement fosters a stronger relationship between clients and their advisors, leading to better investment outcomes.

The adoption of AI in wealth management is growing rapidly, with many firms integrating these technologies into their services. According to a report by Deloitte, 60% of wealth management firms are investing in AI to enhance their offerings, including automation in wealth management.

5.2. Generative AI for Asset Management

Generative AI is a subset of AI that focuses on creating new content or data based on existing information. In asset management, generative AI is being utilized to optimize investment strategies and enhance portfolio performance.

Generative AI can analyze historical market data and generate synthetic datasets, allowing for better modeling and simulation of investment scenarios. By using generative models, asset managers can create innovative trading strategies that adapt to changing market conditions. Additionally, generative AI can simulate various market environments, helping managers assess potential risks and develop mitigation strategies. It can also automate the research process by generating insights from vast amounts of financial data, enabling managers to make more informed decisions. Furthermore, asset managers can use generative AI to design personalized financial products that meet specific client needs and preferences, similar to the offerings of wealth robo advisors.

The integration of generative AI in asset management is still in its early stages, but its potential is significant. A study by McKinsey indicates that AI could create up to $1 trillion in value for the asset management industry by 2030, particularly through the use of robotic process automation in wealth management.

At Rapid Innovation, we understand the transformative power of AI and blockchain technologies in wealth management. By partnering with us, clients can expect to achieve greater ROI through enhanced efficiency, personalized strategies, and cost-effective solutions.

5.3. AI-Driven Investment Strategies

AI-driven investment strategies leverage advanced algorithms and machine learning techniques to analyze vast amounts of data, identify patterns, and make informed investment decisions. These ai investment strategies are transforming the investment landscape by providing more accurate predictions and optimizing portfolio management.

- Enhanced Data Analysis

AI can process and analyze large datasets much faster than traditional methods. It identifies trends and correlations that may not be visible to human analysts, enabling clients to make data-driven decisions that enhance their investment outcomes. - Predictive Analytics

Machine learning models can predict stock price movements based on historical data. These models continuously learn and adapt to new information, improving their accuracy over time, which translates to better ai investment strategies and higher returns for our clients. - Algorithmic Trading

AI algorithms can execute trades at high speeds, capitalizing on market inefficiencies. They can analyze market conditions in real-time, allowing for quick decision-making that can lead to increased profitability. - Risk Assessment

AI can assess the risk associated with various investment options. It helps in diversifying portfolios by identifying assets with low correlation, thereby minimizing potential losses and maximizing returns. - Personalization

AI-driven platforms can tailor ai investing strategies to individual investor profiles. They consider factors like risk tolerance, investment goals, and market conditions, ensuring that clients receive customized solutions that align with their financial objectives. - Cost Efficiency

Automating investment processes reduces operational costs. AI can minimize human error, leading to more reliable investment outcomes and ultimately enhancing the return on investment (ROI) for our clients.

By integrating AI into investment strategies and risk management, financial institutions can enhance their operational efficiency, improve decision-making, and better navigate the complexities of the financial landscape. Partnering with Rapid Innovation means leveraging our expertise to achieve greater ROI and drive sustainable growth in your financial endeavors.

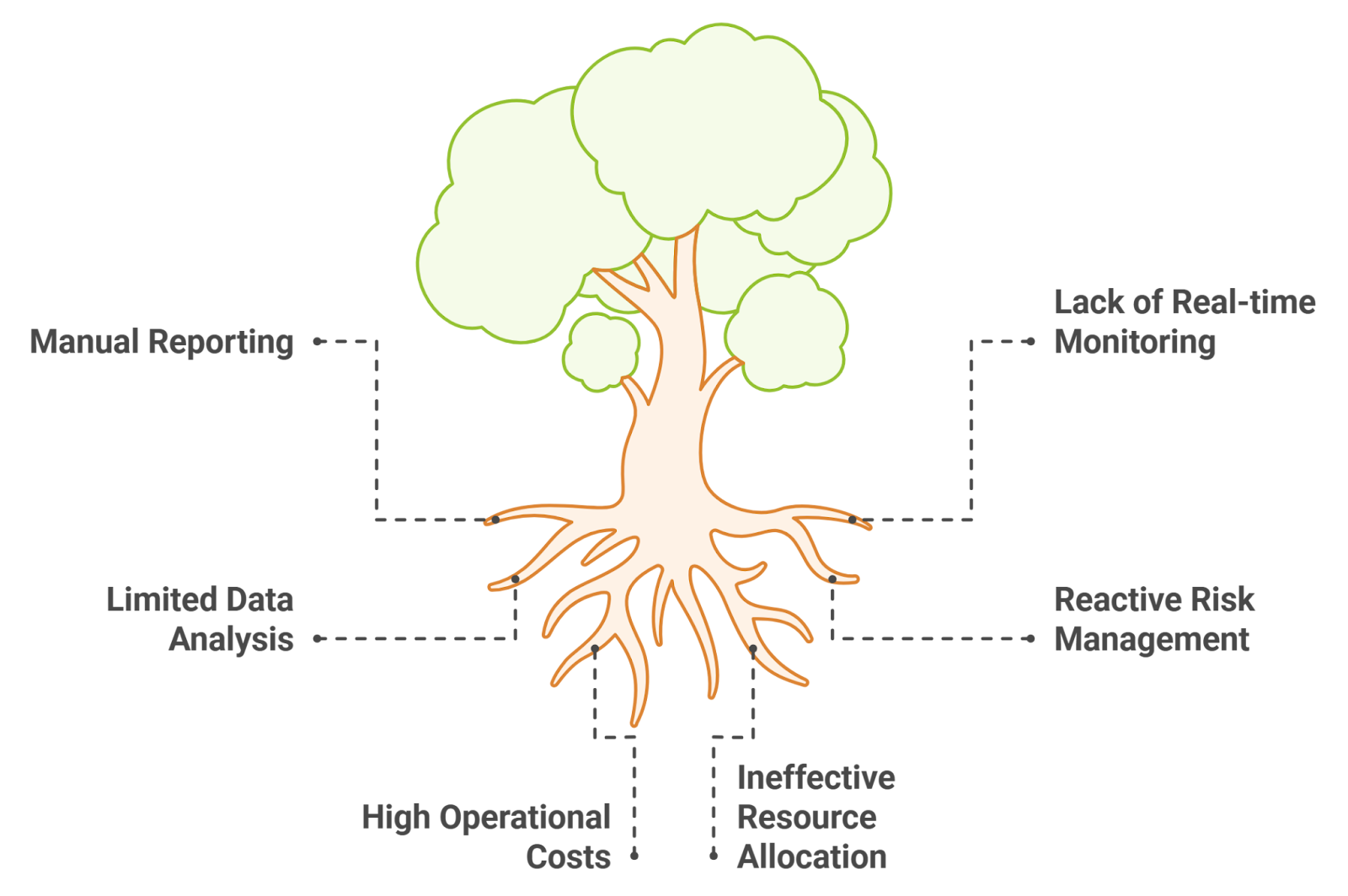

6. AI in Risk Management and Compliance in Banking

AI is transforming risk management and compliance in banking by enhancing financial risk assessments through real-time analytics, allowing institutions to identify and mitigate potential threats. It also streamlines regulatory reporting by automating compliance checks, ensuring timely and accurate submissions. Additionally, AI supports due diligence processes by analyzing vast amounts of data, enabling informed decision-making and reducing exposure to risks.

6.1 AI for Financial Risk Management

Artificial Intelligence (AI) is reshaping financial risk management by enhancing the accuracy and effectiveness of risk assessment and mitigation strategies. As financial markets become increasingly complex and interconnected, traditional risk management methods struggle to keep pace. AI offers innovative solutions to address these challenges, enabling financial institutions to better identify, assess, and respond to various types of risks.

- Enhanced Risk Assessment:

AI leverages machine learning algorithms to analyze vast datasets quickly, uncovering patterns and insights that may not be visible through conventional analysis. This capability enables organizations to make informed decisions regarding credit, market, and operational risks. - Real-Time Risk Monitoring:

AI systems facilitate continuous and real-time monitoring of risk factors across the organization. By integrating AI with real-time data feeds, institutions can track changes in market conditions, credit ratings, and other relevant metrics that influence risk, allowing for swift identification of emerging risks. - Predictive Analytics for Risk Mitigation:

AI-driven predictive analytics enables financial institutions to foresee potential risks based on historical trends and behavioral patterns. For instance, analyzing transaction data allows AI to predict the likelihood of defaults or identify potential market downturns, enabling proactive risk management. - Automating Risk Reporting:

AI technologies streamline the collection, analysis, and reporting of risk data, ensuring that reports are generated accurately and efficiently. Automated reporting minimizes human error and frees up valuable time for risk management teams, allowing them to focus on strategic initiatives. - Improved Decision-Making:

AI provides risk managers with advanced analytical tools that enhance decision-making capabilities. By presenting insights and recommendations based on data analysis, AI helps organizations evaluate different scenarios and make informed choices regarding risk mitigation strategies. - Cost Efficiency and Resource Optimization:

Implementing AI in financial risk management leads to significant cost savings and resource optimization. By automating processes and improving the accuracy of risk assessments, organizations can reduce operational costs and optimize the allocation of human resources.

6.2. AI for Financial Compliance and Regulatory Reporting

AI is transforming the landscape of financial compliance and regulatory reporting by enhancing accuracy, efficiency, and speed. Financial institutions face a myriad of regulations that require meticulous reporting and compliance efforts. AI technologies streamline finance regulatory compliance processes significantly.

- Enhanced Data Analysis: AI algorithms can analyze vast amounts of data quickly, identifying patterns and anomalies that may indicate compliance issues. Machine learning models can be trained to recognize compliance risks based on historical data.

- Real-time Monitoring: AI systems can provide continuous monitoring of transactions and activities, ensuring compliance in real-time. This allows organizations to respond promptly to potential violations or irregularities.

- Automated Reporting: AI can automate the generation of regulatory reports, reducing the time and effort required for manual reporting. This automation minimizes human error and ensures that reports are submitted accurately and on time.

- Predictive Analytics: AI can predict future compliance risks by analyzing trends and behaviors, allowing organizations to take proactive measures. This predictive capability helps in resource allocation and risk management.

- Cost Efficiency: By automating compliance processes, organizations can reduce operational costs associated with manual compliance efforts. AI can also help in reallocating human resources to more strategic tasks rather than routine compliance checks. For more insights on this topic, visit AI and Machine Learning for Regulatory Compliance.

6.3. AI in Due Diligence Processes

Due diligence is a critical component of financial transactions, mergers, and acquisitions. AI is increasingly being utilized to enhance the due diligence process, making it more thorough and efficient.

- Data Collection and Analysis: AI can gather and analyze data from various sources, including public records, social media, and financial statements. This comprehensive data collection helps in forming a complete picture of the entity under review.

- Risk Assessment: AI tools can assess the risk associated with potential investments or partnerships by analyzing historical data and market trends. This assessment can include evaluating credit risk, operational risk, and reputational risk.

- Document Review: Natural language processing (NLP) capabilities allow AI to review and extract relevant information from large volumes of documents quickly. This reduces the time spent on manual document review and increases accuracy.

- Enhanced Decision-Making: AI can provide insights and recommendations based on data analysis, aiding decision-makers in evaluating potential risks and benefits. This data-driven approach enhances the quality of decisions made during the due diligence process.

- Improved Collaboration: AI tools can facilitate collaboration among teams by providing a centralized platform for data sharing and communication. This ensures that all stakeholders have access to the same information, improving transparency and efficiency.

6.4. Automating Regulatory Compliance with AI

The automation of regulatory compliance through AI is revolutionizing how organizations manage compliance obligations. This shift not only enhances efficiency but also reduces the risk of non-compliance.

- Streamlined Processes: AI can automate repetitive compliance tasks, such as data entry and report generation, freeing up human resources for more complex tasks. This streamlining leads to faster compliance processes and reduces the likelihood of errors.

- Continuous Compliance: AI systems can continuously monitor compliance with regulations, ensuring that organizations remain compliant at all times. This proactive approach helps in identifying potential compliance issues before they escalate.

- Integration with Existing Systems: AI can be integrated with existing compliance management systems, enhancing their capabilities without requiring a complete overhaul. This integration allows organizations to leverage their current infrastructure while benefiting from AI advancements.

- Regulatory Change Management: AI can track changes in regulations and assess their impact on the organization’s compliance framework. This capability ensures that organizations can adapt quickly to new regulatory requirements.

- Audit Readiness: Automated compliance processes ensure that organizations maintain accurate records and documentation, making them audit-ready at all times. This preparedness reduces the stress and resource allocation typically associated with audits.

- Cost Reduction: Automating compliance processes can lead to significant cost savings by reducing the need for extensive manual labor and minimizing the risk of fines associated with non-compliance. Organizations can allocate resources more effectively, focusing on strategic initiatives rather than compliance-related tasks.

At Rapid Innovation, we understand the complexities of AI financial compliance and regulatory reporting. By leveraging our expertise in AI and blockchain technologies, we empower organizations to achieve greater ROI through enhanced efficiency, reduced costs, and improved decision-making capabilities. Partnering with us means you can expect streamlined processes, real-time insights, and a proactive approach to compliance that positions your organization for success in a rapidly evolving regulatory landscape.

7. Machine Learning Applications in Banking and Finance

Machine learning (ML) is transforming the banking and finance sectors by enabling organizations to analyze vast amounts of data, automate processes, and enhance customer experiences. The applications of ML in these industries are diverse and impactful, leading to improved efficiency and better decision-making.

7.1. Predictive Models for Customer Segmentation and Personalization

Predictive models in machine learning help banks and financial institutions understand their customers better by segmenting them based on various attributes. This segmentation allows for personalized services and targeted marketing strategies.

- Customer Segmentation: ML algorithms analyze customer data, such as transaction history, demographics, and behavior patterns. Customers can be grouped into segments based on similarities, such as spending habits or risk profiles. This segmentation helps banks tailor their products and services to meet specific needs.

- Personalization: Personalized marketing campaigns can be developed using insights from predictive models. Banks can offer customized financial products, such as loans or investment options, based on individual customer profiles. Enhanced customer experience leads to increased satisfaction and loyalty.

- Improved Decision-Making: Predictive analytics can forecast customer behavior, helping banks anticipate needs and preferences. This proactive approach allows for timely interventions, such as offering financial advice or alerts for unusual spending.

- Examples of Tools: Tools like customer relationship management (CRM) systems leverage ML to enhance customer interactions. Platforms such as Salesforce and HubSpot utilize predictive analytics for better customer engagement.

7.2. Machine Learning for Fraud Detection in Finance

Fraud detection is a critical area where machine learning has made significant strides. Financial institutions face constant threats from fraudulent activities, and ML provides advanced techniques to identify and mitigate these risks.

- Real-Time Monitoring: ML algorithms can analyze transactions in real-time to detect anomalies that may indicate fraud. By establishing a baseline of normal behavior, any deviation can trigger alerts for further investigation.

- Pattern Recognition: Machine learning models can identify patterns associated with fraudulent activities by analyzing historical data. Techniques such as clustering and classification help in recognizing suspicious behavior. This is particularly relevant in fraud detection in banking using machine learning.

- Reduced False Positives: Traditional fraud detection systems often generate numerous false positives, leading to unnecessary investigations. ML models improve accuracy by learning from past data, thus reducing the number of false alarms.

- Adaptive Learning: Machine learning systems continuously learn and adapt to new fraud tactics. As fraudsters evolve their methods, ML models can update their algorithms to stay ahead of potential threats.

- Case Studies: Many banks have successfully implemented ML for fraud detection, resulting in significant reductions in losses. For instance, JPMorgan Chase reported a decrease in fraud-related losses by utilizing machine learning techniques.

- Tools and Technologies: Solutions like SAS Fraud Management and FICO Falcon Fraud Manager employ machine learning to enhance fraud detection capabilities. These tools provide comprehensive analytics and reporting features to support decision-making.

In conclusion, machine learning applications in banking and finance, particularly in customer segmentation and fraud detection, are revolutionizing how institutions operate. The use cases of machine learning in banking are extensive, including banking machine learning use cases that enhance operational efficiency. By leveraging predictive models and advanced algorithms, banks can enhance customer experiences and protect against financial crimes effectively. At Rapid Innovation, we specialize in implementing these cutting-edge ML solutions, ensuring that our clients achieve greater ROI through improved operational efficiency and enhanced customer satisfaction. Partnering with us means gaining access to expert insights and tailored strategies that drive success in the competitive financial landscape. Visit our blog to read more information on the use cases of machine learning.

7.3. Developing Predictive Analytics for Financial Insights

Predictive analytics in finance involves using statistical algorithms and machine learning techniques to analyze historical data and predict future financial outcomes. This approach helps organizations make informed decisions based on data-driven insights.

- Key components of predictive analytics:

- Data collection: Gathering historical financial data from various sources, including transactions, market trends, and economic indicators.

- Data processing: Cleaning and organizing data to ensure accuracy and relevance for analysis.

- Model development: Creating predictive models using techniques such as regression analysis, time series analysis, and machine learning algorithms.

- Validation: Testing the models against historical data to assess their accuracy and reliability.

- Benefits of predictive analytics in finance:

- Improved forecasting: Organizations can better predict revenue, expenses, and cash flow, leading to more accurate budgeting and financial planning.

- Risk management: Predictive models can identify potential risks and help organizations develop strategies to mitigate them.

- Enhanced decision-making: Financial professionals can make more informed decisions based on data-driven insights rather than intuition.

- Applications of predictive analytics in finance:

- Credit scoring: Assessing the creditworthiness of individuals and businesses by analyzing historical repayment behavior.

- Fraud detection: Identifying unusual patterns in transactions that may indicate fraudulent activity.

- Investment analysis: Evaluating potential investment opportunities by predicting market trends and asset performance.

Predictive analytics use cases in finance are diverse, including applications in financial predictive modeling and predictive analytics in capital markets. Additionally, predictive analytics in corporate finance and predictive analytics in finance and accounting are becoming increasingly important for organizations looking to leverage data for strategic advantage.

8. AI for Financial Document Processing

Artificial Intelligence (AI) is transforming the way financial documents are processed, making it faster, more accurate, and cost-effective. AI technologies, such as natural language processing (NLP) and machine learning, enable organizations to automate the analysis and management of financial documents.

- Key features of AI in document processing:

- Optical character recognition (OCR): Converting scanned documents and images into machine-readable text for easier analysis.

- NLP: Understanding and interpreting human language to extract relevant information from unstructured data.

- Machine learning: Continuously improving the accuracy of document processing through training on historical data.

- Benefits of AI in financial document processing:

- Increased efficiency: Automating document processing reduces the time and effort required to manage large volumes of paperwork.

- Enhanced accuracy: AI algorithms minimize human errors in data entry and analysis, leading to more reliable financial information.

- Cost savings: Reducing manual labor and streamlining processes can significantly lower operational costs.

- Applications of AI in financial document processing:

- Invoice processing: Automating the extraction of data from invoices for faster payment processing and reconciliation.

- Compliance monitoring: Analyzing documents for compliance with regulations and identifying potential issues.

- Contract analysis: Reviewing contracts to extract key terms and conditions, ensuring adherence to agreements.

8.1. Automating Document Analysis and Processing

Automating document analysis and processing is a critical aspect of leveraging AI in finance. This involves using technology to streamline the handling of financial documents, reducing manual intervention and increasing overall efficiency.

- Steps in automating document analysis:

- Document capture: Using OCR and scanning technologies to digitize physical documents.

- Data extraction: Employing AI algorithms to identify and extract relevant data points from documents, such as dates, amounts, and parties involved.

- Data validation: Implementing checks to ensure the accuracy of extracted data against predefined criteria or databases.

- Benefits of automating document analysis:

- Time savings: Automation significantly reduces the time spent on manual data entry and document review.

- Improved compliance: Automated systems can be programmed to adhere to regulatory requirements, reducing the risk of non-compliance.

- Enhanced data accessibility: Digitized documents and extracted data can be easily stored, searched, and retrieved, improving overall data management.

- Challenges in automating document analysis:

- Data quality: Ensuring the accuracy and completeness of the data being processed is crucial for reliable outcomes.

- Integration: Seamlessly integrating automated systems with existing financial software and workflows can be complex.

- Change management: Organizations may face resistance from employees accustomed to traditional document processing methods.

- Future trends in document automation:

- Increased use of AI: As AI technologies continue to evolve, their application in document processing will become more sophisticated.

- Greater focus on security: Ensuring the security of sensitive financial data during processing will be a priority for organizations.

- Enhanced user experience: Developing user-friendly interfaces for automated systems will facilitate adoption and improve efficiency.

At Rapid Innovation, we specialize in harnessing the power of predictive analytics and AI to help our clients achieve greater ROI. By partnering with us, organizations can expect improved forecasting, enhanced decision-making, and significant cost savings through automation. Our expertise in these domains ensures that clients not only meet their financial goals but also stay ahead of the competition in an ever-evolving market landscape, particularly through the use of predictive analytics in finance and predictive finance strategies.

8.2. AI for Advanced Document Processing in Compliance

- AI technologies are transforming how organizations manage compliance documentation, particularly in the realm of AI document processing compliance.

- Advanced document processing involves the use of AI to automate the extraction, classification, and analysis of compliance-related documents.

- Key benefits include:

- Increased accuracy in identifying compliance risks.

- Reduction in manual labor and time spent on document review.

- Enhanced ability to track regulatory changes and ensure adherence.

- AI can analyze vast amounts of data from various sources, including:

- Regulatory filings

- Internal policies

- Industry standards

- Natural Language Processing (NLP) is a critical component, enabling AI to understand and interpret complex legal language.

- Organizations can leverage AI to:

- Automate the generation of compliance reports.

- Monitor ongoing compliance through real-time data analysis.

- Identify anomalies or deviations from compliance standards.

- By implementing AI in document processing, companies can achieve:

- Improved risk management.

- Better resource allocation.

- Enhanced decision-making capabilities.

- According to a report, organizations using AI for compliance can reduce costs by up to 30% (source: Deloitte).

8.3. Streamlining Contract Analysis with AI

- Contract analysis is a crucial aspect of legal and business operations, often requiring significant time and resources.

- AI streamlines this process by automating the review and analysis of contracts.

- Key features of AI in contract analysis include:

- Automated extraction of key terms and clauses.

- Risk assessment based on historical data and benchmarks.

- Comparison of contracts against regulatory requirements.

- Benefits of using AI for contract analysis:

- Faster turnaround times for contract reviews.

- Increased accuracy in identifying potential risks and obligations.

- Enhanced collaboration among legal teams and stakeholders.

- AI tools can also provide insights into:

- Contract performance and compliance.

- Opportunities for renegotiation or optimization.

- By utilizing machine learning algorithms, AI can learn from past contracts to improve future analyses.

- Organizations can achieve:

- Cost savings through reduced legal fees.

- Improved negotiation outcomes.

- Better compliance with contractual obligations.

- A study found that AI can reduce contract review times by up to 80% (source: McKinsey).

9. AI for Financial Modeling and Planning

- AI is revolutionizing financial modeling and planning by providing advanced analytical capabilities.

- Financial modeling involves creating representations of a company's financial performance, while planning focuses on forecasting future financial outcomes.

- Key applications of AI in this area include:

- Predictive analytics for revenue forecasting.

- Scenario analysis to evaluate potential business outcomes.

- Risk assessment and management through data-driven insights.

- Benefits of AI in financial modeling and planning:

- Enhanced accuracy in financial predictions.

- Ability to process large datasets quickly and efficiently.

- Improved decision-making through real-time data analysis.

- AI can identify trends and patterns that may not be apparent through traditional analysis methods.

- Organizations can leverage AI to:

- Optimize budgeting processes.

- Streamline financial reporting.

- Enhance strategic planning initiatives.

- The integration of AI in financial planning can lead to:

- Increased agility in responding to market changes.

- Better alignment of financial goals with business strategy.

- More informed investment decisions.

- Research indicates that companies using AI in financial planning can achieve a 20% increase in forecasting accuracy (source: PwC).

At Rapid Innovation, we understand the complexities of compliance, contract analysis, and financial planning. By partnering with us, you can leverage our expertise in AI and blockchain technologies to streamline your operations, reduce costs, and enhance your decision-making capabilities. Our tailored solutions are designed to help you achieve greater ROI while ensuring compliance and optimizing your business processes. Let us help you navigate the future of technology with confidence and efficiency.

9.1. AI in Financial Forecasting and Predictive Analytics

Artificial Intelligence (AI) has transformed financial forecasting and predictive analytics by enhancing accuracy and efficiency.

- Improved Data Analysis: AI algorithms can analyze vast amounts of historical data quickly, identifying patterns and trends that may not be visible to human analysts. This capability allows organizations to make data-driven decisions that significantly improve their financial outcomes.

- Machine Learning Models: These models can learn from new data, continuously improving their predictions over time. This adaptability is crucial in the ever-changing financial landscape, ensuring that businesses remain competitive and responsive to market dynamics.

- Risk Assessment: AI can assess risks by evaluating various factors, including market conditions, economic indicators, and company performance, leading to more informed decision-making. By understanding potential risks, organizations can mitigate losses and capitalize on opportunities.

- Enhanced Accuracy: Studies show that AI-driven forecasts can outperform traditional methods, with some reports indicating accuracy improvements of up to 30%. This level of precision can lead to better resource allocation and investment strategies, ultimately driving greater ROI.

- Automation: AI automates repetitive tasks, allowing financial analysts to focus on strategic planning and decision-making rather than data collection and processing. This efficiency not only saves time but also reduces the likelihood of human error.

9.2. AI for Financial Planning and Scenario Modeling

AI plays a significant role in financial planning and scenario modeling, enabling organizations to prepare for various future outcomes.

- Scenario Analysis: AI can simulate multiple financial scenarios based on different variables, helping businesses understand potential risks and opportunities. This foresight allows companies to develop robust strategies that align with their objectives.

- Real-Time Adjustments: With AI, organizations can adjust their financial plans in real-time as new data becomes available, ensuring they remain agile and responsive to market changes. This flexibility is essential for maintaining a competitive edge.

- Predictive Modeling: AI tools can create predictive models that forecast future financial performance based on historical data and current trends. These insights empower businesses to make proactive decisions that enhance profitability.

- Resource Allocation: AI helps in optimizing resource allocation by analyzing which areas of the business will yield the highest returns under different scenarios. This strategic approach maximizes the effectiveness of investments.

- Strategic Decision-Making: By providing insights into potential future states, AI supports executives in making informed strategic decisions that align with their long-term goals. This alignment is crucial for sustainable growth and success.

9.3. AI for Real-Time Financial Insights

AI enables organizations to gain real-time financial insights, which are crucial for timely decision-making.

- Instant Data Processing: AI can process and analyze financial data in real-time, providing immediate insights that can influence business strategies. This capability allows organizations to act swiftly in response to market fluctuations.

- Enhanced Reporting: Automated reporting tools powered by AI can generate financial reports quickly, allowing stakeholders to access critical information without delay. This efficiency enhances transparency and facilitates better communication.

- Predictive Alerts: AI systems can send alerts about significant changes in financial metrics, enabling proactive management of potential issues. This proactive approach helps organizations mitigate risks before they escalate.

- Improved Cash Flow Management: AI can analyze cash flow patterns and predict future cash needs, helping businesses maintain liquidity and avoid financial pitfalls. Effective cash flow management is vital for operational stability.

- Competitive Advantage: Organizations leveraging AI for real-time insights can respond faster to market changes, gaining a competitive edge over those relying on traditional methods. This agility is essential for thriving in today's fast-paced business environment.

By partnering with Rapid Innovation, clients can harness the power of AI in financial forecasting and predictive analytics, as well as blockchain technologies to achieve their financial goals efficiently and effectively. Our expertise in these domains ensures that organizations not only improve their operational efficiency but also realize greater ROI through informed decision-making and strategic planning.

10. Generative AI for Finance and Banking

Generative AI in banking is transforming the finance and banking sectors by enhancing efficiency, improving customer experiences, and enabling better decision-making. This technology leverages machine learning algorithms to generate new content, analyze data, and automate processes, making it a valuable asset in these industries.

10.1. Use Cases of Generative AI in Banking

Generative AI has a wide range of applications in banking, including:

- Customer Service Enhancement: Chatbots powered by generative AI can provide 24/7 customer support, handle inquiries, process transactions, and offer personalized financial advice.

- Fraud Detection and Prevention: AI models can analyze transaction patterns to identify anomalies. Generative AI can simulate potential fraud scenarios, helping banks to strengthen their security measures.

- Risk Assessment and Management: Generative AI can create predictive models to assess credit risk and analyze vast amounts of data to identify potential risks in investment portfolios.

- Personalized Marketing: Banks can use generative AI to create tailored marketing campaigns based on customer behavior. This technology can generate personalized product recommendations, increasing customer engagement.

- Regulatory Compliance: Generative AI can assist in automating compliance processes by generating reports and monitoring transactions. It can help banks stay updated with changing regulations by analyzing legal documents and guidelines.

- Financial Forecasting: AI models can generate forecasts based on historical data and market trends, helping banks make informed decisions regarding investments and resource allocation.

10.2. Automating Report Generation with Generative AI

Generative AI significantly streamlines the report generation process in banking, offering several advantages:

- Efficiency Improvement: Automating ai report generation reduces the time spent on manual data entry and analysis. Generative AI can quickly compile data from various sources, producing reports in real-time.

- Consistency and Accuracy: AI-generated reports minimize human error, ensuring that data is accurately represented. Consistent formatting and structure enhance readability and professionalism.

- Customization and Personalization: Generative AI can tailor reports to meet specific client or regulatory requirements. It can generate different versions of reports for various stakeholders, ensuring relevant information is highlighted.

- Data Visualization: AI tools can create visual representations of data, making complex information easier to understand. This enhances the decision-making process by providing clear insights.

- Scalability: As banks grow, the volume of reports required increases. Generative AI can scale to meet these demands without compromising quality and can handle large datasets efficiently, making it suitable for both small and large financial institutions.

- Cost Reduction: Automating report generation can lead to significant cost savings by reducing the need for extensive human resources. It allows staff to focus on higher-value tasks, such as strategic planning and customer engagement.

Generative AI is revolutionizing the finance and banking sectors by automating processes, enhancing customer experiences, and improving decision-making capabilities. Its applications in customer service, fraud detection, risk management, personalized marketing, regulatory compliance, financial forecasting, and report generation are just the beginning of its potential impact on the industry.

At Rapid Innovation, we specialize in harnessing the power of generative AI in banking to help our clients achieve greater ROI. By partnering with us, you can expect enhanced operational efficiency, improved customer satisfaction, and a significant reduction in costs. Our expertise in AI and blockchain development ensures that you are equipped with cutting-edge solutions tailored to your specific needs, driving your business forward in an increasingly competitive landscape. For more information, visit our article on how artificial intelligence is used in banks.

10.3. Generative AI in Personalized Financial Services

Generative AI is transforming the landscape of personalized financial services by enabling institutions to tailor their offerings to individual customer needs. This technology leverages algorithms to analyze vast amounts of data and generate insights that can enhance customer experiences.

- Customized Financial Products

Generative AI can create personalized investment portfolios based on individual risk tolerance and financial goals. It can also suggest tailored loan products that fit a customer's financial situation, ensuring that clients receive solutions that align with their unique circumstances, such as individual pension plans or private banking services. - Enhanced Customer Interactions

AI-driven chatbots can provide real-time assistance, answering queries and offering financial advice, including money management advisor services. These systems can learn from customer interactions to improve their responses over time, leading to more meaningful engagements and higher customer satisfaction. - Predictive Analytics

Generative AI can analyze spending patterns to predict future financial behavior, helping customers make informed decisions. It can identify potential financial issues before they arise, allowing for proactive management and ultimately leading to better financial health for clients, particularly in areas like financial planning for retirees. - Improved Marketing Strategies

Financial institutions can use generative AI to segment customers and create targeted marketing campaigns. This leads to higher engagement rates and improved customer satisfaction, as clients receive relevant offers that resonate with their needs, such as personalized financial planning or wealth management near me. - Risk Assessment and Management

AI can assess the creditworthiness of individuals more accurately by analyzing a broader range of data points. This helps in reducing default rates and improving overall financial stability, which is crucial for both institutions and their clients, especially in private banking and wealth management advisor services.

11. Ethical AI and Data Privacy in Finance

As financial institutions increasingly adopt AI technologies, ethical considerations and data privacy become paramount. The use of AI must align with ethical standards to protect consumers and maintain trust.

- Transparency in AI Algorithms

Financial institutions should disclose how AI algorithms make decisions, especially in lending and investment. This transparency helps customers understand the rationale behind financial products and services, fostering trust and confidence, particularly in areas like financial advisor free advice. - Fairness and Bias Mitigation

AI systems must be designed to avoid biases that could lead to unfair treatment of certain customer groups. Regular audits and assessments can help identify and rectify any biases in AI models, ensuring equitable service delivery. - Accountability and Governance

Establishing clear accountability for AI-driven decisions is essential to ensure ethical practices. Financial institutions should have governance frameworks in place to oversee AI deployments, promoting responsible use of technology. - Consumer Consent and Control

Customers should have the right to know how their data is being used and the ability to opt-out of data collection. Providing clear privacy policies and consent forms can enhance customer trust and empower clients in their financial journeys, including personalized financial advice. - Compliance with Regulations

Financial institutions must adhere to data protection regulations, such as GDPR and CCPA, to safeguard consumer data. Regular compliance checks can help ensure that AI systems operate within legal boundaries, protecting both the institution and its clients.

11.1. Ensuring Data Privacy in AI Deployments

Data privacy is a critical concern in the deployment of AI technologies in finance. Protecting sensitive customer information is essential for maintaining trust and compliance with regulations.

- Data Encryption

Encrypting sensitive data both at rest and in transit helps protect it from unauthorized access. Strong encryption protocols should be implemented to safeguard customer information, ensuring that data remains confidential. - Anonymization Techniques

Anonymizing data can help protect individual identities while still allowing for valuable insights to be generated. Techniques such as data masking and aggregation can be employed to enhance privacy without compromising analytical capabilities. - Access Controls

Implementing strict access controls ensures that only authorized personnel can access sensitive data. Role-based access can limit exposure to data based on job responsibilities, further securing customer information. - Regular Security Audits

Conducting regular security audits can help identify vulnerabilities in AI systems and data handling processes. These audits should assess both technical and procedural aspects of data privacy, ensuring robust protection measures are in place. - Employee Training

Training employees on data privacy best practices is crucial for minimizing human error. Regular workshops and updates on data protection regulations can keep staff informed and vigilant in safeguarding customer data. - Incident Response Plans

Having a robust incident response plan in place can help organizations quickly address data breaches. This plan should outline steps for containment, investigation, and communication with affected customers, ensuring a swift and effective response to any incidents.

By partnering with Rapid Innovation, clients can leverage our expertise in AI and blockchain to enhance their financial services while ensuring ethical practices and data privacy. Our tailored solutions not only drive efficiency but also maximize ROI, allowing clients to achieve their business goals effectively, including services like private wealth management near me and financial management near me.

11.2. Addressing Bias and Fairness in AI Algorithms

- AI algorithms can inadvertently perpetuate or amplify existing biases present in training data.

- Bias can arise from:

- Historical data that reflects societal inequalities.

- Lack of diversity in the teams developing AI systems.

- Misrepresentation of certain demographic groups in datasets

- Addressing bias involves:

- Conducting regular audits of AI systems to identify and mitigate bias.

- Implementing fairness metrics to evaluate algorithm performance across different demographic groups.

- Utilizing diverse datasets that accurately represent the population.

- Techniques to reduce bias include:

- Algorithmic adjustments, such as re-weighting training data.

- Employing fairness-aware machine learning models.

- Engaging stakeholders from various backgrounds in the development process.

- Regulatory frameworks are emerging to guide ethical AI practices, emphasizing transparency and accountability.

- Organizations are encouraged to adopt best practices for ethical AI, such as:

- Establishing clear guidelines for data collection and usage.

- Promoting an inclusive culture within AI development teams.

- Providing training on bias and fairness for AI practitioners. For more information on best practices, visit best practices for AI practitioners.

11.3. Ethical Concerns in AI-Driven Financial Decisions

- AI is increasingly used in financial services for tasks like credit scoring, fraud detection, and investment strategies.

- Ethical concerns include:

- Lack of transparency in decision-making processes, leading to distrust among consumers.

- Potential for discrimination against marginalized groups in lending and insurance.

- Over-reliance on algorithms that may not account for unique individual circumstances

- Key ethical considerations involve:

- Ensuring that AI systems are explainable, allowing users to understand how decisions are made.

- Implementing robust data privacy measures to protect sensitive financial information.

- Balancing automation with human oversight to ensure fair treatment of customers.

- Financial institutions must consider:

- The implications of algorithmic trading on market stability.

- The potential for AI to exacerbate economic inequalities.

- The need for regulatory compliance in AI application

- Best practices for ethical AI in finance include:

- Regularly reviewing and updating algorithms to reflect changing societal norms.

- Engaging with stakeholders, including customers and advocacy groups, to gather feedback.

- Establishing ethical review boards to oversee AI initiatives.

12. Future Trends of AI in the Banking Sector

- The banking sector is poised for significant transformation through AI technologies.

- Key trends include:

- Enhanced customer service through AI-powered chatbots and virtual assistants.

- Improved risk management using predictive analytics to identify potential defaults or fraud.

- Personalized banking experiences driven by AI algorithms analyzing customer behavior and preferences.

- Other notable trends are:

- Increased automation of back-office operations, leading to cost savings and efficiency.

- Adoption of AI for regulatory compliance, helping banks navigate complex regulations.

- Integration of AI with blockchain technology for secure and transparent transactions.

- The rise of open banking is facilitating:

- Greater collaboration between banks and fintech companies, leveraging AI for innovative solutions.

- Enhanced data sharing, allowing for more comprehensive customer insights.

- Future challenges may include:

- Addressing cybersecurity risks associated with AI systems.

- Ensuring ethical use of AI while maintaining competitive advantage.

- Navigating regulatory landscapes that are evolving to keep pace with technological advancements.

- Overall, the future of AI in banking promises to enhance operational efficiency, improve customer experiences, and drive innovation.

At Rapid Innovation, we understand the complexities and challenges that come with implementing ethical AI in finance and blockchain technologies. Our expertise in developing tailored solutions ensures that your organization can navigate these trends effectively, maximizing your return on investment. By partnering with us, you can expect enhanced operational efficiency, improved customer engagement, and a commitment to ethical practices that foster trust and transparency in your AI initiatives. Let us help you achieve your goals efficiently and effectively.

12.1. AI Innovations in Mobile and Internet Banking

Artificial Intelligence (AI) is transforming mobile and internet banking by enhancing user experience, improving security, and streamlining operations. Key innovations include: